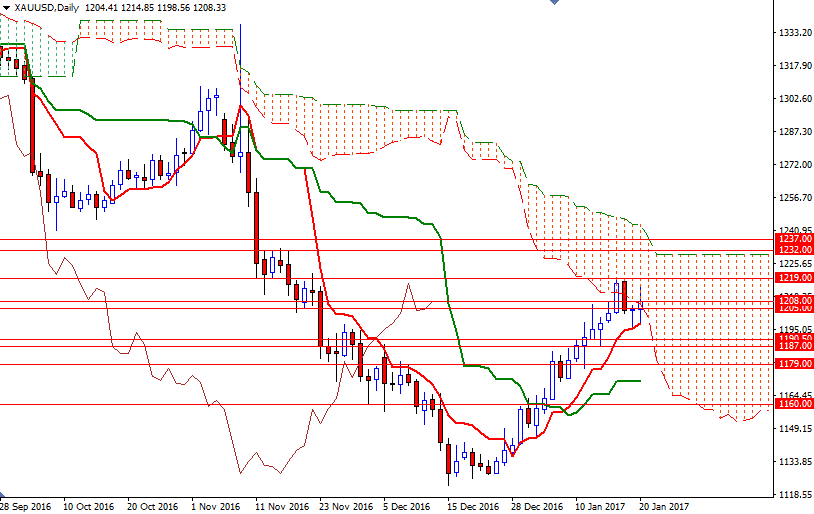

Gold prices settled at $1208.33 an ounce, rising 0.85% over the course of the week, as a weaker US dollar and concerns about Britain's exit from the EU helped provide a lift to the precious metal. Uncertainty over the Trump administration's economic policies also has been supportive for gold recently but hawkish comments from top Fed officials prevented the market from rallying significantly higher. The XAU/USD pair broke through the $1208/5 resistance and marched towards the $1220/19 region as expected. However, the market's inability to penetrate this barrier prompted investors to cash in some profits after weeks of gains and pushed prices towards the Ichimoku cloud on the 4-hour time frame.

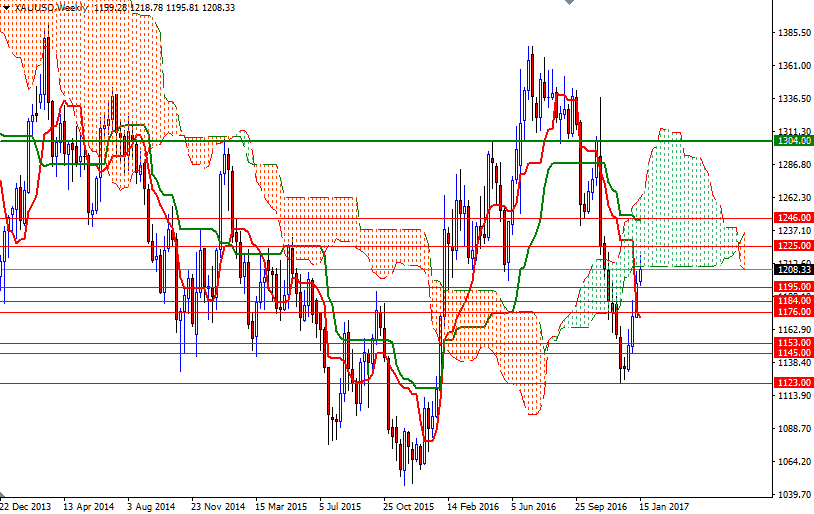

Apparently, the market is driven by uncertainty at the moment as Trump’s economic plans (and whether the Congress will endorse large tax cuts and increases in infrastructure spending) are still not clear and may yet impact Fed's policies. In the meantime, the prospect of further interest rate increases this year is likely to weigh on gold. From a technical perspective, there are two things to pay attention. First of all, the short-term charts are still bullish, with the market trading above the Ichimoku clouds on M30, H1 and H4 time frames. Plus, we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the daily and 4-hourly charts. On the other hand, the weekly and the daily Ichimoku clouds and on top of us and they overlap in the 1232/12 area.

With these in mind, I think gold prices will tend toward consolidation for some time or at least pull back before gaining enough momentum to approach the 1250/46 region. The 1220/19 area is the first strategic camp for the bulls to capture if they intend to challenge the bears on the 1225 battle field. Closing above 1225 could provide the bulls extra fuel they need to reach the next significant barrier standing in the 1237/2 zone, where the top of the daily cloud resides. Once beyond that, XAU/USD will be targeting 1250/46. If the bears take over and push prices back below 1195, then the 1190.50-1187 zone will probably be the next stop. Breaking down below this support implies that the bears are on their way to visit 1179/6. This area has been both resistive and supportive in the past, we need to get down below there in order to continue to the downside and test 1170/69.