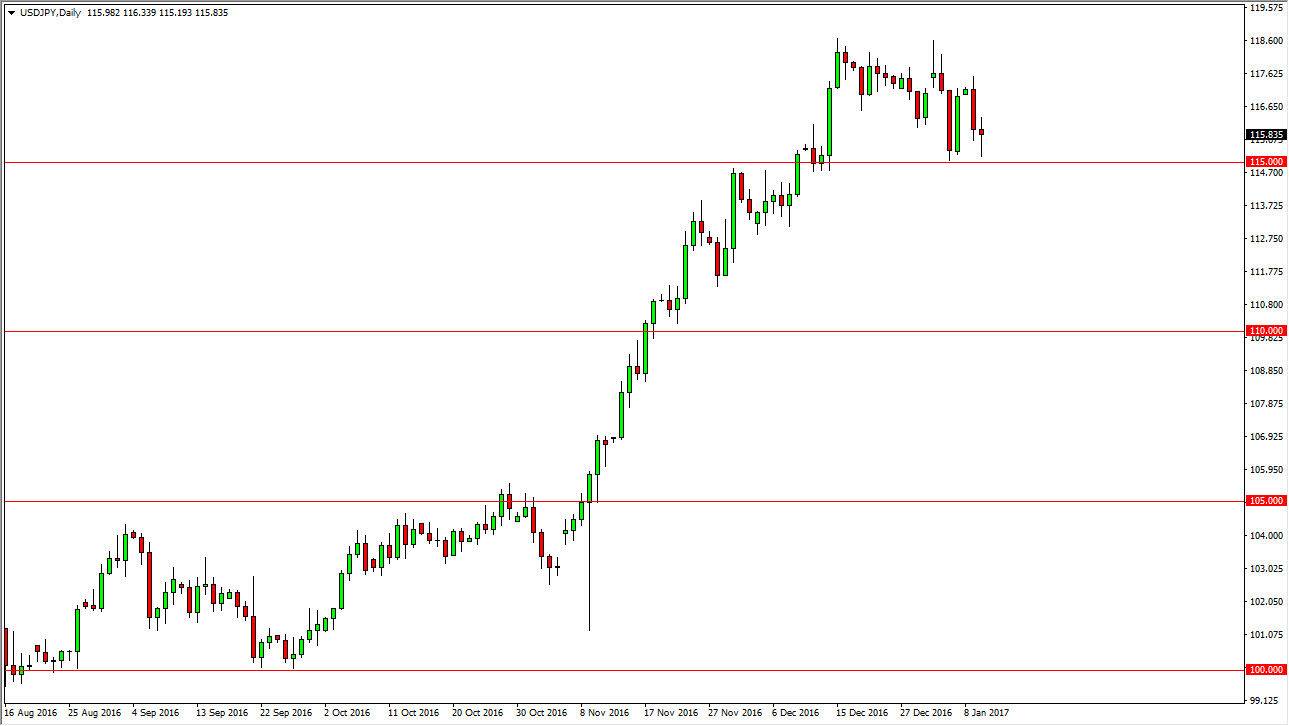

USD/JPY

The USD/JPY pair went back and forth on Tuesday, testing the 115 level for support. The resulting candle looks a bit like a hammer, and that hammer of course could be a nice buying opportunity as we see so much in the way of support just below. I think the support goes all the way down to the 111.50 level, and of course the Bank of Japan and its massive quantitative easing program should continue to favor an upward trajectory when it comes to this currency pair. We have recently had a bit of a pullback, and quite frankly it could continue. Because of this, I am patiently awaiting a signal to start buying again, and a break above the top the candle from Tuesday would be that signal. Otherwise, I will look for areas below the show signs of support to go long.

AUD/USD

The AUD/USD pair went back and forth, showing signs of choppiness and indecision. Initially, the Australian dollar looks healthy during the day but as we get closer to the end of the session, looks as if we are running out of strength. Paying attention to the gold market will go a long way as well, because the gold market has such a massive influence on the Australian dollar. I do recognize that the 0.73 level underneath will be supportive, but once we break down below there we should continue to go much lower.

That move would send the Australian dollar down to the 0.7150 level, which has been supportive in the past. I think this is what’s about to happen but I do recognize that the choppiness will be difficult to deal with. On entering, if we can break above the top of the candle for the session on Tuesday, we could go higher but I see so much in the way of noise and resistance above that I find rallies to more than likely offer selling opportunities.