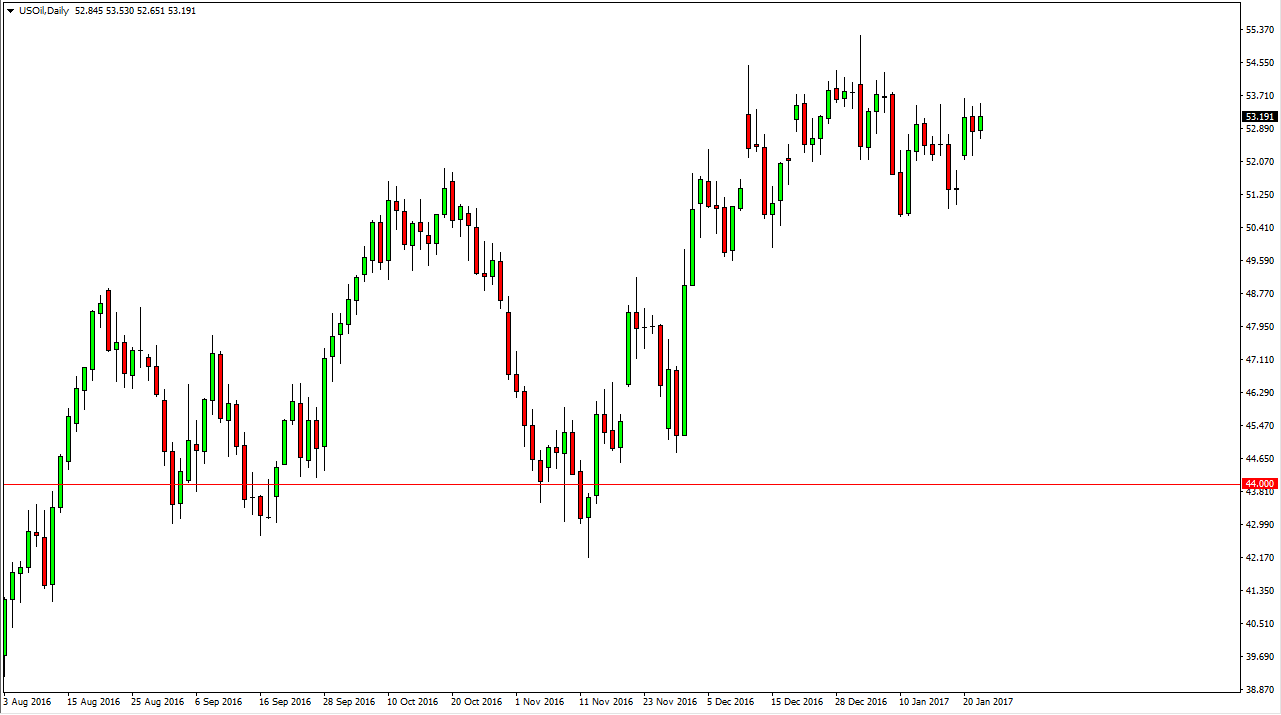

WTI Crude Oil

The WTI Crude Oil market had a quiet Tuesday, as we await the inventory numbers today. We ended up a relatively flat looking candle being printed at the end of the session, and thus there’s not much to say about the session itself. However, the inventory numbers lately have been rather bearish so it will be interesting to see where we go from here. Currently, I believe that the market is consolidating between the $50 level on the bottom, and the $55 level on the top. With this in mind I don’t have any desire to place longer-term trades. I believe that the market will continue to consolidate but one would have to think that it’s only a matter of time before the oversupply issue reenters the mindset of traders around the world.

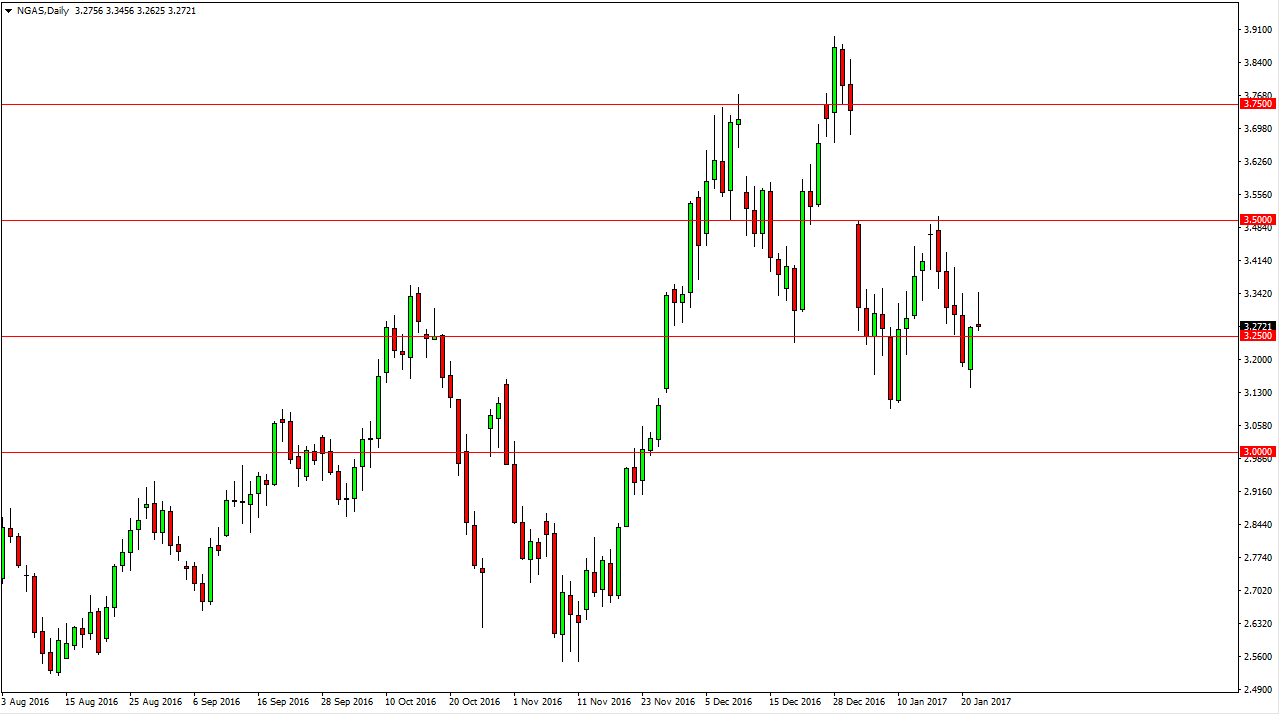

Natural Gas

The natural gas markets initially tried to rally during the session on Tuesday, but turned around to form a shooting star. The shooting star of course is a negative candle and it’s just above the $3.25 level. That’s an area that had been supportive in the past so I think if we can break down below there, the market should continue to go even lower. Alternately, if we can break above the top of the shooting star, that would be a very bullish sign any could send this market looking for the $3.50 level above. That begins the massive gap from a few weeks ago, and if we can break above there the market should then reached all the way to the $3.73 handle. Either way, I think longer-term there is a serious threat of bearish pressure, as the warmer than expected temperatures in the northeastern United States continue to wear on the value of this market. On top of that, oversupply is a constant thorn in the side of the buyers, and thus it’s only a matter of time before breakdown.