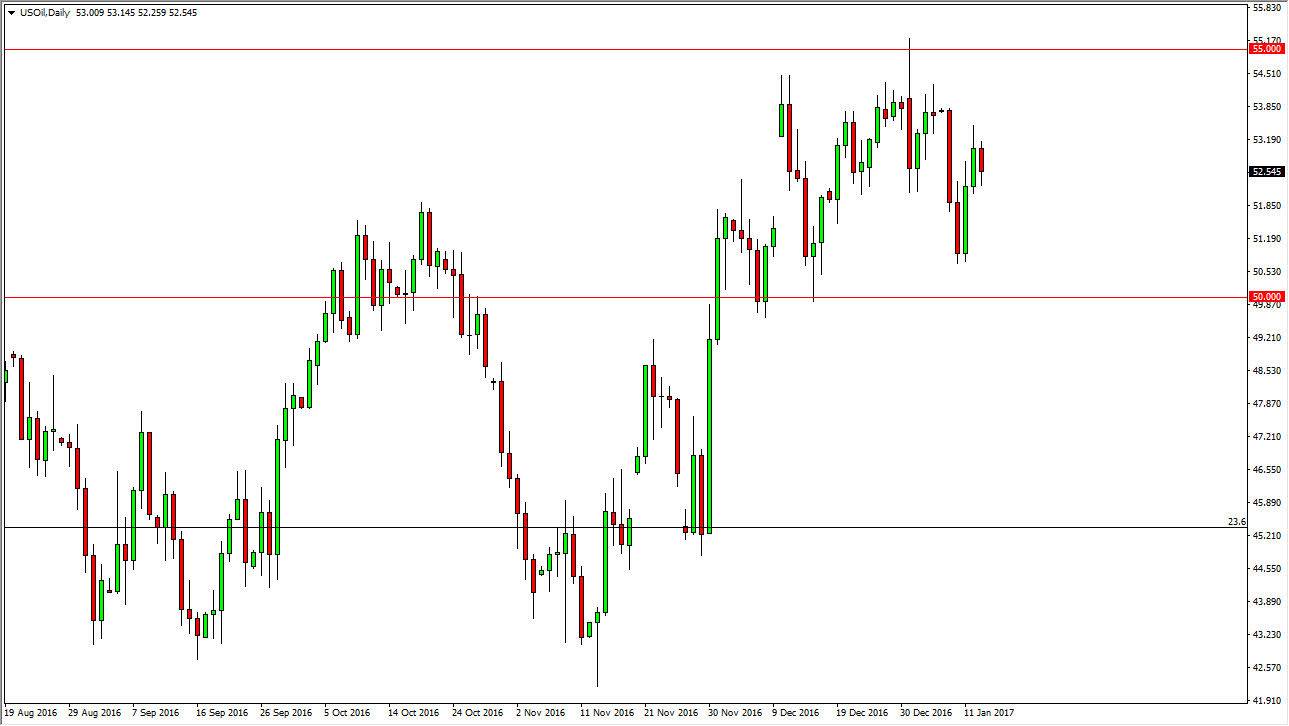

WTI Crude Oil

The WTI Crude Oil market fell on Friday, as we have gotten a little bit overextended. Ultimately, this is a market that should continue to be choppy in general, and as we continue to consolidate I expect a lot of volatility. The $55 level above is resistive, just as the $50 level underneath is supportive. Because of this, expect a lot of back and forth trading, as we come to terms with whether there is an oversupply issue. Personally, I believe there is but the market isn’t entirely convinced quite yet. If we did break above the $55 level, the market should then reach towards the $60 level. Ultimately, the one thing I think you can count on is that this will not be a market for the squeamish.

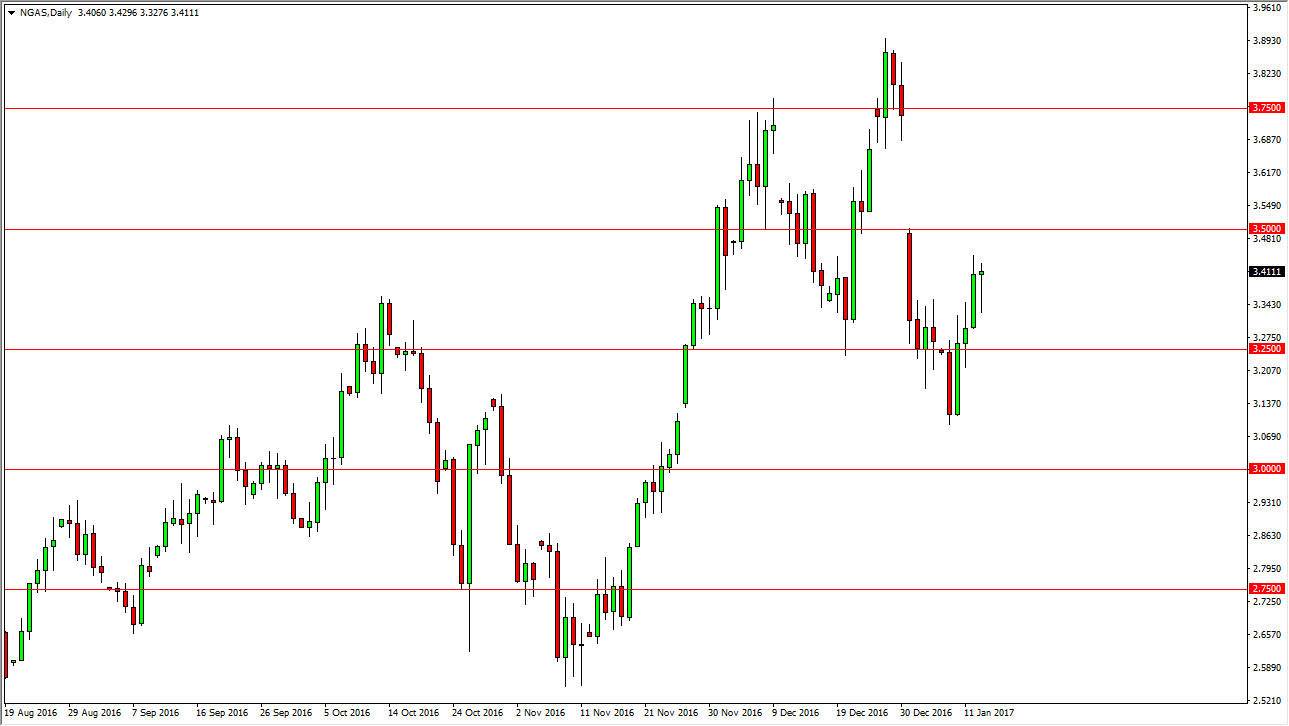

Natural Gas

The natural gas markets fell initially on Friday but turned around to form a massive hammer. The hammer of course is a bullish sign, and we are oversold at the moment. At the $3.50 level is the bottom of the massive gap that send this market lower, so that’s the beginning of massive resistance. Because of this, I feel that short-term traders might be able to take advantage of this bounce, but I’m a little bit more comfortable waiting for an exhaustive daily candle that I can start selling as the gap was so vicious. Natural gas markets will continue to suffer at the hands of warmer weather in the northeastern corridor of the United States, which of course is the largest consumer of natural gas in the world.

Alternately, if we break down below the bottom of the hammer that form during the day on Friday could be a signal that were going to go back down towards the $3.15 level. Either way, I do believe longer-term we are dropping.