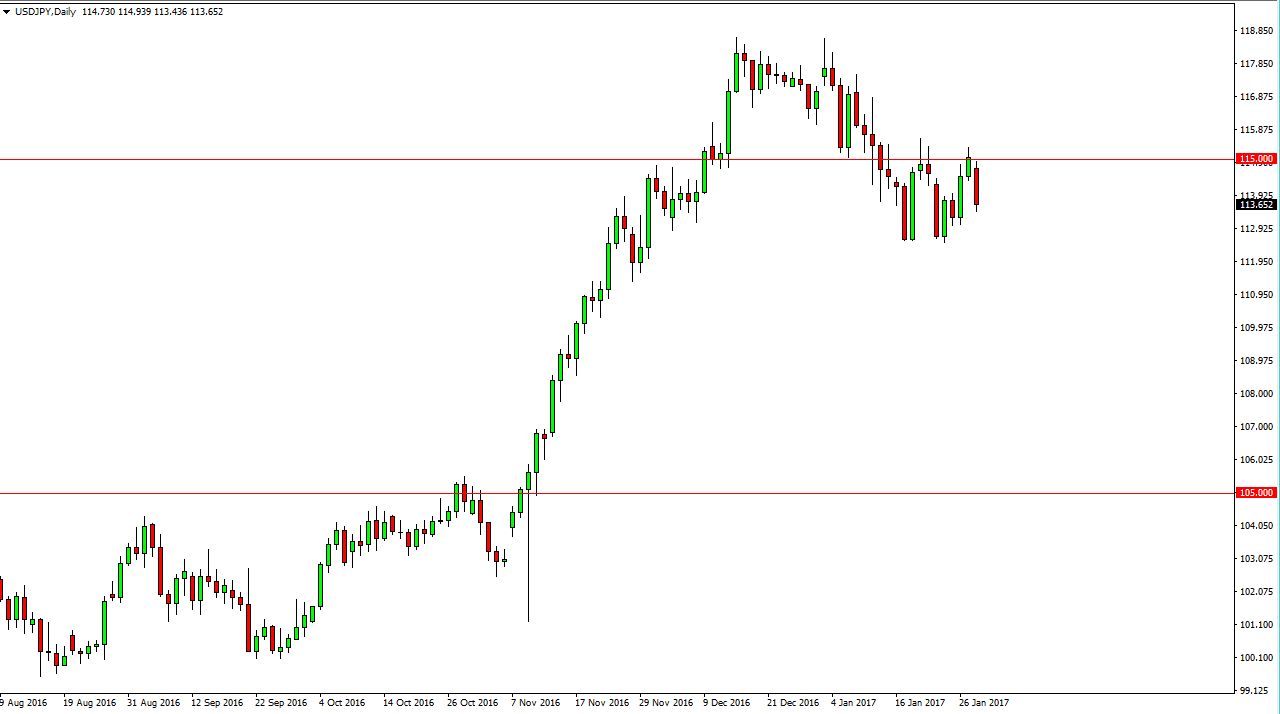

USD/JPY

The USD/JPY pair fell during the day on Monday, as the 115 level has offered quite a bit of resistance. With this, the market should then reach down towards the 112.50 level where I would expect to see quite a bit of support. I think that the short-term market will favor sellers, but I don’t have any interest in trying that trade, as I am waiting for a signal to start buying as I believe it is the longer-term move, and other words it should be easier to deal with the volatility. If we can break above the 115.50 level, I believe the market then goes to the 118.50 level, and then possibly towards the 120 level after that. A breakdown below the 112.50 level would be very negative though.

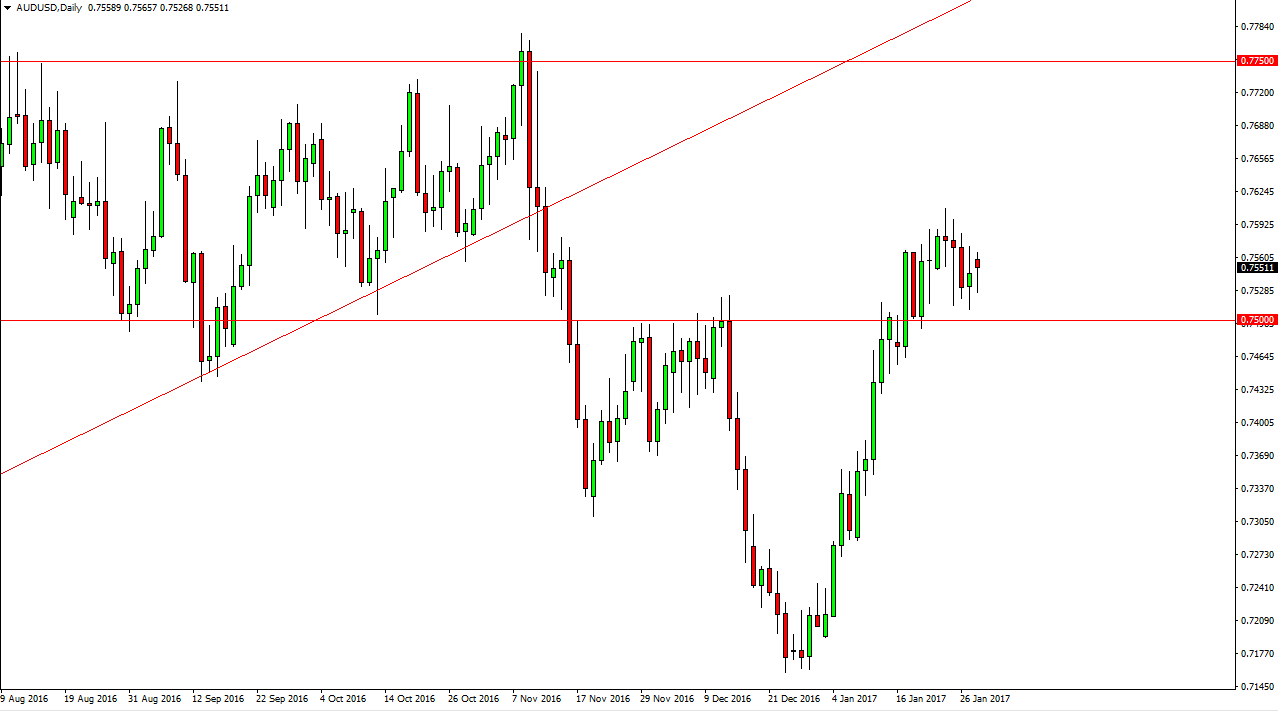

AUD/USD

The Australian dollar initially fell during the session on Monday, finding support just above the 0.75 handle. By doing so, the market turned around and formed a nice looking hammer, suggesting that we are going to see more buying pressure. Pay attention to gold, as it approaches the $1200 level it should decide as to where it goes next. That of course will influence the Australian dollar itself, so I believe that the two moves will coincide. If we go higher, I think the market then reaches towards the 0.7750 level. If we break down below here, I think that there is a significant amount of support all the way down to the 0.74 level underneath. Once we get below there, I think that the market finally breaks down significantly and reaches towards the 0.71 handle.

Ultimately, I believe that it’s more likely to break to the upside though, so I am much more comfortable in buying either supportive candles or a breakout above the recent high as we have seen so much in the way of bullish pressure.