As we receive the Nonfarm Payrolls announcement during the day today, the gold markets will be extraordinarily volatile. The announcement influences the value the US dollar, which of course has a massive effect on what happens with gold. We recently had a pop higher in the value of gold, but I think a lot of this would have been due to a position squaring at the end of the year, and then people being somewhat suspicious of holding onto the position through illiquid markets, and of course the jobs number coming out today.

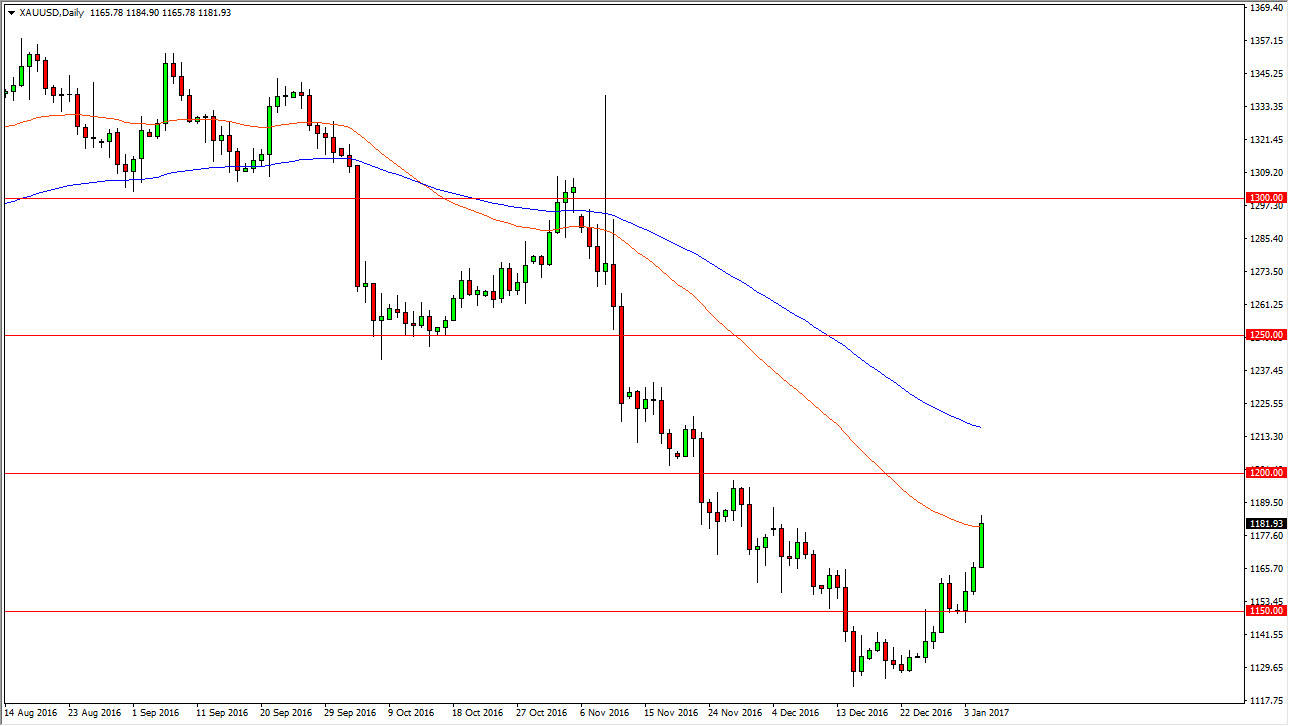

Keep in mind, the jobs number surprising to the upside could put a lot of upward pressure on the US dollar, which by extension puts a lot of downward pressure on the gold markets. On the chart, I have the 50-day exponential moving average colored in red, and you can see that the market is currently testing that area. Above there, we have the blue 100-day exponential moving average, which of course is also followed by longer-term traders.

I suspect that we could have a little bit of a rally from here, but I would anticipate quite a bit of exhaustion of the $1200 handle. That’s an area that I think will define the trend. As long as we stay below there I am willing to sell an exhaustive candle as it appears. I don’t like gold yet, although it is starting to show signs of life. For what it’s worth, we haven’t even reached the 38.2% Fibonacci retracement level from the “Donald Trump election” spike. Because of this, I believe that gold markets may be offering a nice selling opportunity for those of you who are patient enough to wait for the signal. Currently, I think we are getting very close, and of course the jobs number can have a knock-on effect necessary to push lower.