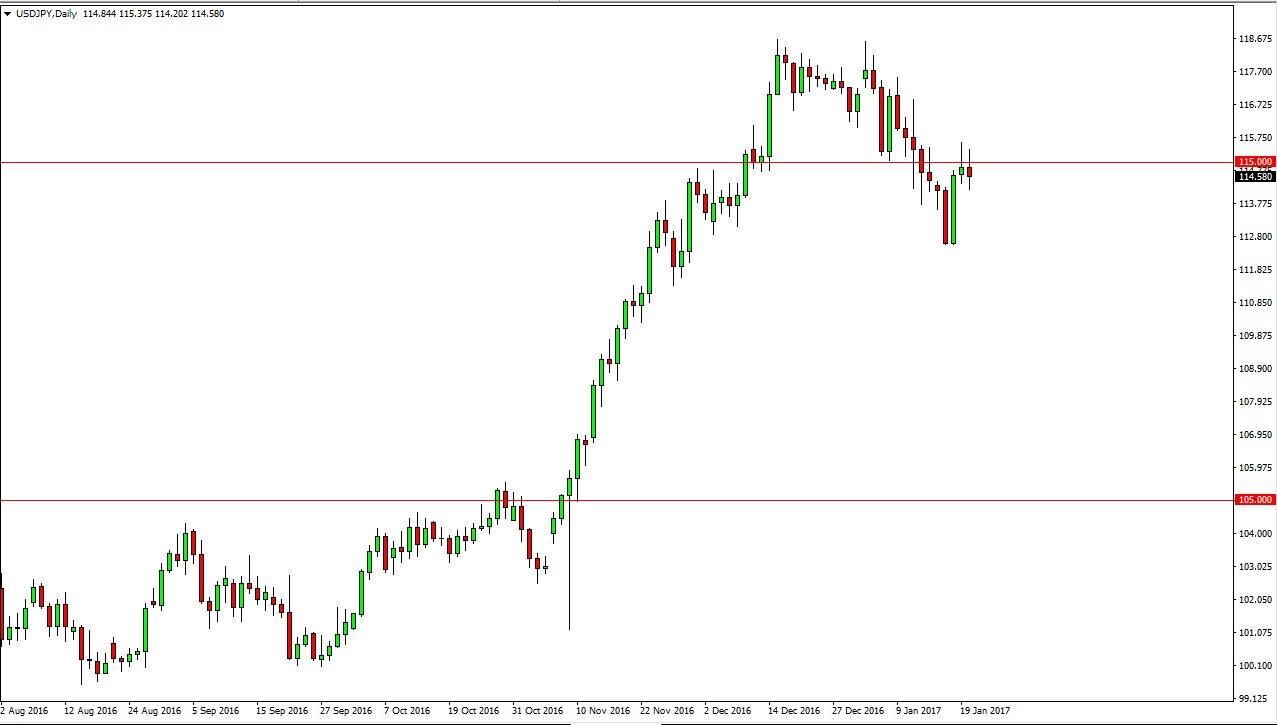

USD/JPY

The USD/JPY pair tried to rally during the session on Friday, but just as we saw on Thursday, sellers came in above the 115 handle. Because of this, the market looks as if it could roll over a little bit but quite frankly I am very bullish of this market and recognize that the longer-term trend has shifted to the upside. A pull back here only offers value that we can continue to go long. A break above the top of the Thursday candle could be a buying opportunity as well, as the market should then reach towards the 118.50 level above. Once we get there, I would expect the next move to be to the 120 handle. I have no interest in selling this market, interest rate expectations certainly favor the US dollar.

AUD/USD

The AUD/USD pair went back and forth during the session on Friday, as we continue to find buyers just above the 0.75 handle. Because of this, I think it’s only a matter of time before we must make some type of decision. Underneath the 0.75 level, there is a lot of noise, so I think that breaking down will be a rather choppy process. The market then could continue to go much lower but I recognize it’s going to need a little bit of help. I believe that help would come from the gold markets, as they tend to have a massive amount of influence on the Australian dollar longer term.

Alternately, if we can break above the top of the candle for the session on Friday, the market could then go to the 0.7750 level. That’s an area where I see a massive amount of resistance, but between here and there is a lot of choppiness. Either way, it doesn’t really matter which direction we go but I need to see the gold markets influencing the Australian dollar in order to take that trade.