USD/CAD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at any of the support levels which were reached.

Today’s USD/CAD Signals

Risk 0.50% per trade.

Trades must be entered before 5pm New York time today only.

Long Trades

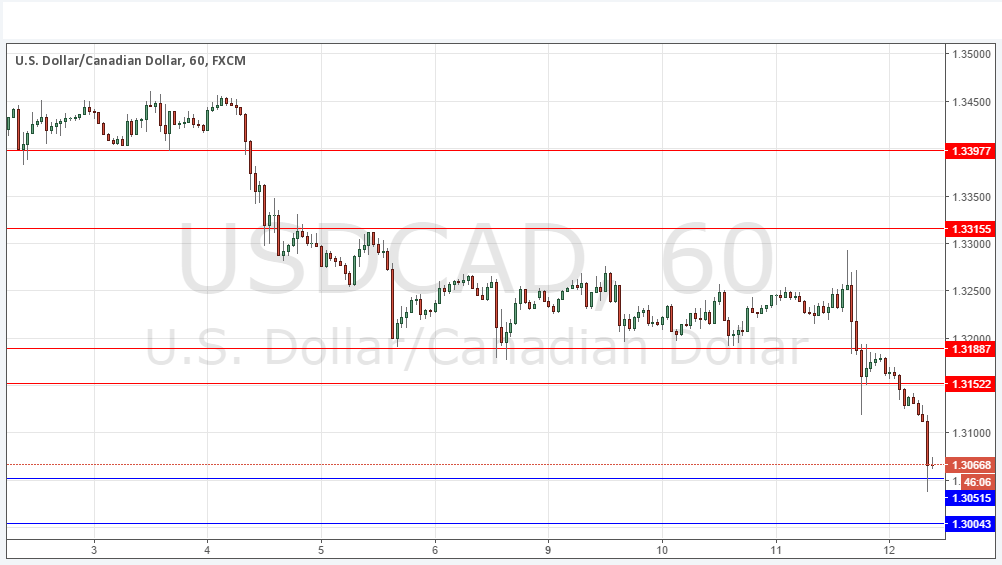

Go long after the next bullish price action rejection following a first touch of 1.3051 or 1.3004.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short after the next bearish price action rejection following a first touch of 1.3152 or 1.3189.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CAD Analysis

The CAD has been one of the stronger currencies against the USD for a few weeks now, and with yesterday’s strong drop by the USD, this pair is now at a price below its level of 3 months ago, a fact which is technically significant and suggestive of the end of the bullish trend that although weak had been in force for several months.

Previously supportive levels look to have flipped to become new resistance cleanly and solidly.

The outlook is bearish, but it should be noted that a key psychological support level is not far below at 1.3000 and that could hold up any further fall, at least for some period of time.

There is nothing due today regarding the CAD. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time.