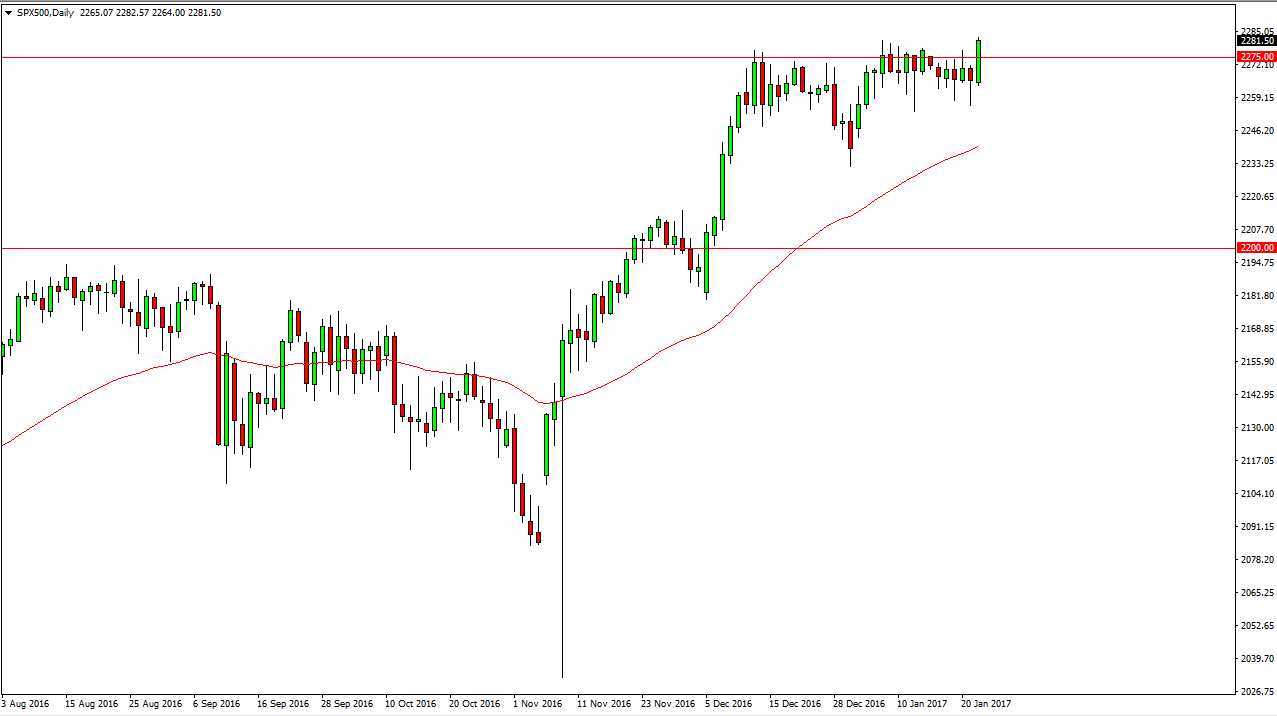

S&P 500

The S&P 500 broke out during the day on Tuesday, breaking above the 2280 handle and showing signs of a longer-term uptrend getting ready to happen. We have been grinding for quite some time, and now it looks as if we are building enough momentum to continue the longer-term uptrend. Pullbacks should continue to offer buying opportunities as I have in the past, and I believe that the market will reach towards the 2300 level. We can break above there, and then the market will certainly go even higher, perhaps reaching towards the 2500 level. I have no interest in selling, the uptrend looks very healthy and it appears that the traders are ready to go back into the marketplace.

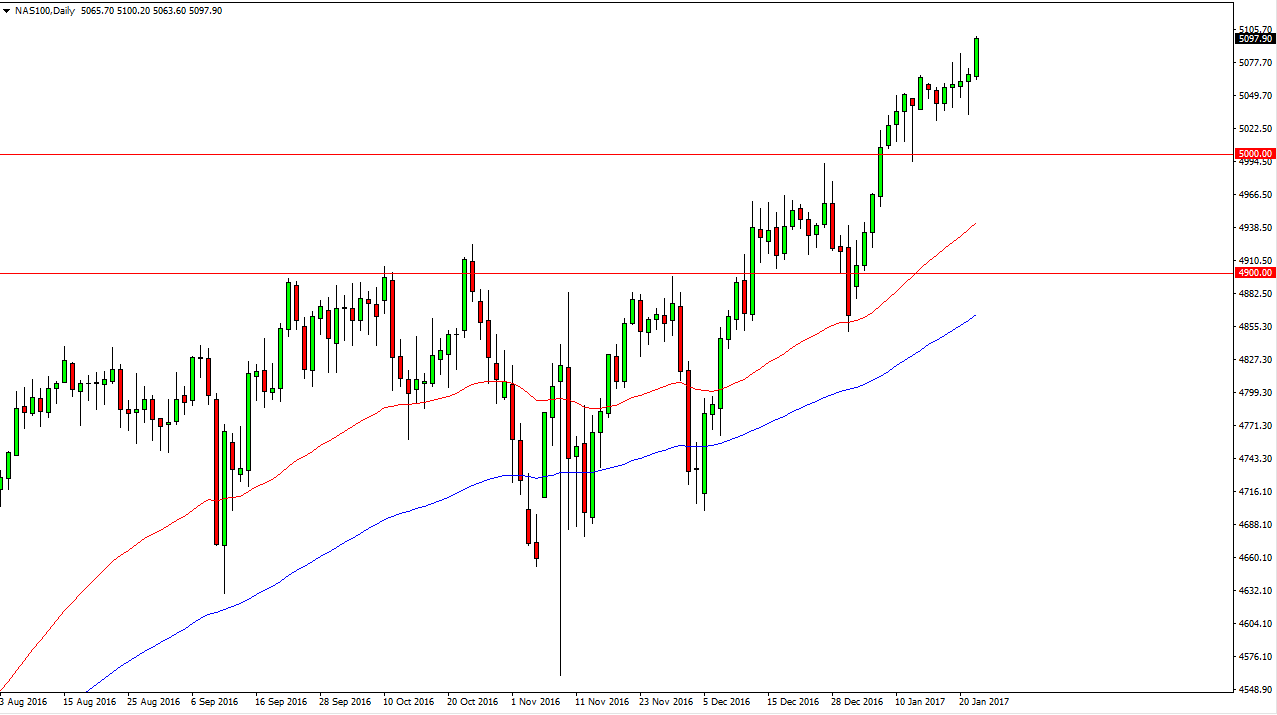

NASDAQ 100

The NASDAQ 100 broke out during the day on Tuesday, clearing the recent high and suggesting that we are not only going to touch 5100, but were going to break above there. Pullbacks continue to offer buying opportunities, as there is more than enough support between here and the 5000 level to continue to push this market to the upside. The NASDAQ 100 has been leading the way for other US indices, and I believe it’s only a matter of time before we reach to extremely high levels, as we continue the longer-term uptrend. When you look at the chart, you can plainly see that the 50-day exponential moving average and the 100-exponential moving average both suggests that we are not only in an uptrend, but we are in a very healthy one. I like the NASDAQ 100 as I do all US indices, mainly because of the soon to be spending that will be done in the US infrastructure, and of course the fact that the labor markets are starting to look a little bit healthier. I have no interest in selling, and believe that the US will lead the way.