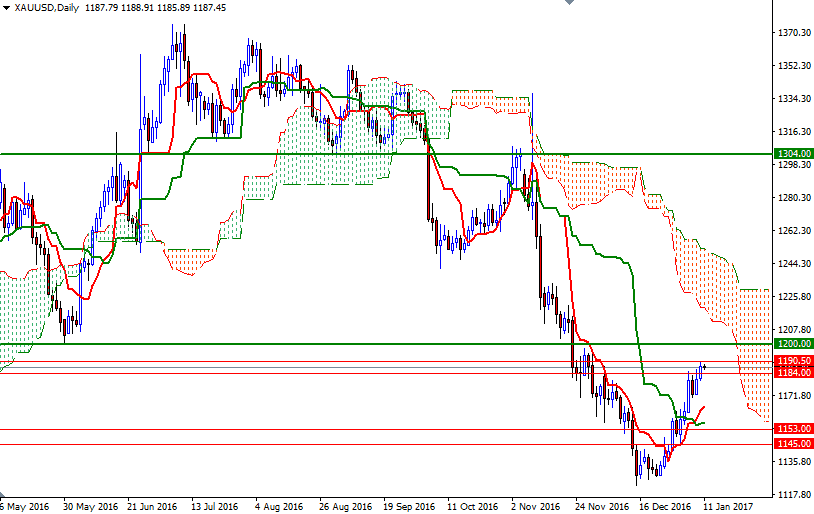

Gold prices rose $6.13 an ounce on Tuesday to settle at their highest level in six weeks, buoyed by an easing U.S. dollar and physical buying in Asia. Technical buying pressure was also behind gold's advance yesterday. In my previous analysis I had pointed out that it looked like the market was going to make a trip to the $1190.50 level once we broke above $1179.

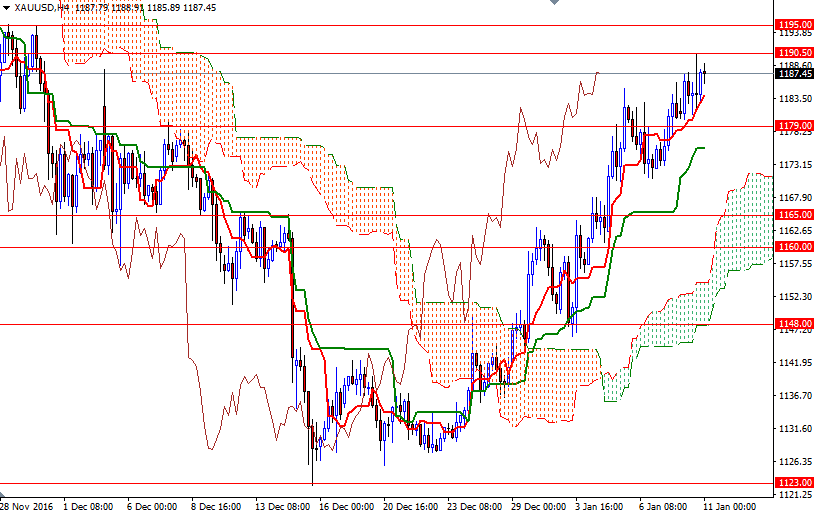

Apparently, traders are taking a cautious stance before Trump's news conference in which he is expected to spell out more about his plans for the U.S. economy. Despite the negative medium-term outlook, the XAU/USD pair is still trading above the Ichimoku clouds on the 4-hour time frame the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned.

The 1190.50 level acted as both support and resistance several times in the past so clearing that resistance is essential for a bullish continuation towards 1195. The bulls will have to push through 1195 level so that they can gain momentum to tackle 1200. Beyond that, the 1208/5 zone stands out as an obvious resistance. However, if the bulls run out of steam and fail to convincingly push prices above 1190.50, the market will return to 1184/2 region. Dropping through 1179/7 opens up the risk of a move towards 1173/0. The bears will have to drag the market back below 1170 so that they can make an assault on 1165.