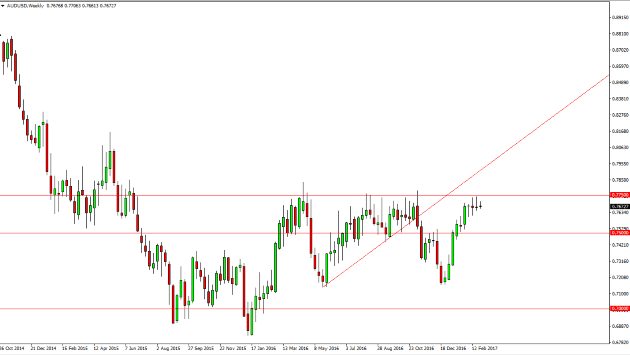

The AUD/USD pair has been struggling as of late, mainly because we have been a bit overextended. The 0.7750 level should continue to be resistive, and I think in the meantime sellers will probably return every time the market gets close. However, I also feel that it’s only a matter of time before we break above their and that should be the signal that were going to go higher again.

Gold markets of course have an influence on the Australian dollar, and they look like they are trying to pick up a little bit. Because of this, it’s probably only a matter of time before the Australian dollar rises, and finally breaks above that barrier. In the meantime, you must think that there might be pull back some time to time, as the barrier has been so solid. A pullback will more than likely find plenty of support below, and the 0.75 level will almost undoubtedly be the “floor” for the month of March. I would be very surprised if we breakdown below that area, and thus I believe that if we pull back to that region, it’s a nice buying opportunity.

The goal markets breaking above the $1250 level recently of course would be also a reason to think that the Australian dollar will go higher. I think all the signals are lining up or move to the upside, so at this point I don’t have any interest in shorting and only look at those pullbacks as opportunity. The one scenario that would change everything is that we somehow broke down below the 0.75 level, which would be very negative and have me selling down to the 0.72 handle, but I don’t think that’s going to happen anytime soon. Because of this, I remain bullish of the Australian dollar but I also recognize that we may have a little bit of work to do ahead of us to realize the full potential.