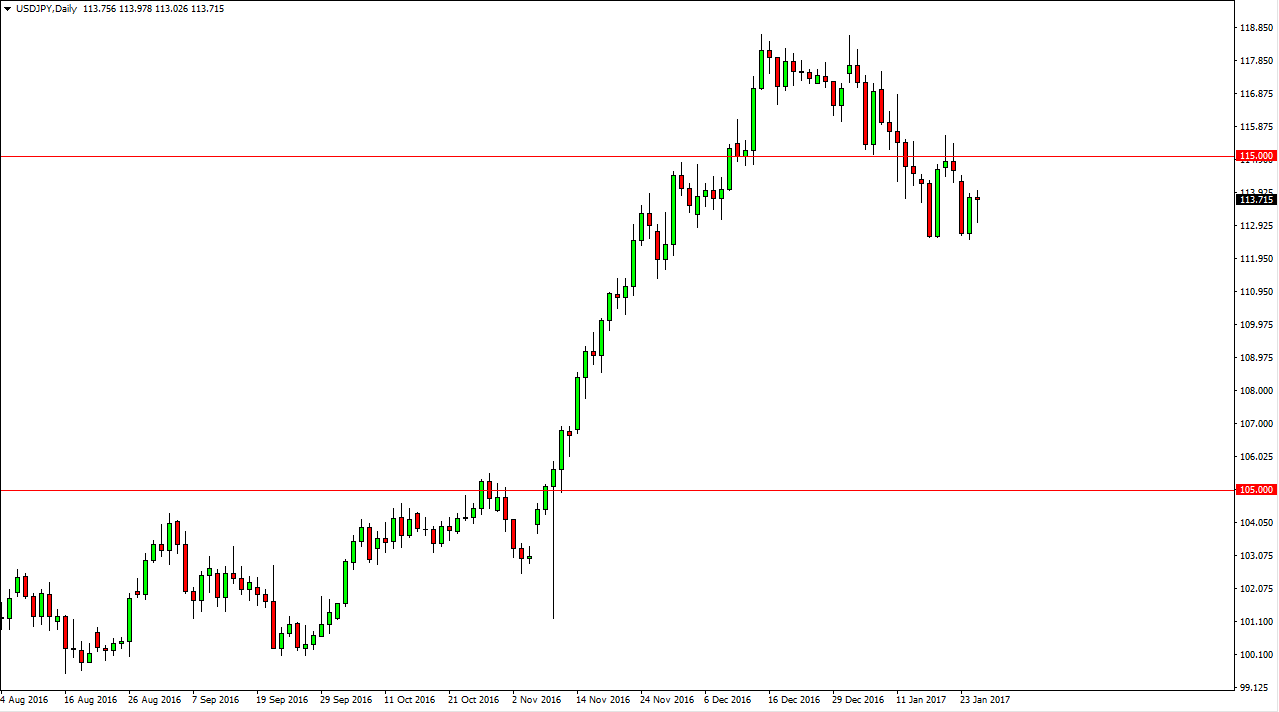

USD/JPY

The USD/JPY pair fell initially during the day on Wednesday, but found enough support to turn around to form a hammer. It looks as if the market is going to reach towards the 115 handle again, an area that should now be resistive. Because of this, I believe that the market will continue to find buyers but if we can break above the top of the shooting stars that are sitting at that level, I become even more bullish. After all, I think that the 112.50 level has offered quite a bit of support, and with that it’s likely that the markets find the US dollar tenable mainly due to the Federal Reserve looking to hike interest rates several times over the next year.

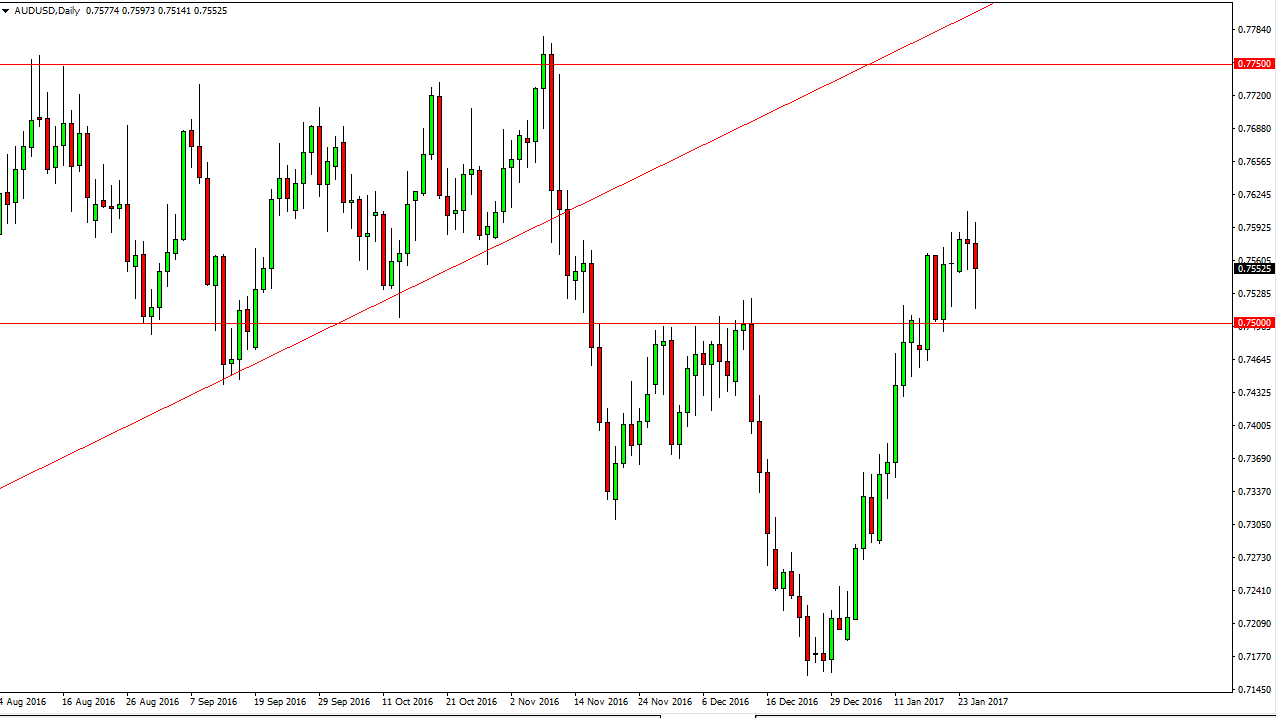

AUD/USD

The Australian dollar initially fell during the day on Wednesday, but found enough support at the 0.75 level to turn things around and formed a hammer. The hammer of course is a bullish sign, and I believe that we will eventually continue to go much higher, perhaps reaching towards the 0.7750 level. I believe that the gold markets rallying will course help the Australian dollar, and therefore if we can see both of these marks go higher, it becomes much easier to hang onto a trade.

If we can break down below the 0.75 level, the market looks as if there is plenty of support just below there, and as a result that should continue to give this market very difficult. Once we break below the 0.74 level, then I feel that the Australian dollar will be very negative, and we should then continue to drop down to even lower levels. My base case scenario is that we do go higher, but I think that the only thing you can count on is quite a bit of choppiness.