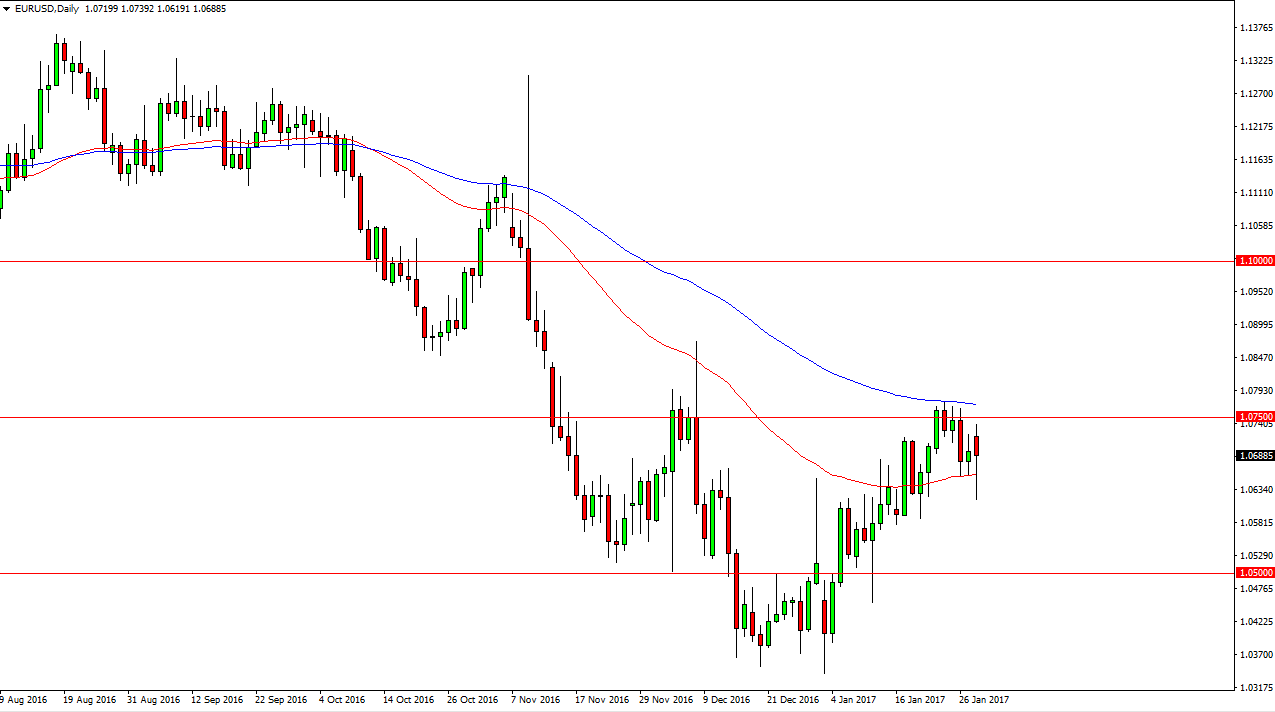

EUR/USD

The EUR/USD pair broke down significantly at the open on Monday, but found enough support underneath the 50-day exponential moving average to turn things around to form a relatively supportive looking hammer. If we can break above the top of a hammer, and more importantly the 100-day moving average, pictured in blue, I believe that the market will continue to a much higher. If we breakdown below the bottom of the hammer, that of course is a very negative sign and could send this market looking for the 1.05 level underneath. Either way, I think the one thing you can count on is volatility in this market. After all, there are a lot of concerns with the European Union, but at the same time questions about whether the Federal Reserve is going to be able to raise interest rates as fast as people expect.

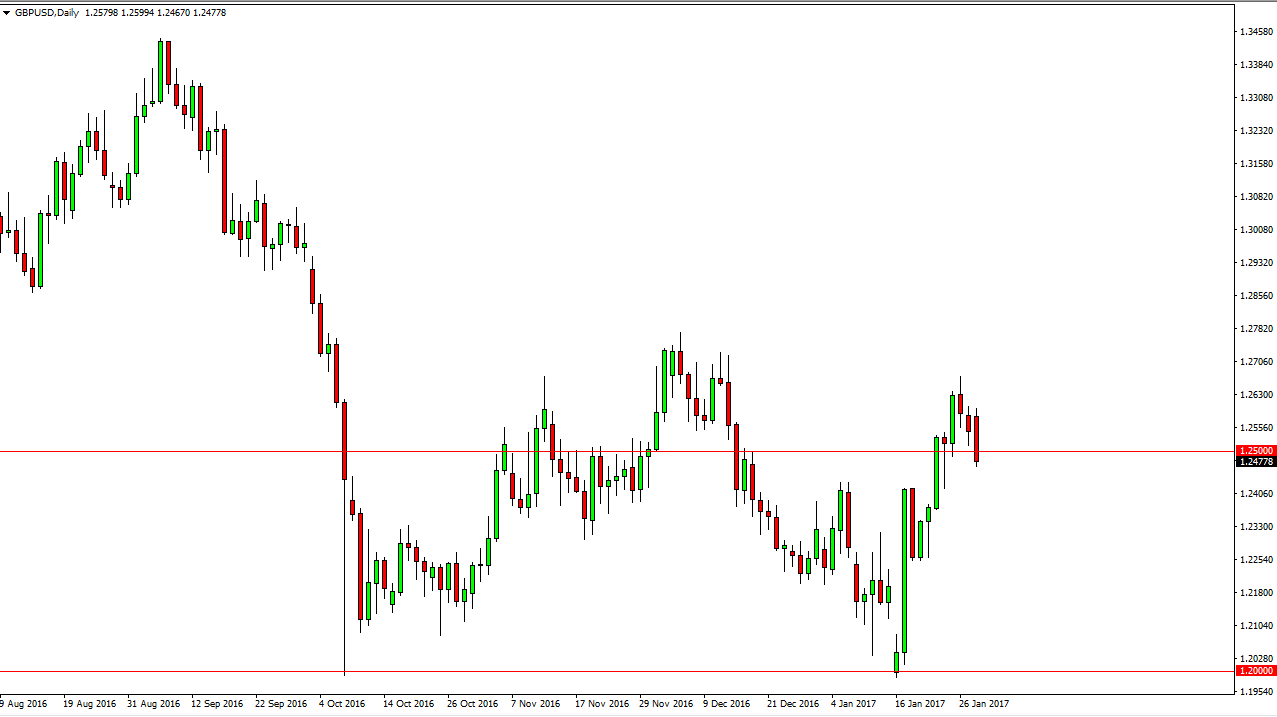

GBP/USD

The British pound fell below the 1.25 level during the day on Monday, but I believe there is a significant amount of support just below, down to at least the 1.24 level if not lower than that. I think it’s only a matter of time before the buyers return, and a supportive candle gives me enough reason to start buying the British pound again. The impulsive move that we have seen recently is a not-so-subtle attempt at a trend change, which of course can be a very volatile affair. Because of this, I believe that support will eventually show itself again, and we should take advantage of that going forward. It’s not until we breakdown below the 1.2250 level that I would be comfortable selling, because at that point you would not only breakdown below several candles, but breakdown below a hammer. I believe that the 1.2750 level above is resistance, and once we break above there we should continue to go much higher over the longer term.