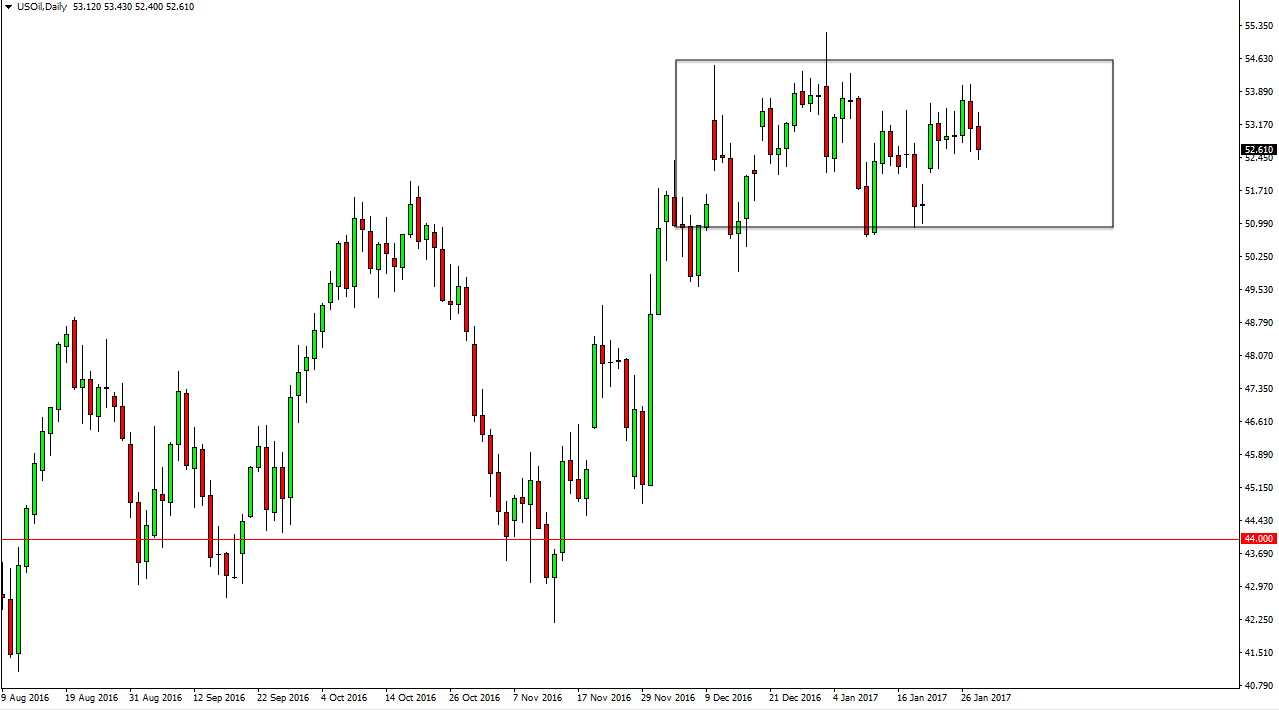

WTI Crude Oil

The petroleum markets were a bit mixed during the day, as we had initially rallied but then turned back around to fall. This was true and not only the WTI market, but also the Brent market. There is a gap below that should continue to offer support, extending down to the $51.50 level. Ultimately, this market is consolidating overall, but I think that eventually we will start to see selling pressure pick up. Currently, I believe that the market will continue to bounce around between the $50 level on the bottom, and the $55 level above. Until we can break out of that range, I think it’s going to be a lot of short-term choppiness ahead, but I believe that the oversupply is eventually going to get in the way of the buyers.

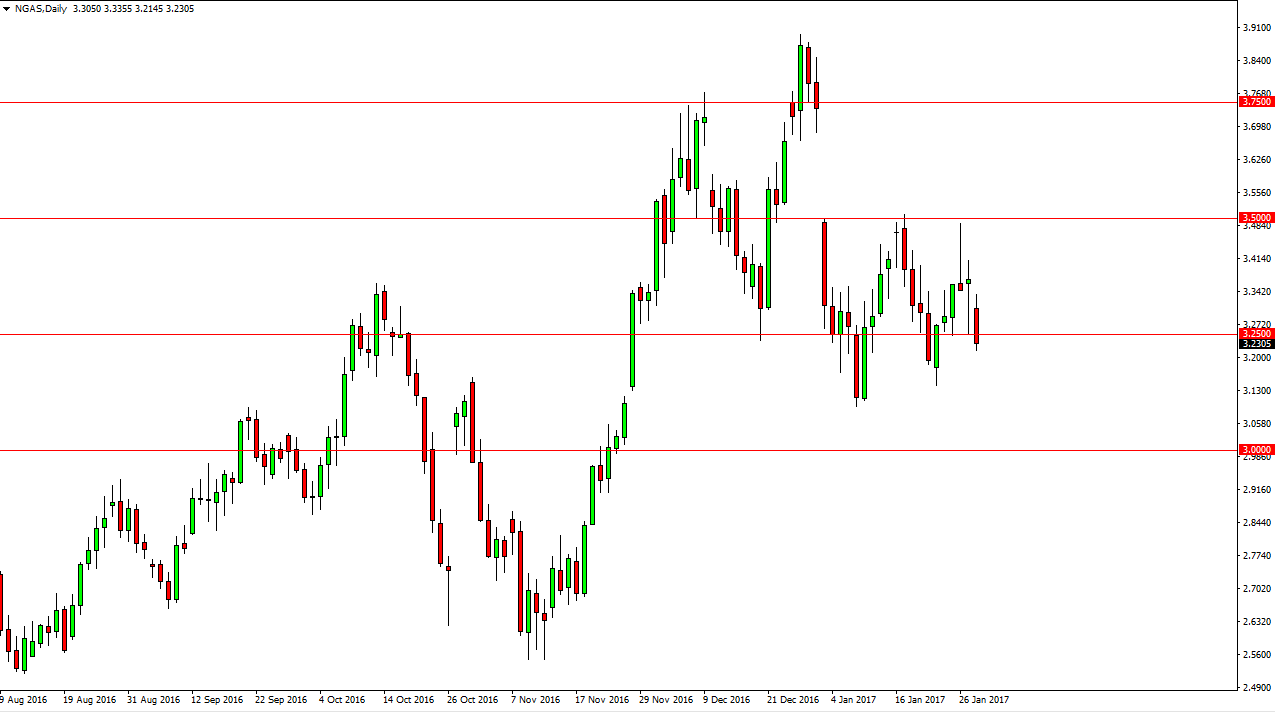

Natural Gas

Natural gas markets gap lower at the open on Monday, as we continue to see quite a bit of volatility in this market. By gapping, the market suggests that we are going to continue to go lower, and I feel it’s only a matter of time before the sellers get involved in this market, as we breakdown below the $3.25 level. The market should then reach towards the $3.10 level underneath, which had previously been supportive. I believe that the market will continue to see quite a bit of volatility, and every time we rally it should offer a selling opportunity as the warmer temperatures should continue to weigh upon the market. I have no interest in buying the natural gas markets, as it shows so much bearishness in general. Given enough time, I think we will reach towards the $3 level below which of course will be massively supportive due to psychological support and previous action.

I have no scenario in which I am willing to buy natural gas markets, especially as we start to leave the wintertime in the United States.