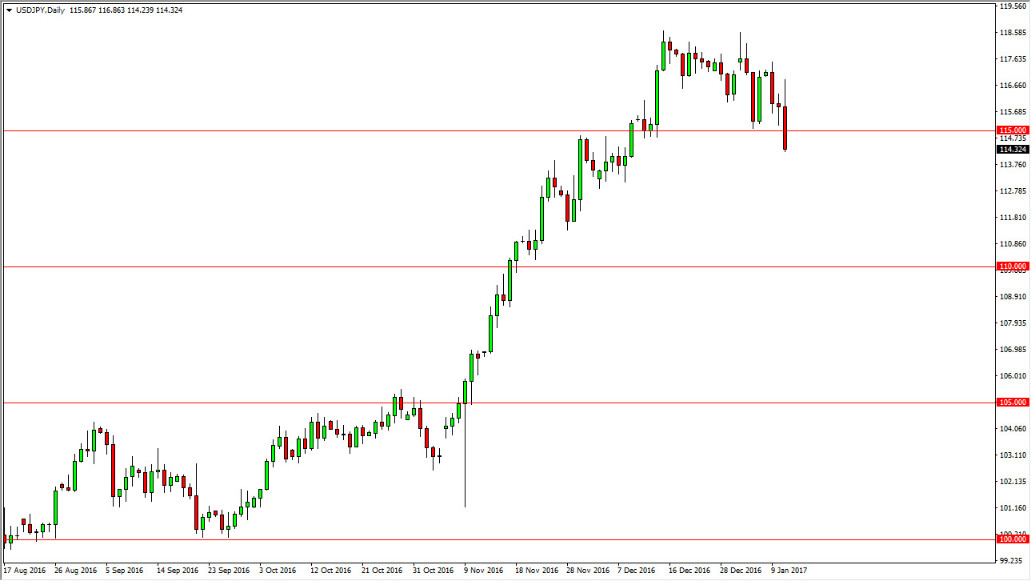

USD/JPY

The US dollar initially tried to rally on Wednesday, but turned around and broke down through the 115 handle. That’s a very bearish move, but ultimately, I believe that there is a significant amount of support all the way down to the 111.50 level, and quite frankly this is a market that Way ahead of itself. I look at these pullbacks as potential value waiting to happen, and as a result I am waiting for a supportive candle in order to take advantage of buying opportunities. I have no interest in selling, and believe that longer-term traders will eventually jump back into this market then continue to ride the move up to the 120 handle.

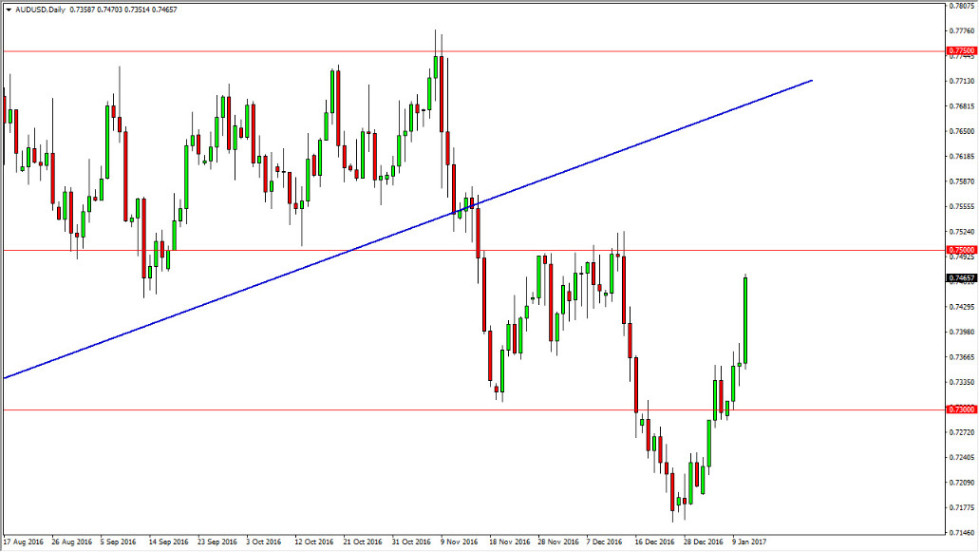

AUD/USD

The Australian dollar showed a certain amount of stubbornness during the day on Wednesday, as we broke down to the upside and screamed towards the 0.75 handle. That’s an area that is massively resistive though, so be interesting see whether or not we can sustain this type of move. I suspect that we won’t be able to, and an exhaustive candle near the 0.75 level is an excellent selling signal from what I can tell. However, I do recognize that if we break above the 0.7530 handle on a four-hour close, then you have to think that were going to try to reach towards the previous uptrend line which gives is market quite a bit of room to move. At this point though, I believe that the gold and Australian dollar market will eventually run out of momentum.

When we do turn around, I think that the market reaches towards the 0.73 level underneath, which is a previous support level. I think that we are going to continue to see a lot of volatility in the markets overall, and the Australian dollar of course will be any different.