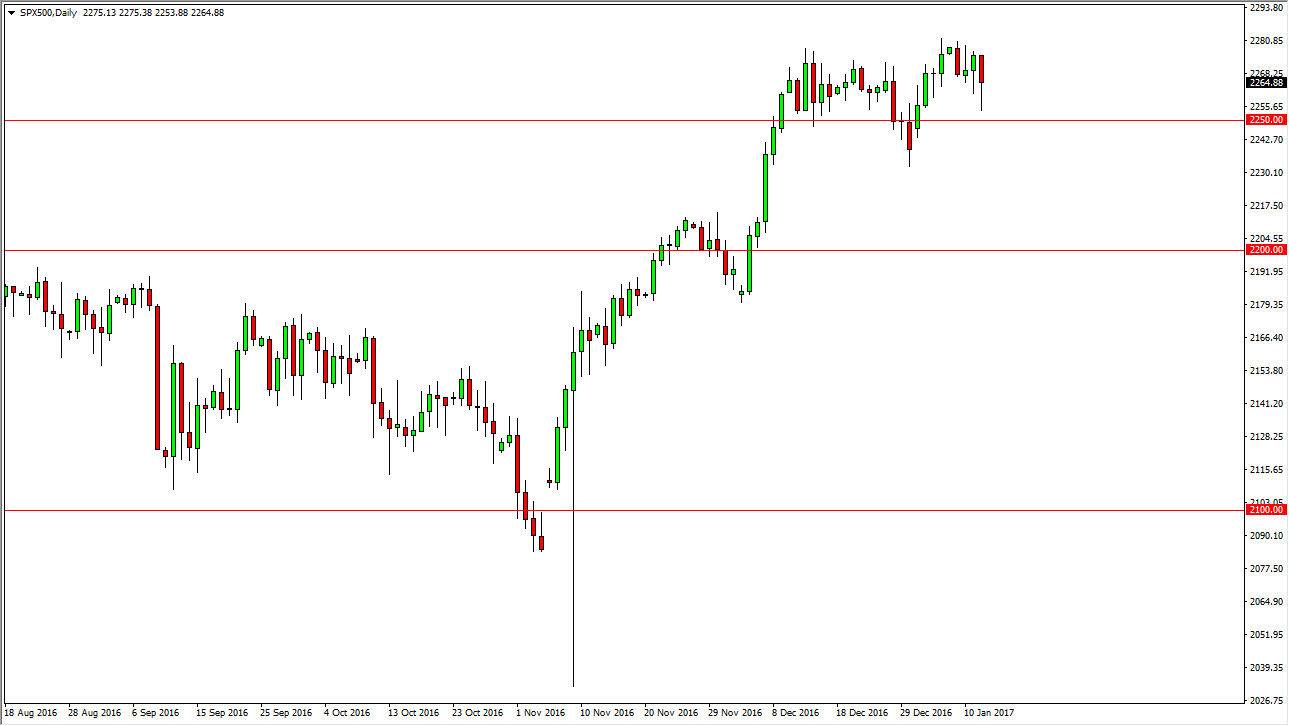

S&P 500

The S&P 500 fell during the session on Thursday, testing the 2250 handle. We did have enough support to turn things around and bounce significantly, so it looks as if the buyers are going to rally going forward. Every time this market pulls back we are looking for buying opportunities, and that sooner or later short-term traders get involved. Given enough time, I believe that we break down of all the recent highs and continue to reach towards the 4300 level, especially considering that the US economic numbers are better than most other economies currently. The unemployment claims announcement came out during the day was less bad than originally thought, so it appears that the labor market is starting to solidify day, and should of course helps stocks.

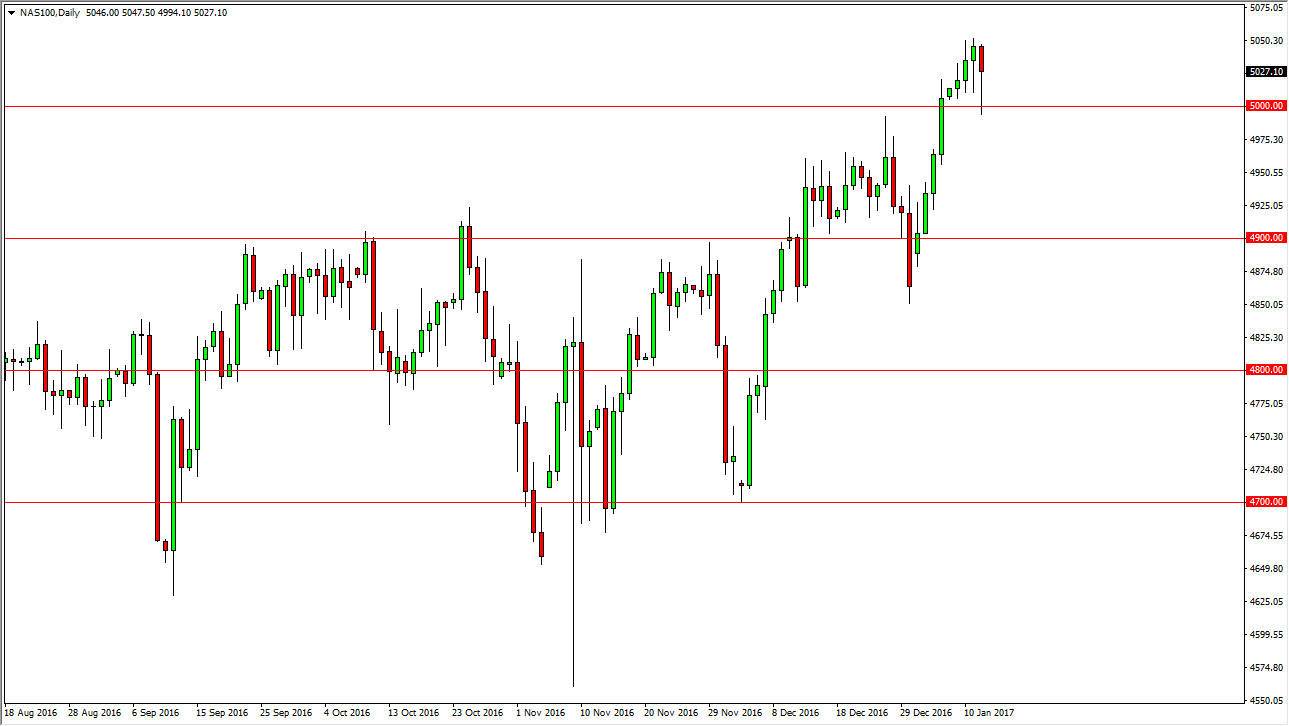

NASDAQ 100

The NASDAQ 100 fell during the day as well, and just like the S&P 500 found support. The 5000-level underneath offered enough support to turn things around and form a hammer. The hammer of course is a bullish sign, and that means that the market should continue to go higher given enough time, the market should continue to break out to fresh, new highs, and thus I am a buyer. I think that the market will have plenty of support all the way down to the 4950-handle underneath which I see as the “floor” in the market.

The markets will fall from time to time, but quite frankly I think that will offer short-term buying opportunities as the longer-term uptrend continues. It could be choppy on the way out, and quite frankly there’s no reason to think that the markets in a turnaround, especially considering how we reacted on Thursday to what was originally a very negative candle. The 5000-level course offers quite a bit of psychological support, and therefore should continue to be an area where people are interested in adding to their positions.