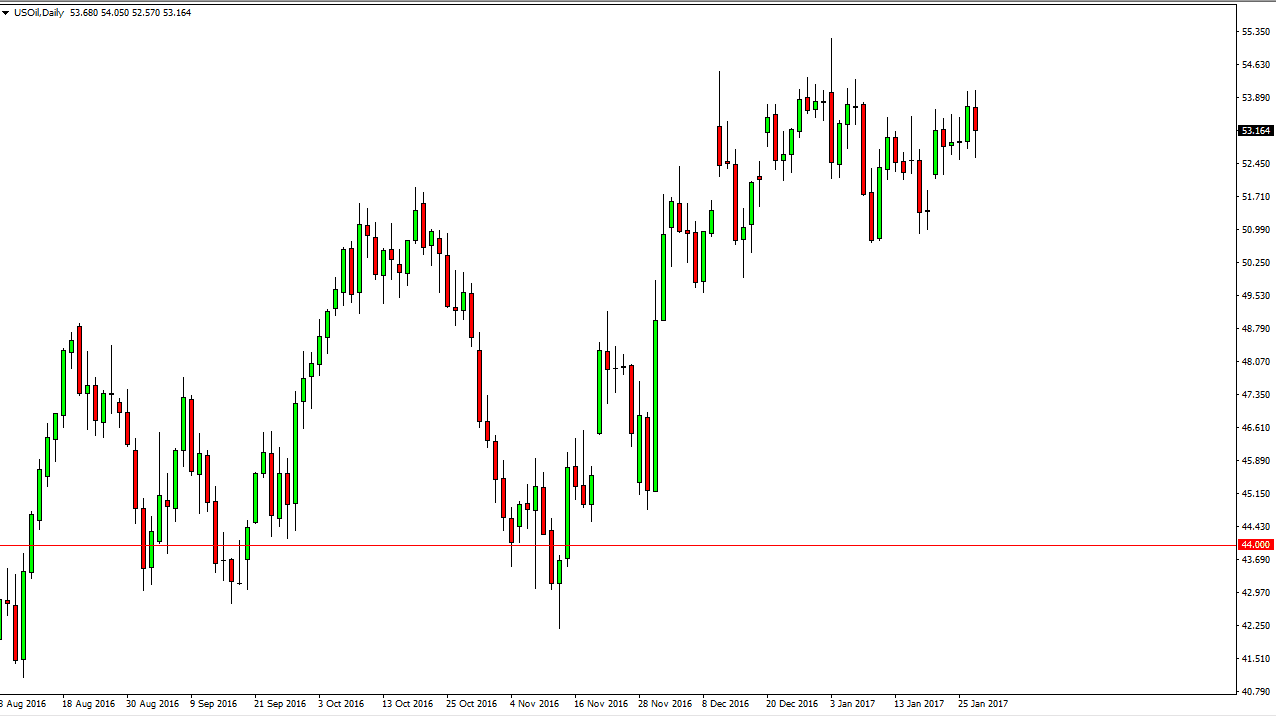

WTI Crude Oil

The WTI Crude Oil market fell initially on Friday but found support near the $52.50 level as we continue to chop back and forth. There are a lot of concerns when it comes to the oil market right now, mainly due to the lack of clarity when it comes to demand. While the inventory numbers keep rising, the market seem to be focusing on the fact that OPEC and several other countries decided on production cuts. In the end, I think that oversupply overwhelms OPEC, and we start seeing selling again. Because of this, I’m waiting to see and exhaustive candle in order to start selling, but I recognize that in the meantime we are simply going back and forth and that’s the way were going to have to trade this market. I believe that the $55 level above is resistance, while $50 below is the bottom of the range.

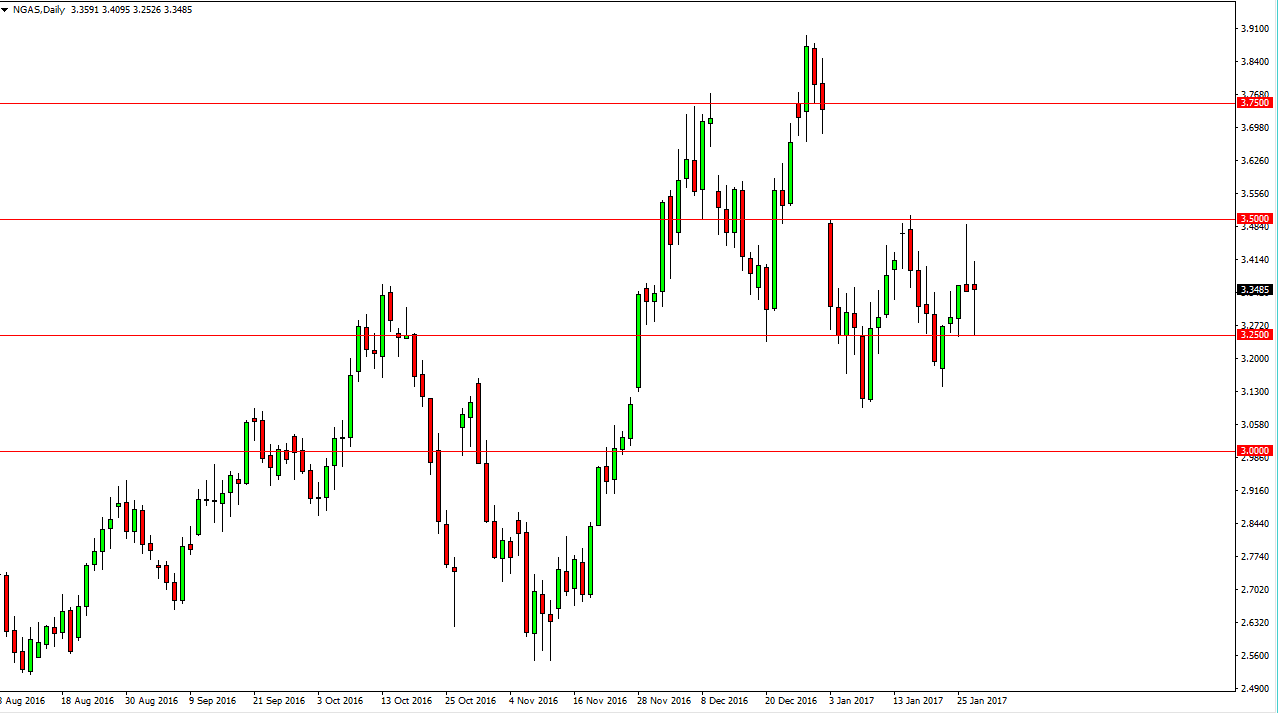

Natural Gas

The natural gas markets fell initially on Friday, testing the $3.25 level. We found enough support to turn things around and formed a hammer, and with this being the case, the market looks as if it is going to remain very volatile and trade between the $3.25 level on the bottom, and the $3.50 level on. Currently, I think we continue to chop around but if we can break above the $3.50 handle, I think we will fill the gap and then reach towards the $3.73 level. If we can break down below the $3.25 level, the market will more than likely reach down to the $3.10 level underneath. Regardless, volatility is going to be a mainstay in this market for the near future, as natural gas markets tend to be very volatile this time of year. I believe ultimately that the market sells off longer-term, as the supply were overwhelmed demand.