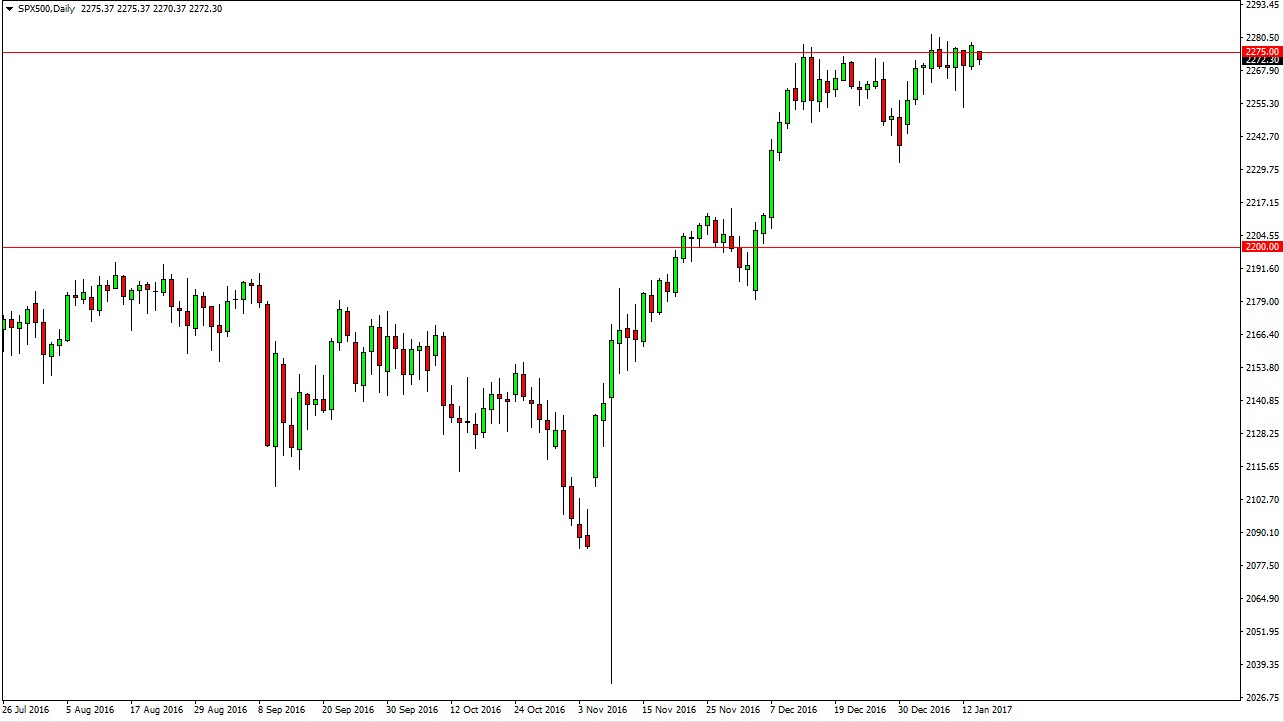

S&P 500

The S&P 500 of course was shut down for trading for the Martin Luther King Jr. holiday, but ultimately the market in the CFD realm was open, but obviously we weren’t going to be trading any massive moves due to the lack of underlying motion. Ultimately, I believe that this market will continue to go higher and given enough time we will break out above the recent highs. With this, the markets are than reach towards the 2300 level, and I believe that pullbacks represent value in a longer-term uptrend that we can take advantage of. The US economy is outperforming so many of the other major economies in the world, and that should be reflected in the stock indices.

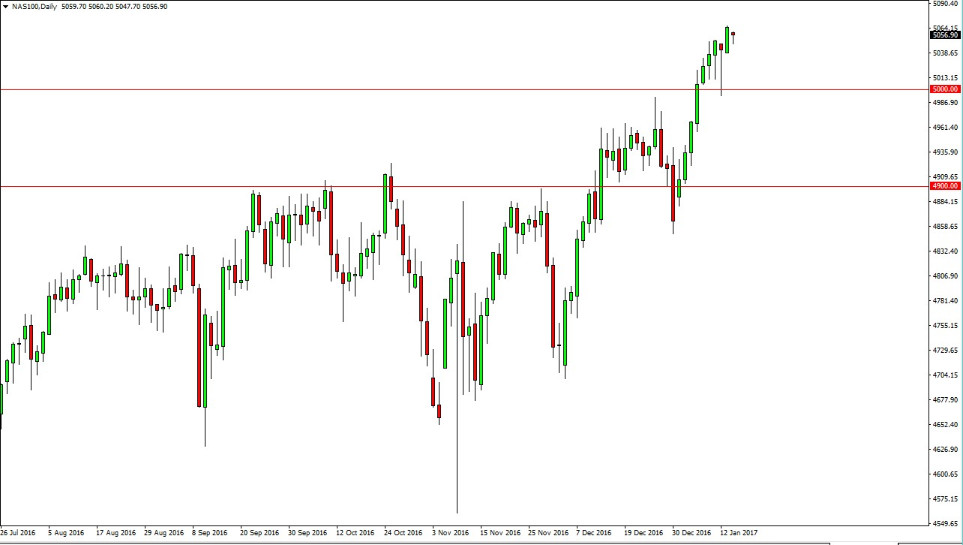

NASDAQ 100

The NASDAQ 100 CFD market mood slightly during the day, but just as the S&P 500 had no underlying action, neither did the NASDAQ 100. I believe that the 5000 level below remains the “floor” in the market, and it’s only a matter of time before we go higher. Ultimately, I think that we could get dips from time to time but they should be looked at as value. I think that we will reach towards the 5100 level, and beyond there for the longer term. Because of this, I think if you can hang on to the volatility this could be a very profitable trade as the NASDAQ 100 looks to be leading the rest of the American indices higher.

I think that the support level at the 5000 level actually will extend all the way down to the 4950 handle. Because of this, the market should continue to find buyers again and again. Any type of supportive candle for me is an opportunity to take advantage of what has been a very strong uptrend, and of course looks to be one of the market leaders at the moment.