The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 29th January 2017

Last week, I predicted that the best trade for this week was likely to be long USD/JPY. The currency pair did go up, but only a little, increasing by 0.44%. Still, a winning trade is a winning trade.

The Forex market seems to be staying in a less predictable mode now, with the well-established bullish trend in the USD since 8th November being called into question, yet still being technically intact.

The Euro and Swiss Franc are currently showing short-term bullishness, as is the British Pound. I therefore suggest again that the best trade this week is likely to be short of the Japanese Yen and long of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

There are not many clear fundamental or sentimental tones in the market right now, even though U.S. GDP came in last Friday lower than the market expected.

There is central bank input coming this week for the British Pound and Japanese Yen, while U.S. Non-Farm Payrolls data is due at the end of the week. The market seems to be waiting for these inputs before making any major moves.

Technical Analysis

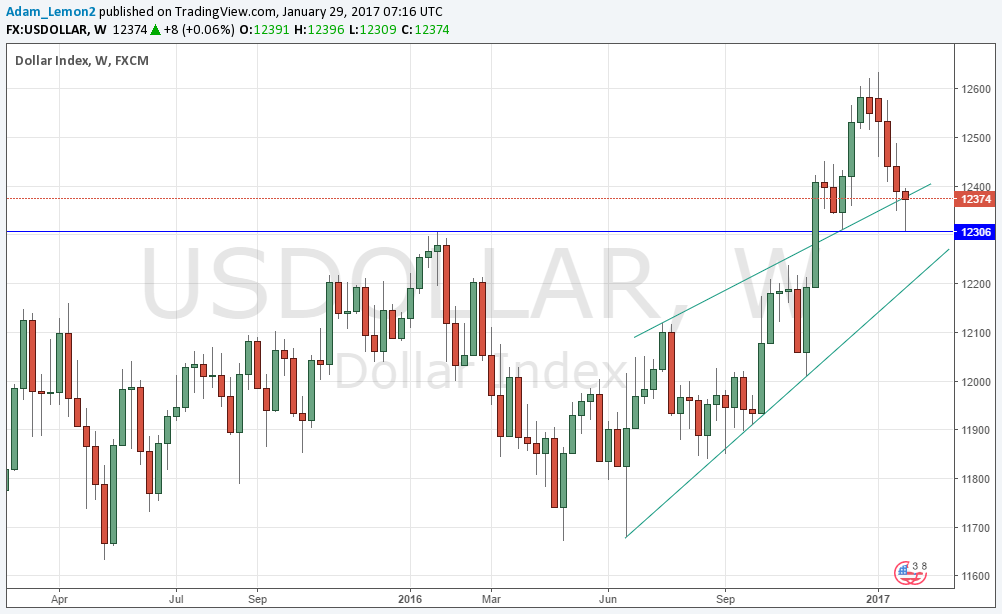

USDX

The U.S. Dollar printed a small bullish pin candle within the scope of a wider bullish trend that is manifested over both the long and short terms. The bullish pin candle is weak, but it suggests some level of support, especially as the price has rejected both the old channel as well as the horizontal support level I had identified at 12306, as shown in the chart below.

USD / JPY

This week we see a reasonably large bullish pin candle, which is significant for its bullishness. We continue to get signs of a possible resumption of the long-term bullish trend, with the price still well above its levels of 3 and 6 months.

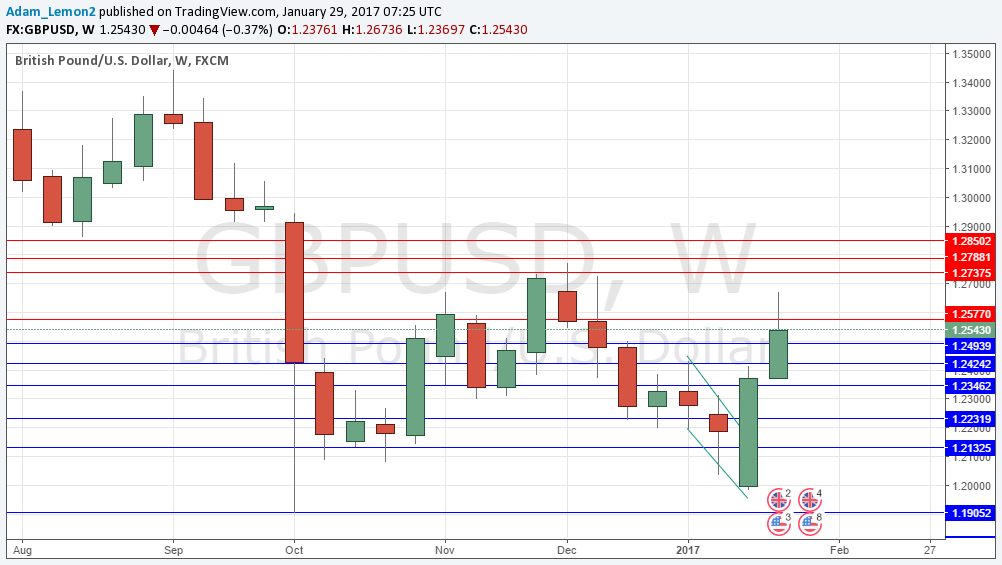

GBP/USD

Another bullish weekly candlestick, although the price was unable to close near its high. I highlighted this bullishness last week. The price is now above its level from 3 months. It looks as if a new long-term bullish trend might be beginning, although the price is still lower than it was compared to 6 months.

Conclusion

Bullish on the USD/JPY currency pair.