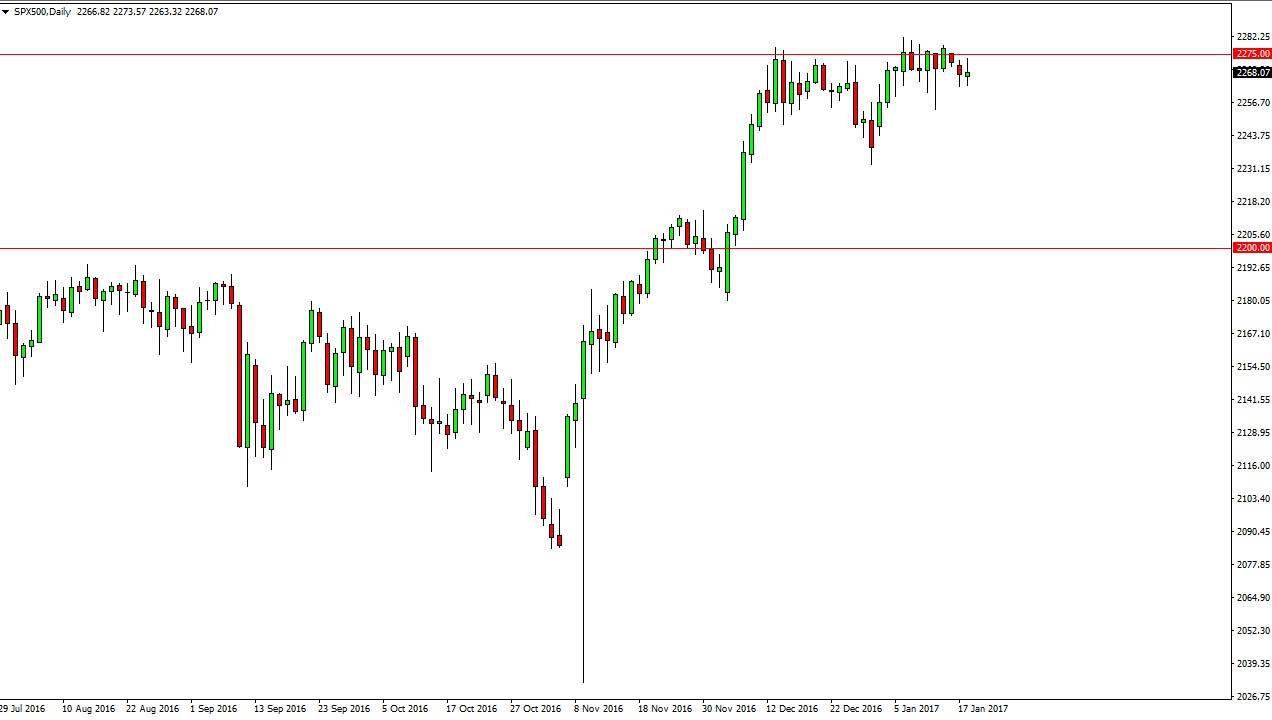

S&P 500

The S&P 500 had a volatile and choppy session on Wednesday as we continue to bang up against the 2275 level. It looks as if the market is trying to build up enough on them to finally go higher, and once we get a fresh, new high I am willing to buy and hold the S&P 500. I think pullbacks will continue to find plenty of support below, starting at the 2250 handle, and then of course extending all the way down to the 2200 handle. Because of this, I believe that buying is the only thing you can do in this market, certainly selling would go against the longer-term trend, and it appears that simply we are going to be taking a bit of a break trying to build up the momentum necessary to continue the bullish move.

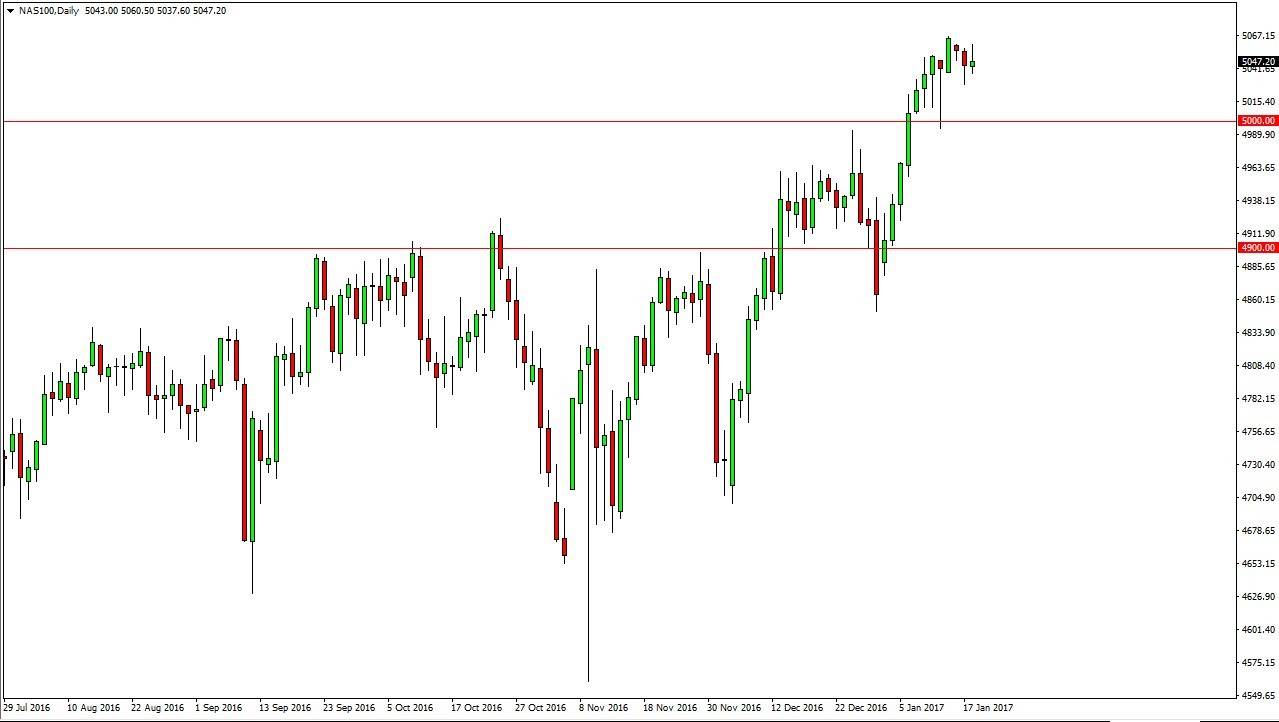

NASDAQ 100

The NASDAQ 100 tried to rally as well, but also gave back most of the gains. By doing so, it looks as if the market is getting ready to pull back but I think there is more than enough support at the 5000 handle under need to continue to push this market higher over the longer term. I’m waiting for a supportive candle at the 5000 region to start going long, or perhaps a breakout above the recent high, as we should then reach towards the 5100 level above. The 4950-level underneath continues to be massively supportive, and because of this I feel there is a support zone of sorts underneath that should continue to push this market higher.

Longer-term, I believe that the NASDAQ 100 continues to lead the way for the rest of the US indices going forward. I have no interest in selling, I believe that the US stock markets well perform most of the other stock markets that I follow.