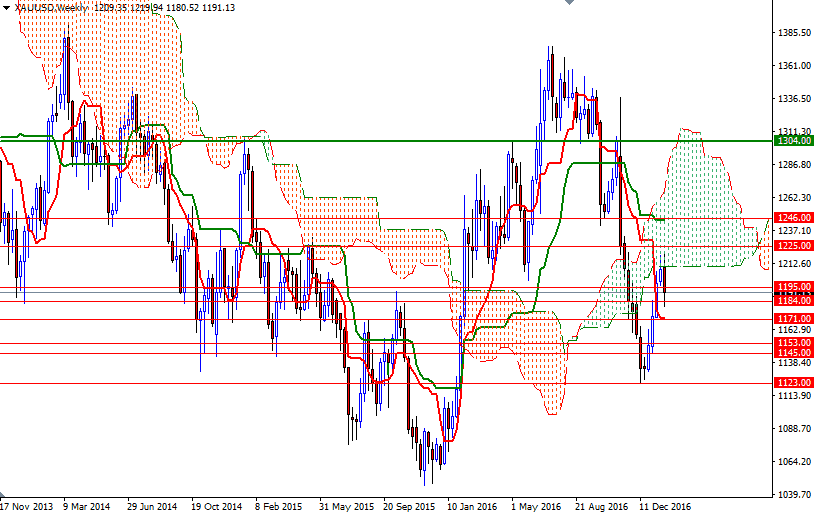

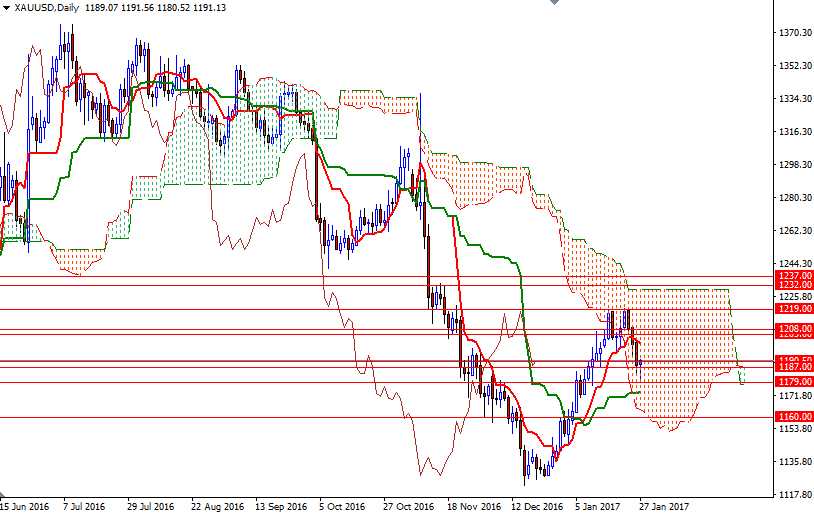

Gold ended the week down 1.5% at $1191.13 an ounce, ending its four-week winning streak, as surging U.S. stock markets took some momentum away from the precious metal. The XAU/USD pair tried to break through $1220 but investors used this used this opportunity to lock in profits. The market pulled back towards $1179 but managed to climb back above $1190.50 on Friday after the greenback suffered from weaker than expected economic data. The Commerce Department reported that gross domestic product increased at a 1.9% annual rate and demand for durable goods fell 0.4% in December.

All eyes will be on the Federal Reserve policy meeting on Wednesday and the U.S. jobs report on Friday. In the meantime, keep an eye on major equity markets. Strong corporate earnings and optimism over Trump’s plans has pushed U.S. stock indexes to record highs and eroded the appeal of safe-haven assets. If the U.S. dollar strengthens heading into the Fed meeting, it could have a negative impact on gold. However, bear in mind that the size and the timing of the tax cut and infrastructure spending are still uncertain, and markets aren’t expecting to see a Fed rate hike before June.

The market’s inability to penetrate the resistance in the 1220/19 area was also behind last week’s decline. Just a week ago I had warned that we could see a pullback before gaining enough momentum to approach the 1250/46 region. Friday’s candle suggests that there are buyers around the 1179 level but the market is below the Ichimoku cloud on the 4-hour time frame. In other words, although we found some support in the vicinity, it might be in danger again unless XAU/USD break through 1208/5. But of course, the bulls will need to push prices beyond 1200-1198 so that they can approach that region. Anchoring somewhere above 1208 would improve the short-term technical picture and open a path to 1220/19. To the downside, the initial support stands in the 1179/7 zone. If the market breaks down below 1177, then 1171/69 will probably be the next stop. Once below that, look for further downside with 1165 and 1160/57 as targets. The bears have to capture this strategic camp in the 1160/57 region to set sail for the 1145 level.