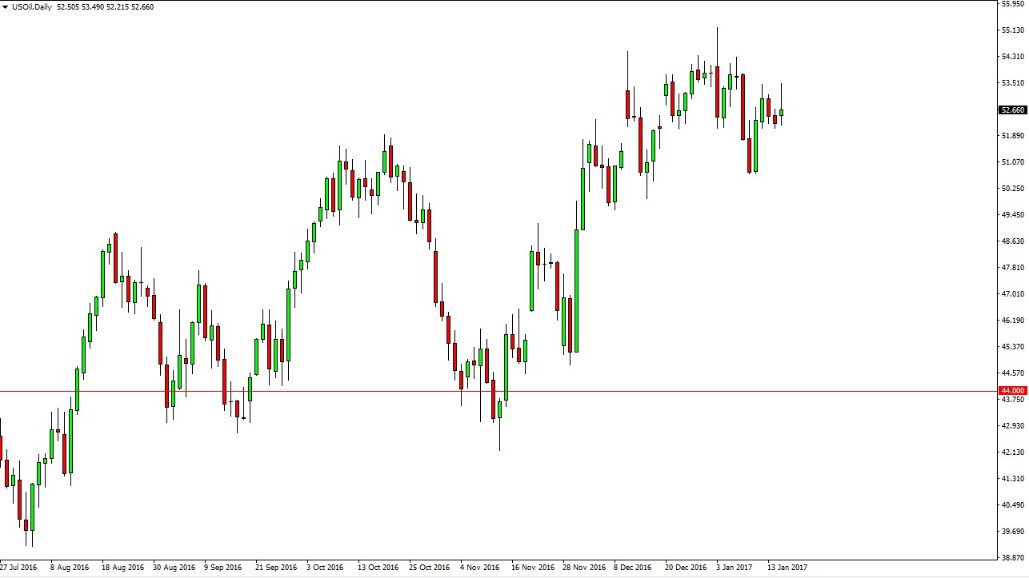

WTI Crude Oil

The WTI Crude Oil market rallied during the session on Tuesday, but found the $53.50 level above to resistive to continue going higher. By pulling back, this suggests to me that we are going to see a bit of a roll over in this market still, and a breakdown below the bottom of the range for the session on Tuesday should send this market down to the $51 level, if not the $50.50 handle. A break above the top of the shooting star suggests that the market will probably try to reach towards the $55 level above. I do think that were starting to run out of strength though, so with this being the case I am looking to sell as I believe the markets are coming to terms with the fact that oil has gone too far.

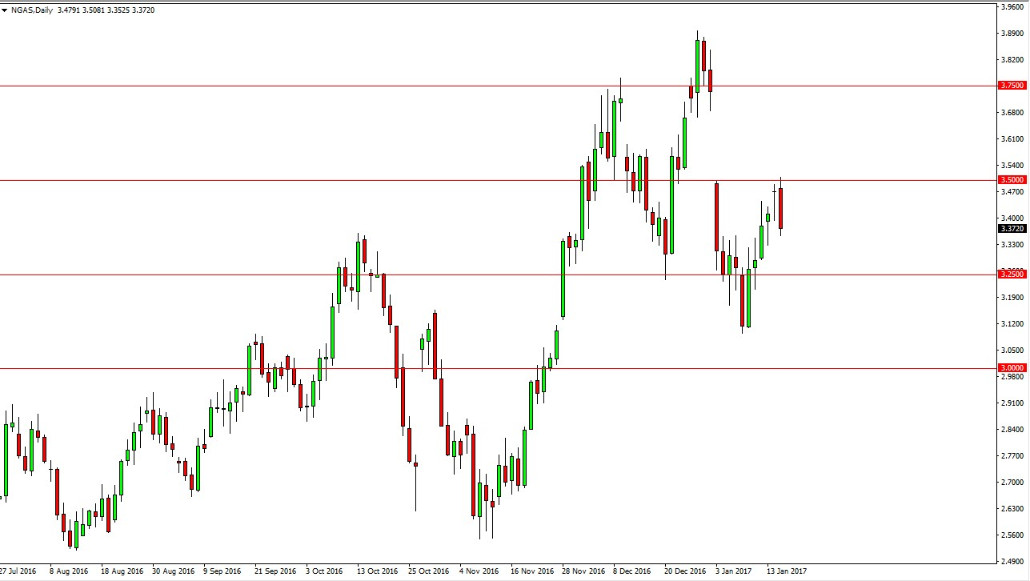

Natural Gas

Natural gas markets fell after initially trying to rally on Tuesday as the $3.50 level offered far too much in the way of resistance. The candle being so negative suggests that we should continue to go lower, and if we breakdown below the bottom of the candle I think we will reach towards the $3.25 handle underneath. If we can break above the top of the candle, then I believe we will try to fill the gap that formed a couple of weeks ago, That would be a very bearish short-term moved to roughly $3.74. I have no interest in hanging onto a longer-term bullish position, I believe that ultimately we start falling again either way, but sometimes gaps don’t get completely filled but rather tested. We’ve already tested the gap so I can see where perhaps the sellers start to get involved again.

There is a lack of demand out there for natural gas in ratio to the massive amounts of supply. The oversupply should continue to be a significant hindrance to higher pricing.