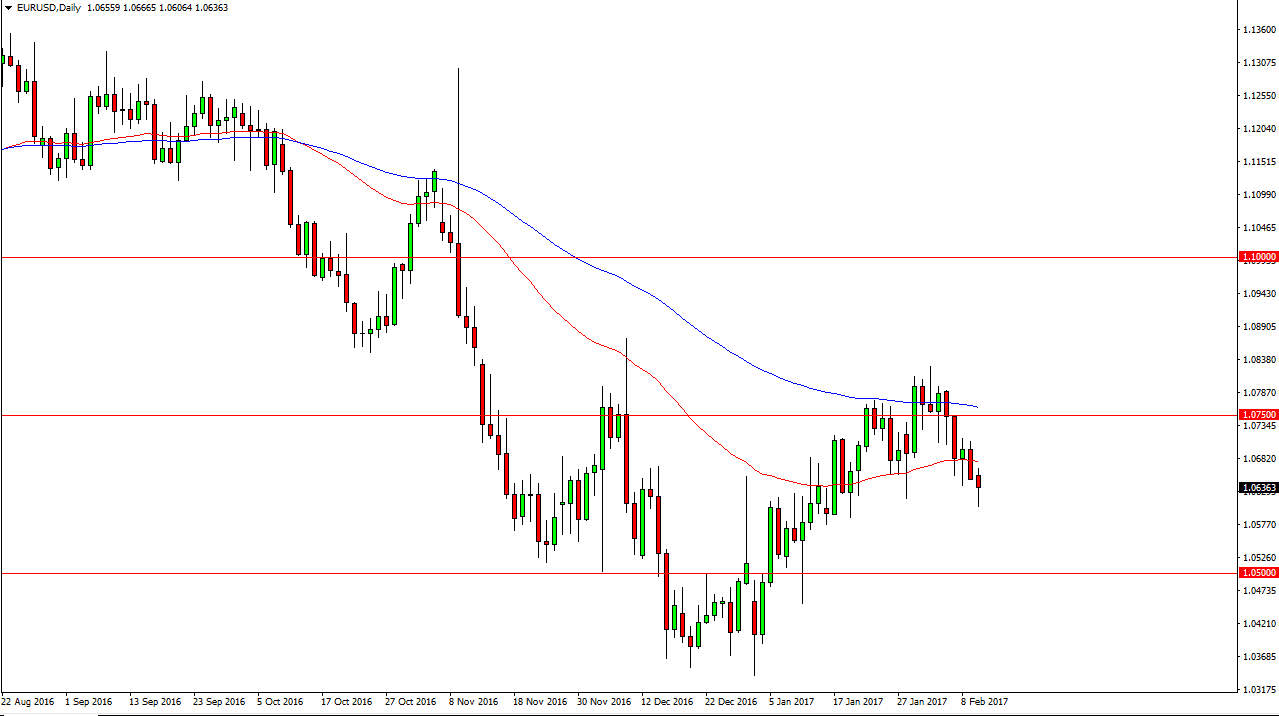

EUR/USD

The EUR/USD pair initially fell during the day on Friday, but found enough support below the 1.06 level to turn around and form a hammer. This is of course a very bullish sign and I think that a break above the top of the hammer sends this market back into the previous consolidation area. I recognize that the 1.0750 level above should continue to be resistance, and of course the blue 100-day exponential moving average on my chart. However, if we break down below the bottom of the hammer for the Friday session, the market could find itself reaching towards 1.05 level over the next several sessions. The way, this is going to be a choppy market, there are a lot of concerns when it comes to the European Union, but a lot of questions about the monetary policy coming out of the United States.

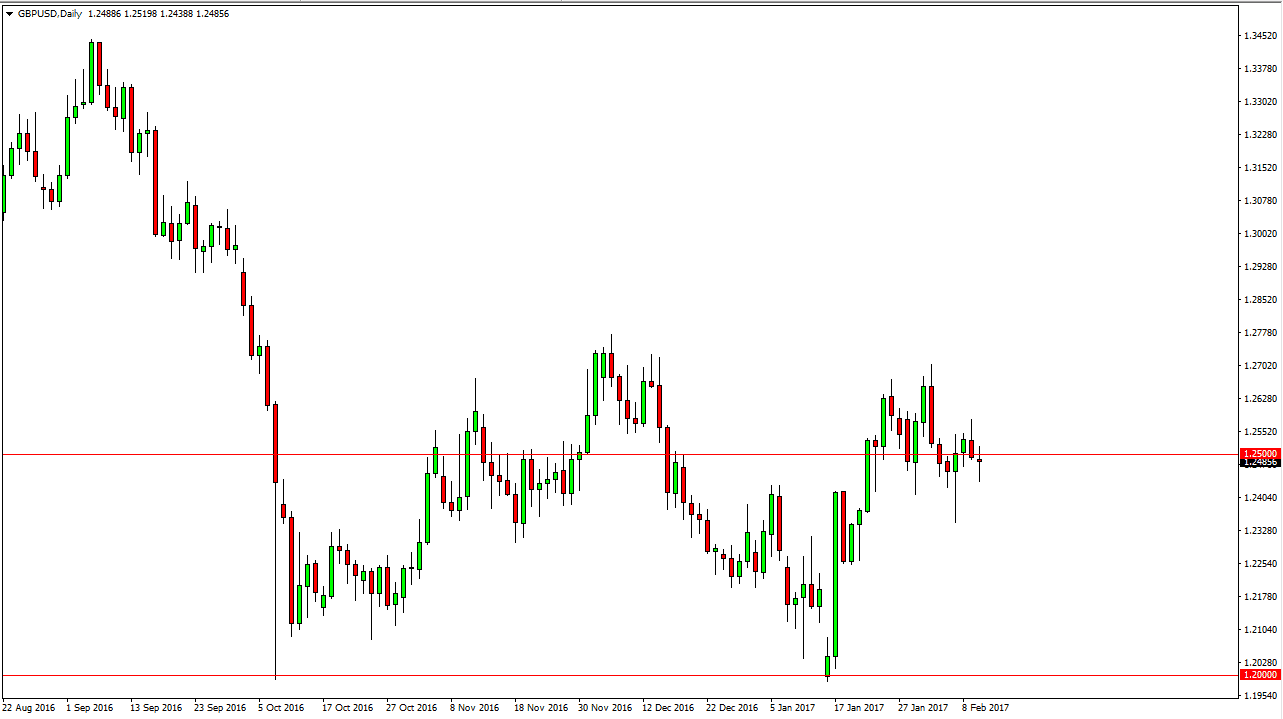

GBP/USD

I’ve been saying for a while now that I think that the British pound is trying to form a permanent bottom in the downtrend. Because of this, it is a very volatile market as trend changes tend to be very difficult to accomplish. However, the recent impulsivity that we have seen to the upside certainly gives credence to that idea. Because of this, I believe that the buyers are starting to look into the longer-term picture for the British pound and more importantly, the British economy. It has been much more resilient than initially thought. Markets tend to overreact to economic news, and I believe that’s what we have seen due to the vote to leave the European Union. Because of this, I think that several careers are going to be made going long the British pound. I know I certainly believe that in the long-term the British pound will find itself much higher against the US dollar as is typical. A break above the top of the range for the Friday session could be a short-term buying opportunity as we continue to chop back and forth.