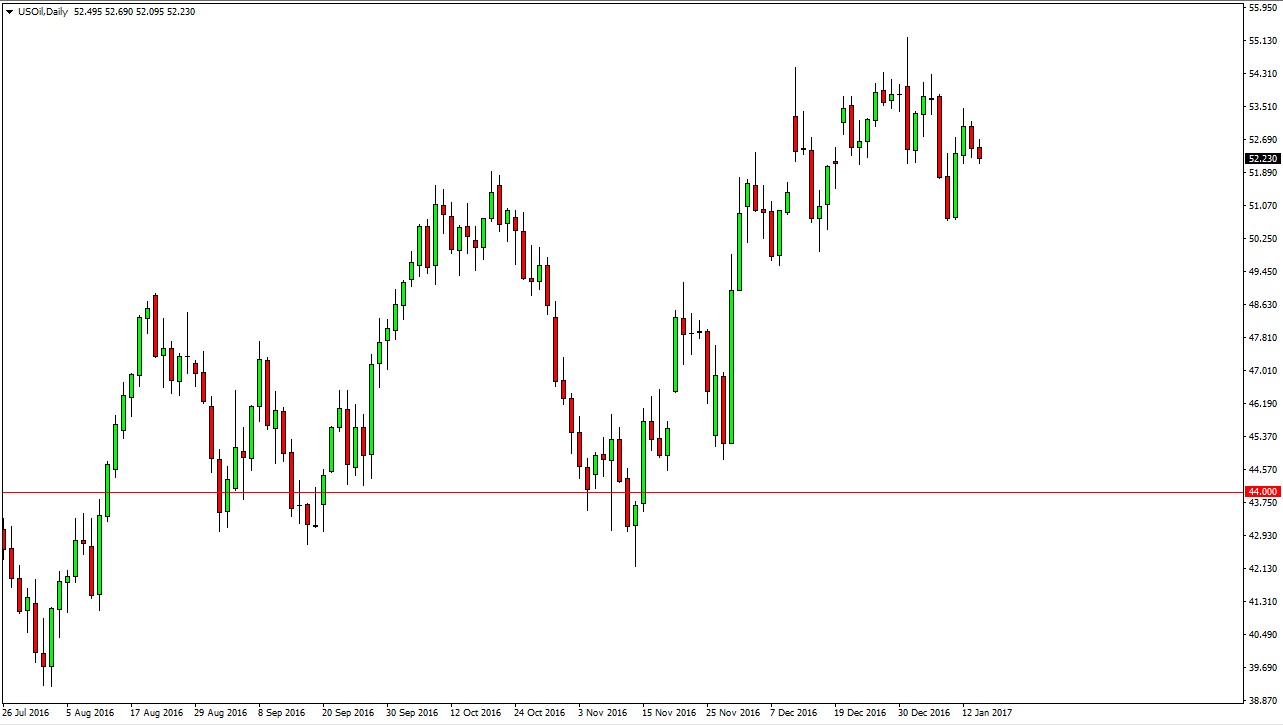

WTI Crude Oil

The WTI Crude Oil market fell slightly on Monday as liquidity would have been a serious issue. It was Martin Luther King Jr. day in the United States, which of course is the reason so many Americans would have been away from their electronic terminals. Ultimately though, what I look at is that we are appearing to try to roll over. Because of this, I think the market is going to reach towards the $50.50 level, as the market simply seems to be running out of steam. The market above sees quite a bit of resistance as well, and I think that the idea of noncompliance when it comes to the output production cuts is starting to enter the mind of traders. A strengthening US dollar of course doesn’t help oil either.

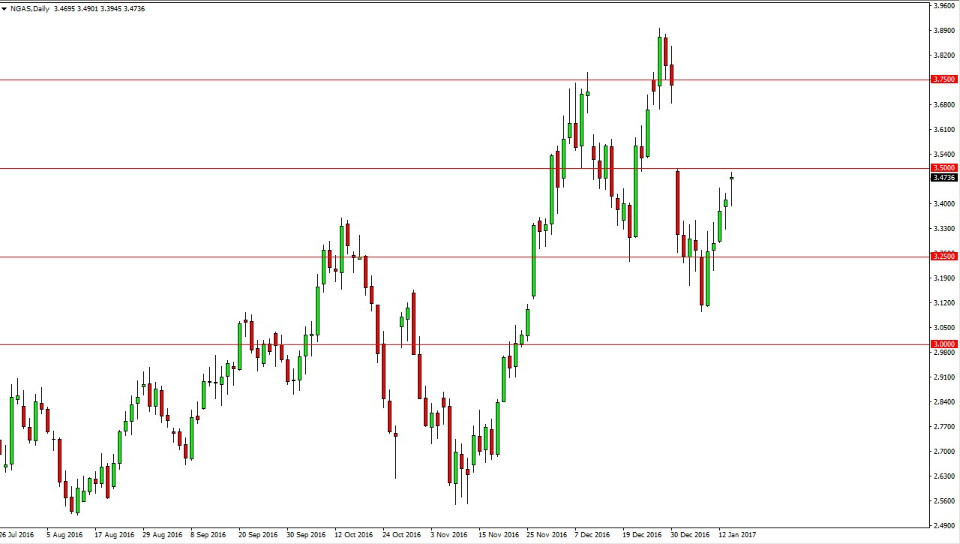

Natural Gas

The natural gas markets rallied after initially gapping and then pulling back to fill that gap on Monday. The $3.50 level was where the massive gap ended from a couple of weeks ago, I think we are about to see this market try to fill that gap, so short-term traders will more than likely get involved above the level. Ultimately, I think that given enough time the sellers will return because that gap was so vicious. Impulsive moves like that typically means something longer-term, and although this is an extraordinarily volatile market, that tends to be true here as well.

This really comes down to be in the to speed market. If your short-term, then you will probably prefer buying this contract. All of you that are longer-term, you’re going to simply wait for an opportunity to short at a higher level. Because of this, there are several different ways to play this market currently. Given enough time, I do think that the longer-term downtrend comes back into play, although we have had a very strong last several months.