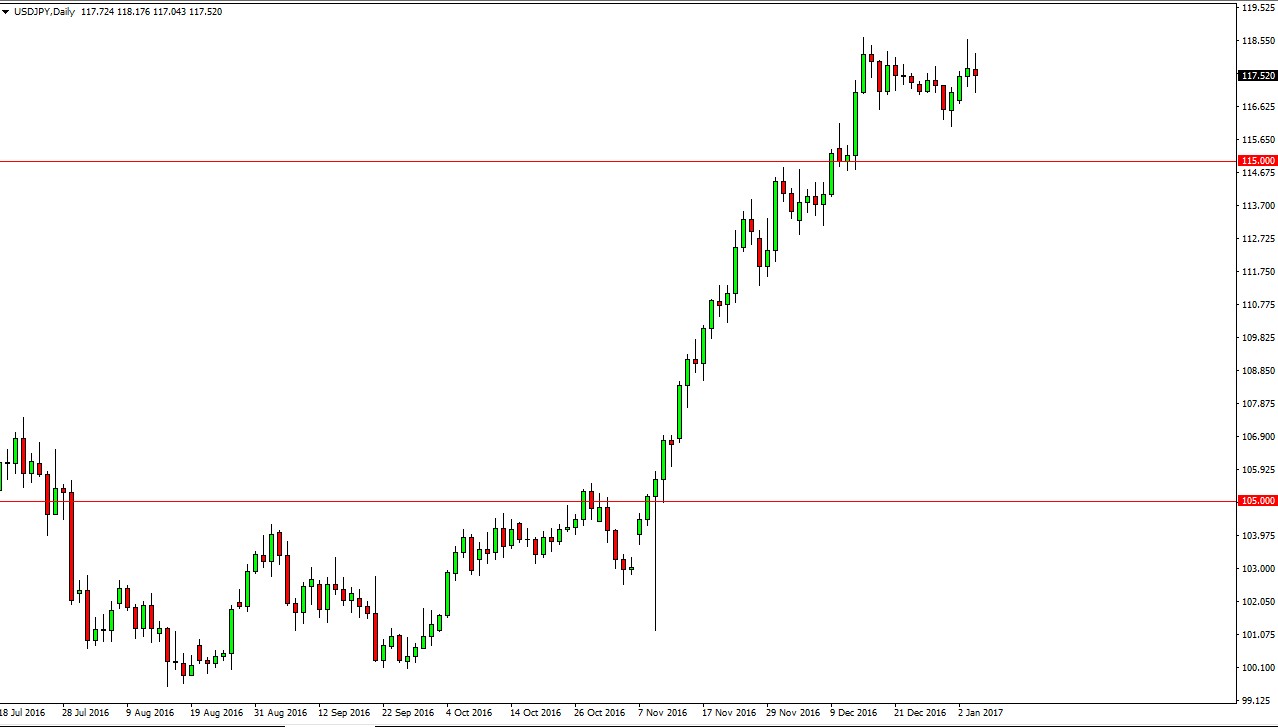

USD/JPY

The US dollar went back and forth against the Japanese yen on Wednesday, as we await the jobs numbers. The market looks content to consolidate in this general vicinity, and that’s not a big surprise to me. I believe that traders typically take a break from the currency markets when they have the job number coming, as a lot of uncertainty and volatility enters the market due to that announcement. I believe the pullbacks offer value the traders will take advantage of, and that the 115 level below is supportive. Because of this, I am looking to buy pullbacks as they occur, but recognize it probably is going to be reasonably quiet over the next couple of sessions. I still have a target of 120 when it comes to this pair, so I have no interest in selling.

AUD/USD

The Australian dollar rallied on Wednesday, breaking above resistance at the 0.7250 handle. I still think there’s a lot of resistance above, and as a result this pair looks as if the bounce is more or less a reflection of the oversold condition that we find the market in. I expect to see massive resistance somewhere near the .7350 level, an area that has been supportive in the past. Because of this, I’m not interested in buying this parent believe that it is only a matter time before we get the exhaustive candle I’m looking for in order to start selling. Gold markets continue to be fairly soft, and that of course works against the value of the Australian dollar in general.

The jobs number could push money into the US dollar yet again, and that of course will work against the value of the Aussie against it. I have no interest in buying, I believe that eventually we will fall enough to test the 0.70 level below.