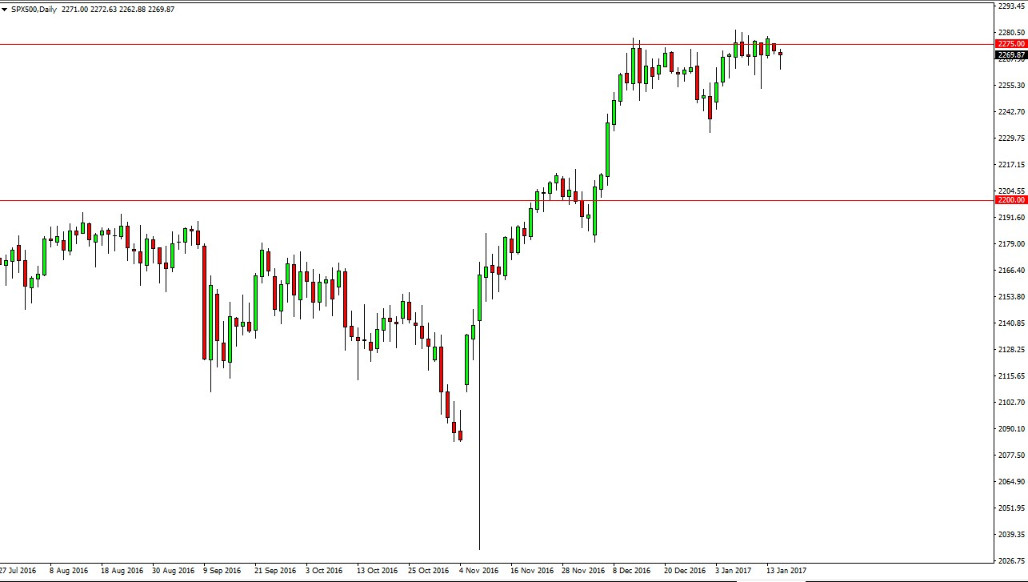

S&P 500

The S&P 500 fell during the Tuesday session but found enough support near the 2250 level to turn around and form a hammer. A break above the top of the candle and more importantly the most recent high should be a buying opportunity as the market will then reach towards the 2300 level. The US stock markets in general are very strong, and it’s obvious that buyers are returning every time we pull back. Because of this, I’m very bullish of this market and recognize that it’s only matter of time before he breaks out and go much higher. I believe that the 2250 level below is going to offer a bit of a “floor” going forward, and thus this is a buy only opportunity as far as I can see.

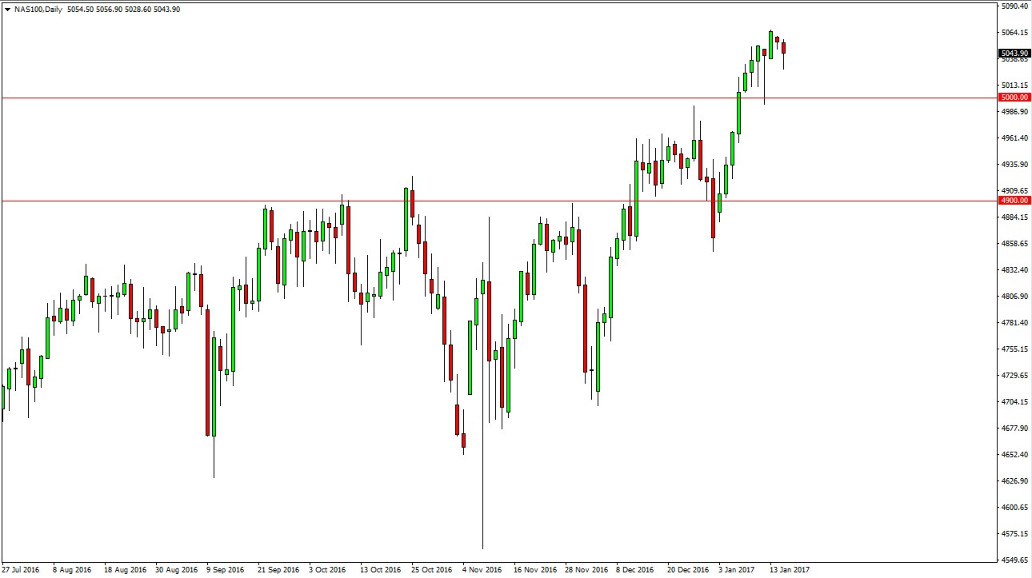

NASDAQ 100

The NASDAQ 100 fell slightly during the session on Tuesday, as we continue to see buyers enter this market. The NASDAQ 100 is currently leading all US indices higher and I believe that there is a massive amount of support starting at the 5000 level below. That support should extend all the way down to the 4950 handle, so I’m waiting for buying opportunities based upon bounces and supportive candles. If we break out to a fresh, new high am also buying there. The NASDAQ 100 looks like it is going to continue to lead the way higher for US indices overall, so I have no interest in shorting.

Keep in mind that the US economy should outperform all the other major economies in the world now, and that of course will bode well for the NASDAQ 100. I think we will reach towards the 5100 level, and then eventually much higher than that given enough time. If we can break above there, I think the market should continue to go to the 5250 handle, and beyond.