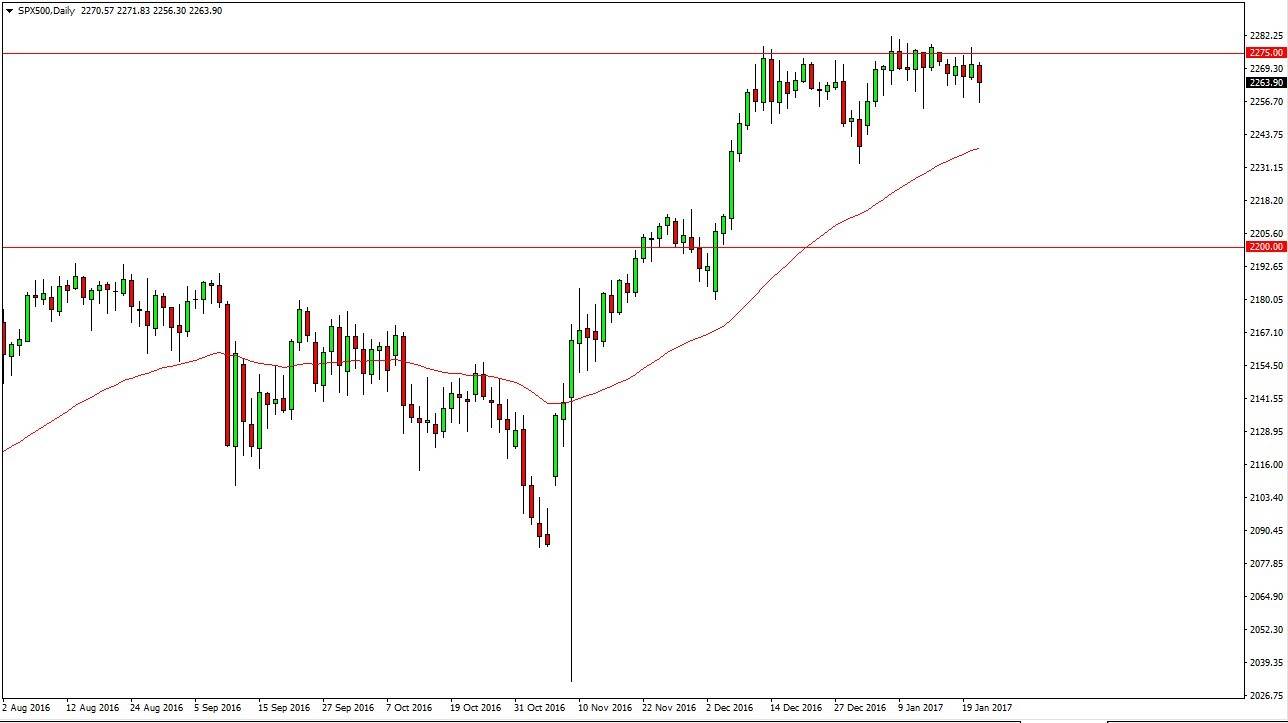

S&P 500

The S&P 500 fell on Monday, but continues to find buyers every time it drops. To me, it seems as if the 2275 level is offering a massive amount of resistance, so given enough time I do think that we will build up the momentum to break out. In the meantime, short-term pullbacks we should get an opportunity to take advantage of value in the stock markets. This is a market that I believe will eventually break out and reach towards the 2300 level, and then eventually much higher than that. I have no interest in selling, as the 50- day exponential moving average looks very healthy, just as the overall uptrend does. Given enough time, this is a market that I believe will reflect the fact that the United States is doing much better than many other economies.

NASDAQ 100

The NASDAQ 100 fell initially during the day but turned around to form a bit of a hammer. We have a shooting star from the previous session though, so I it looks as if the market will continue to struggle in this general vicinity and cause quite a bit of volatility. I believe that the 5000-level underneath it should be massively supportive, as it has been such a large psychological effect attached to it. On pullbacks, I recognize it is value, as we should than reach towards the 5100 level. I have no interest in selling, and I believe that not only is the 5000-level going to offer a bit of a “floor” in the market, but it probably extends all the way down to the 4950 level.

Short-term pullbacks should continue to be the best way to trade this market, I believe that the longer-term buy-and-hold strategy probably won’t work now, just because of all the volatility. However, if you have a long enough time frame, it is possible.