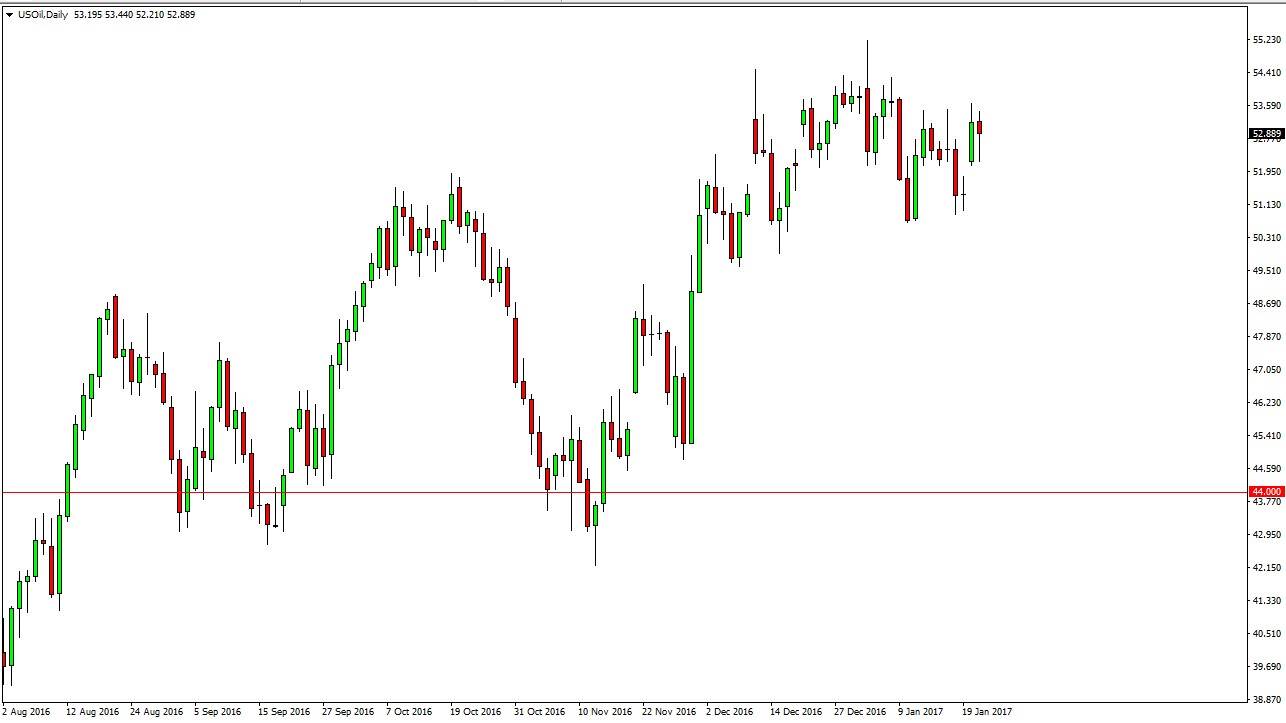

WTI Crude Oil

The WTI Crude Oil market fell initially on Monday, but found enough support at the previous gap to turn around and form a slightly positive looking candle. This is a market that should continue to try to go higher but I also recognize that the $55 level above will continue to be massively resistive, so it’s not until we break above there that I’m comfortable buying with any significant size and time involved. I believe that more than likely the sellers will return as we get closer to that level, so exhaustive and exhaustive candle could be nice short-term selling opportunities. We continue to struggle with oversupply and demand issues, so because of this I believe that the volatility will not only stay, but it could possibly increase.

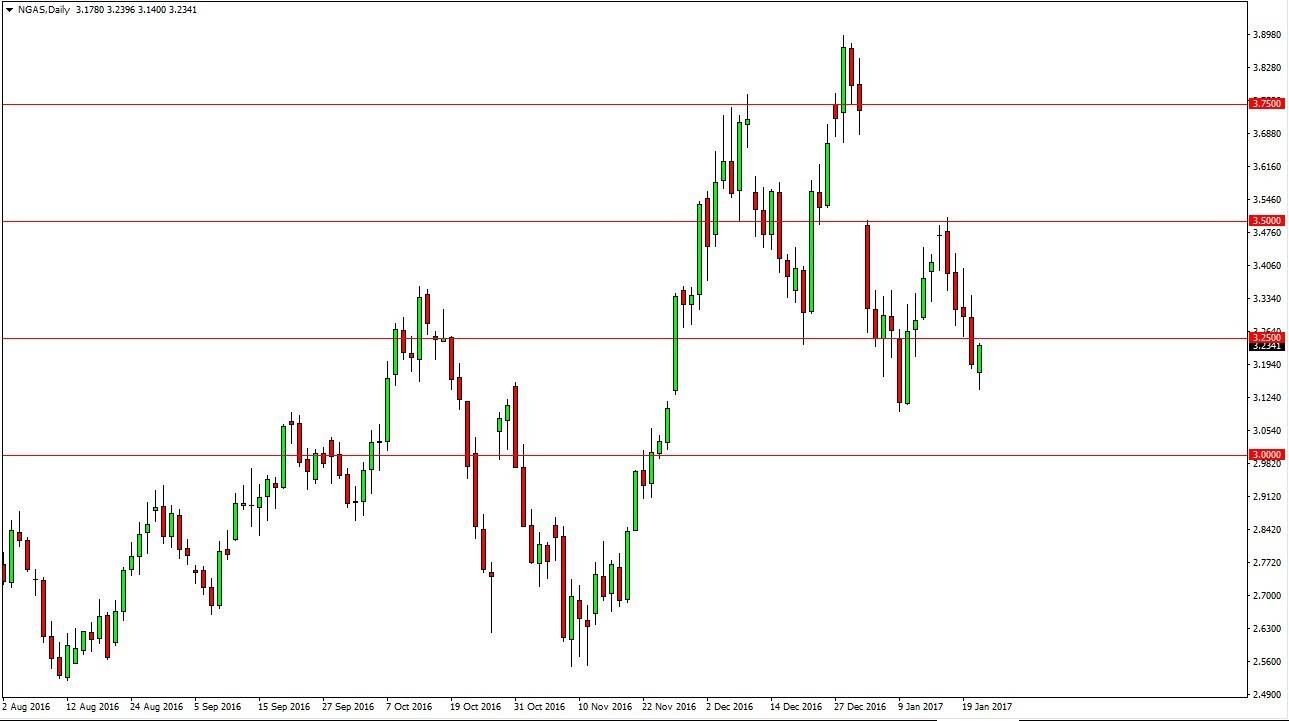

Natural Gas

Natural gas markets initially fell on Monday, but did find a bit of footing at the $3.13 handle. By doing so, we are reaching towards the $3.25 level which has a certain amount of psychological significance. If we can break above there, we could reach towards the $3.50 level yet again. That is the beginning of a massive gap lower, which could get filled. If we can continue to go higher, this is a “higher low”, which of course is a bullish sign but I believe longer-term we have many issues to overcome and quite frankly will be doing so anytime soon.

Exhaustive candles are selling opportunities as far as I can see, and with the warmer than anticipated to pictures in January, the United States is using much less natural gas than typical for this time year. With this being the case, it’s likely that demand will continue to be an issue, especially considering how we have so much proven natural reserves of natural gas in both the United States and Canada.