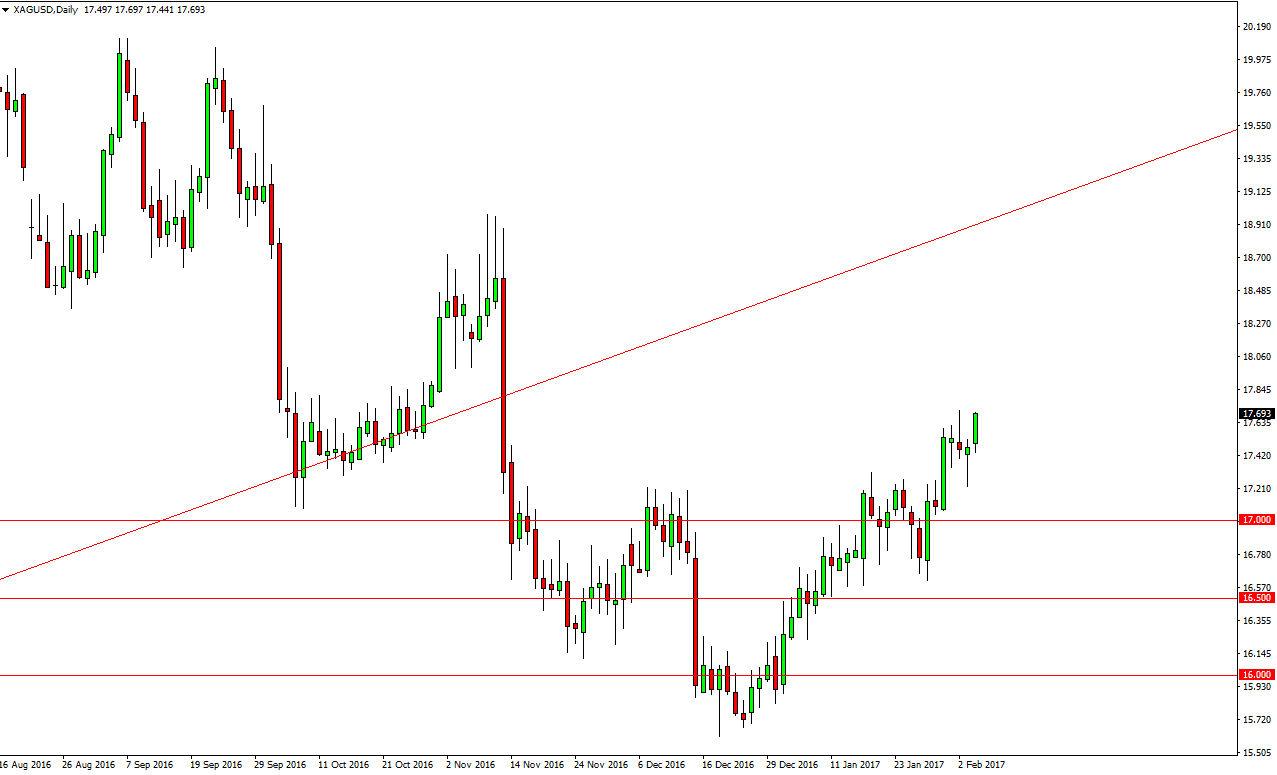

Silver markets broke higher during the session on Monday, reaching towards the top of the shooting star from last week. Gold markets have already broken out to a high above the $1230 level and the candle in the silver market looks very healthy. Because of this, I believe that we will break out and would not be surprised by the time you read this, that we already have. With this being said, I believe that we will then reach towards the $18.50 level above. Pullbacks should continue to offer buying opportunities in a market that is benefiting from a soft US dollar.

Concerns

There are some concerns when it comes to this trade. After all, Silver markets in general are very volatile. However, as long as gold markets continue to rise, I believe that Silver will follow suit as it typically does over the longer term. I also recognize that there’s a lot of noise just above, but ultimately the real resistance is closer to the $18.50 level. Pullbacks should be supported all the way down to at least the $17 level, with the $17.25 level underneath being the first part of the support barrier keeping this market alive.

Ultimately, I believe that the Silver markets have probably bottomed longer-term, and with this being the case if you have the ability to take a non-leveraged position, perhaps you should. I have been buying physical silver again, but this is a long-term type of attitude. If not, then possibly trying the binary options market might be the way to go so that you can at least limit your risk and exposure when it comes to silver trades.

Commodity markets in general should do fairly well, especially commodity currencies. Both the Australian dollar in the New Zealand dollar are looking healthy, so that of course is something to pay attention to as well, as if you have no ability to play metals, perhaps currencies will work.