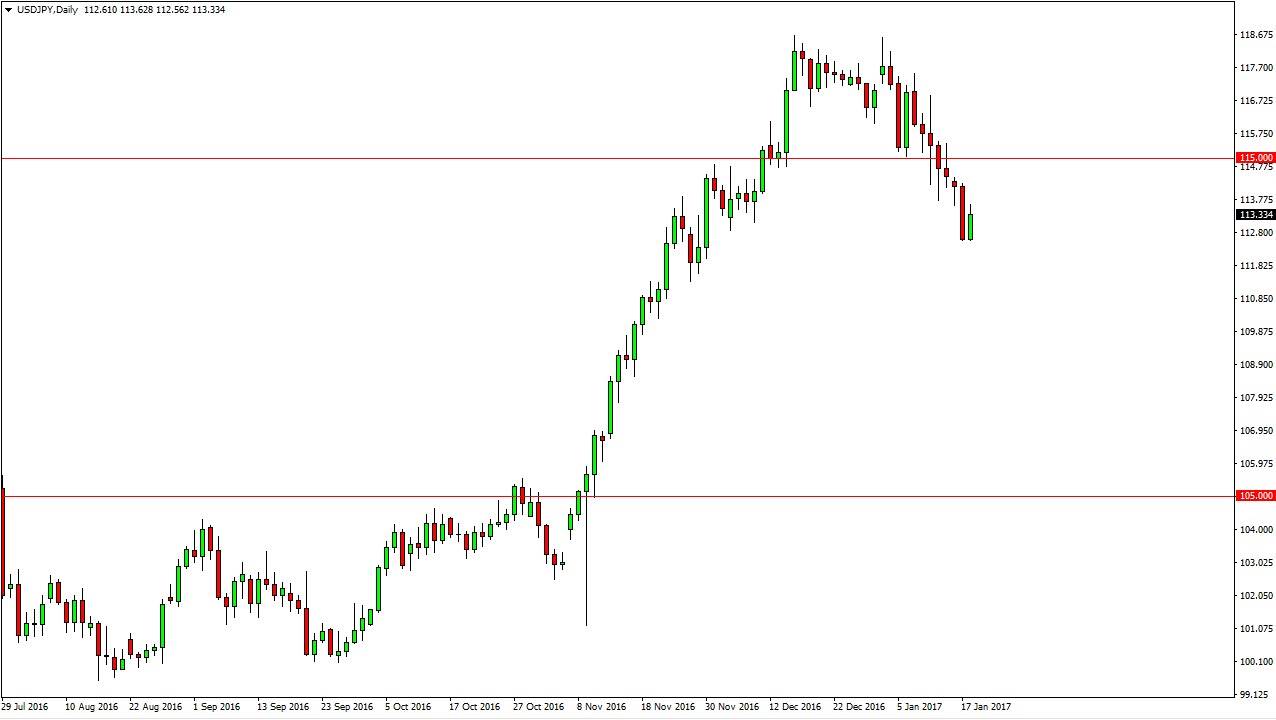

USD/JPY

The US dollar bounced during the day on Wednesday, against the Japanese yen and other currencies around the world. This is a market that should continue to see buyers longer-term, and I believe that there is more than enough support all the way down to at least the 111.50 level, and because of this I have no option for selling. I believe that the market will continue the longer-term uptrend, and that the pullback has simply been a momentum building exercise in a market that may have gotten a bit ahead of itself. The Federal Reserve is looking to raise interest rates this year, while the Japanese central bank is nowhere near doing anything of the sort.

AUD/USD

The Australian dollar pulled back slightly during the day on Wednesday, after having such an explosive session on Tuesday. The 0.75 level continues to be important in this market, and because of that I think it will be vital to stay above there for the buyers to continue to push the pair higher. If we breakdown below the 0.75 level, it’s likely that the market will continue to fall from there. The gold markets will of course influence this market, they always do, so pay attention to that contract. If gold can break above the $1230 level, I think this is a market that will continue to grind its way to the upside.

If we did breakdown, once we get below the 0.7450 level, I think that the sellers would pile into the market and drive it much lower. I don’t know that that’s going to happen, but having said that the first thing that I noticed when I look at this chart is just how overextended we already are. I think volatility is going to be the order of the day, regardless of which direction we go.