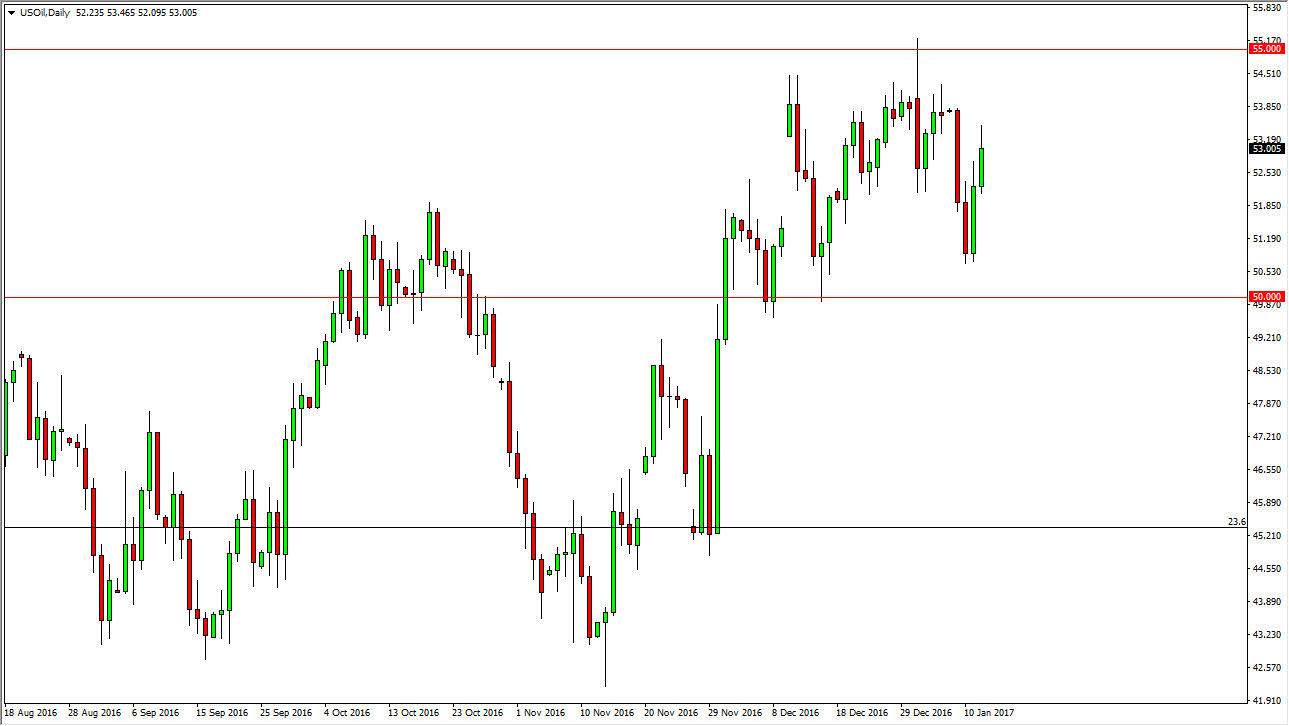

WTI Crude Oil

The WTI Crude Oil markets rallied during the session on Thursday, but continues to see quite a bit of resistance above. Because of this, I feel that this market will eventually forming an exhaustive candle that we can sure, considering that there has been so much consolidation just above. The $55 level seems to be massively resistive, and with that I more than willing to short is only an opportunity. However, we break above the $55 level, the market should then continue to go higher. If that happens, I would anticipate that the market would reach towards the $60 level above. Ultimately, this is a market that should show a lot of volatility because there so many moving pieces, but quite frankly it appears that the demand is driving, so given enough time I think the sellers will win out.

Natural Gas

The natural gas markets rallied during the session on Thursday, extending all the way to the $3.45 level above, which of course is a sign of strength, but I still think of the gap above will continue to offer quite a bit of resistance, and it’s only a matter of time sellers get involved. The gap typically gets filled given enough time, and I think that’s what’s happening now. However, I think it’s can be difficult to go long, at least if you have a bit of an aversion to the idea of volatility. Personally, I will be waiting on the sidelines for an exhaustive daily candle to start selling, because quite frankly the size of the gap that we had several sessions ago is a massively resistive sign, and I believe that the sellers will continue to take over. After all, there is a massive oversupply of natural gas overall, and the weather is starting to warm up in the northeastern corner in the United States.