Gold prices rose on Monday after hitting the lowest level since January 11 in the previous session as a shift in risk sentiment increased demand for safe-haven assets. U.S stocks slipped from recent highs at the start of the week. A lower U.S. dollar index also aided the precious metal. The XAU/USD is currently trading at $1196.75 an ounce, slightly higher than the opening price of $1195.61.

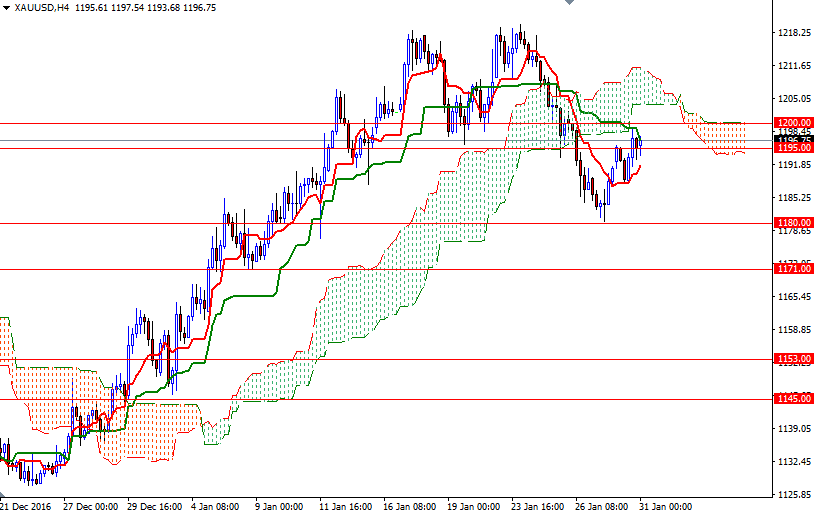

The market challenged the 1200 level yesterday level but failed to break through. As a result, prices returned to the 1195 area. Yesterday's advance pushed prices above the Ichimoku clouds on the H1 and M30 time frames, plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on both time frames. In other words, the short-term charts suggest that XAU/USD is likely to pay another visit to this barrier.

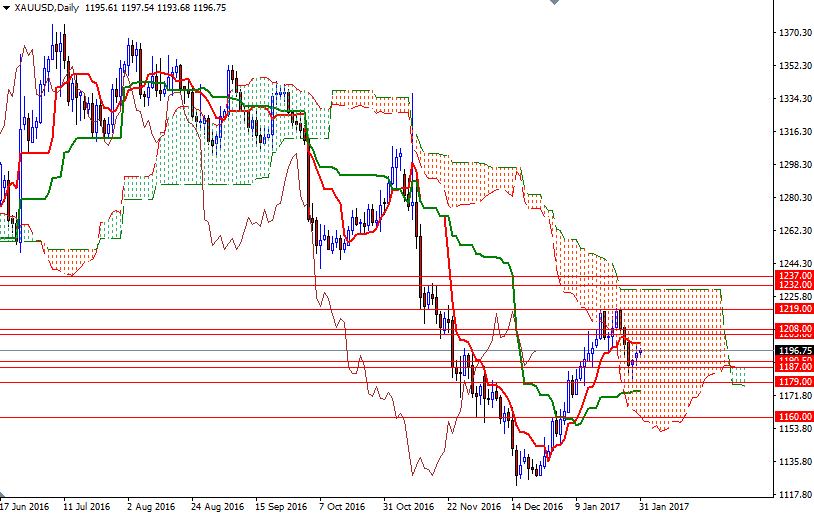

The bulls will need to take out the resistance at 1200.23, which happens to be the daily Tenkan-sen, if they want to have a chance to make an assault on the 1208/5 zone. I think this level is a strategic point for the bulls to conquer so that they can proceed to 1213/2. Closing beyond 1213 would make me think that the bulls are getting ready to test 1220/19. To the downside, the initial support stands in 1195/3, followed by 1190.50-1187. A decline below 1187 would put some pressure on the market and drag prices towards the 1179/7 zone. If XAU/USD dives below 1177, then the 1171/69 area will be the next port of call.