S&P 500

The S&P 500 initially tried to rally on Friday, but continues to find the 2275 level to be overly exhaustive. Because of this, I’m waiting to see whether or not we can break above there on a daily close to start buying. However, that’s not to say that I wouldn’t buy a pullback, because I most certainly what. I believe there is more than enough support below at the 2250 handle to push the market to the upside. I believe that the 2200 level underneath there is essentially a “floor” as well, and longer-term we will not only reach towards 2300, but we will reach much higher levels than that given the longer-term view. Selling isn’t even a possibility at this point, as US indices in general look very healthy.

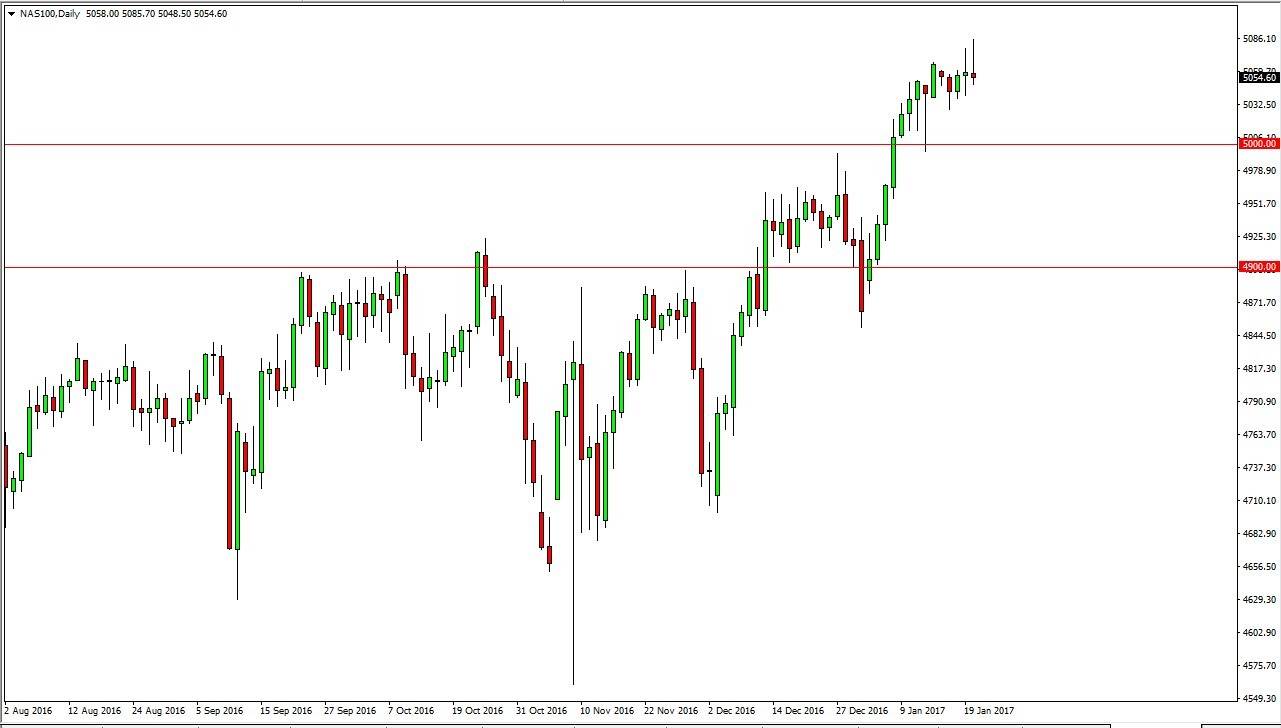

NASDAQ 100

The NASDAQ 100 trying to rally on Friday but after making a fresh, new high we ended up forming an exhaustive candle. Because of this, it looks as if the market could pull back from here but I think there is a bit of the floor at the 5000 handle. The 4950 level underneath there is even more supportive, so at this point I’m waiting to see whether or not we have a supportive candle that we can go long based upon. Alternately, a break above the top of the shooting star is also a very bullish sign would have me going long.

I have no interest in shorting this market, US indices overall are strong. I think the US economy is going to lead the rest of the world this year, so as these indices go, so do the others. Currently, it looks as if the US indices show quite a bit of strength, and I don’t think that is going to change anytime soon. With this, I remain bullish.