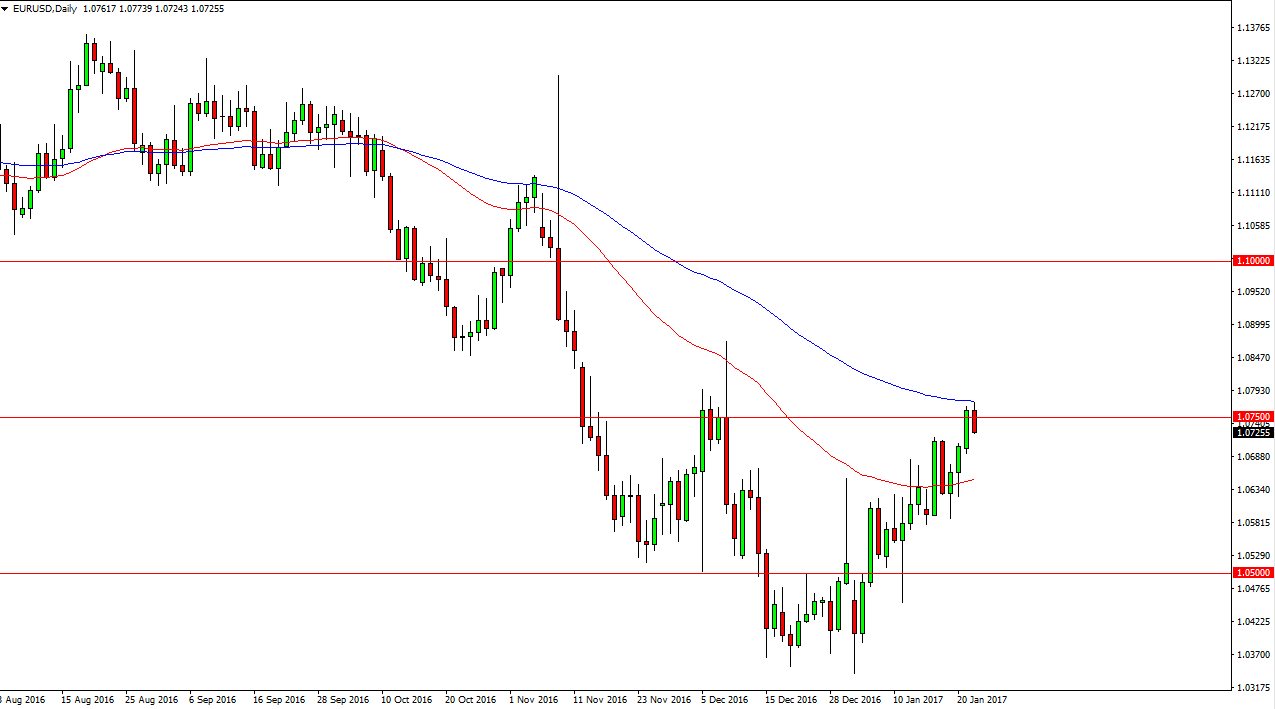

EUR/USD

The EUR/USD pair at the beginning of the session on Tuesday, but found the 100-exponential moving average to be far too resistive to clear. Now that we are finding selling pressure of the 1.0750 level, i.e. begin to wonder whether we have run out of steam. If we can break down below the bottom of the candle, and more importantly the 1.07 level, the market should continue to go much lower. Ultimately, I also believe that the market will go much higher if we can close above the 100-exponential moving average as I mentioned yesterday. I think we’re going to see quite a bit of volatility, but the market is now at a place where we need to make some serious decisions. Because of this, waiting for a daily close to dictate the next position is probably the wisest choice of actions.

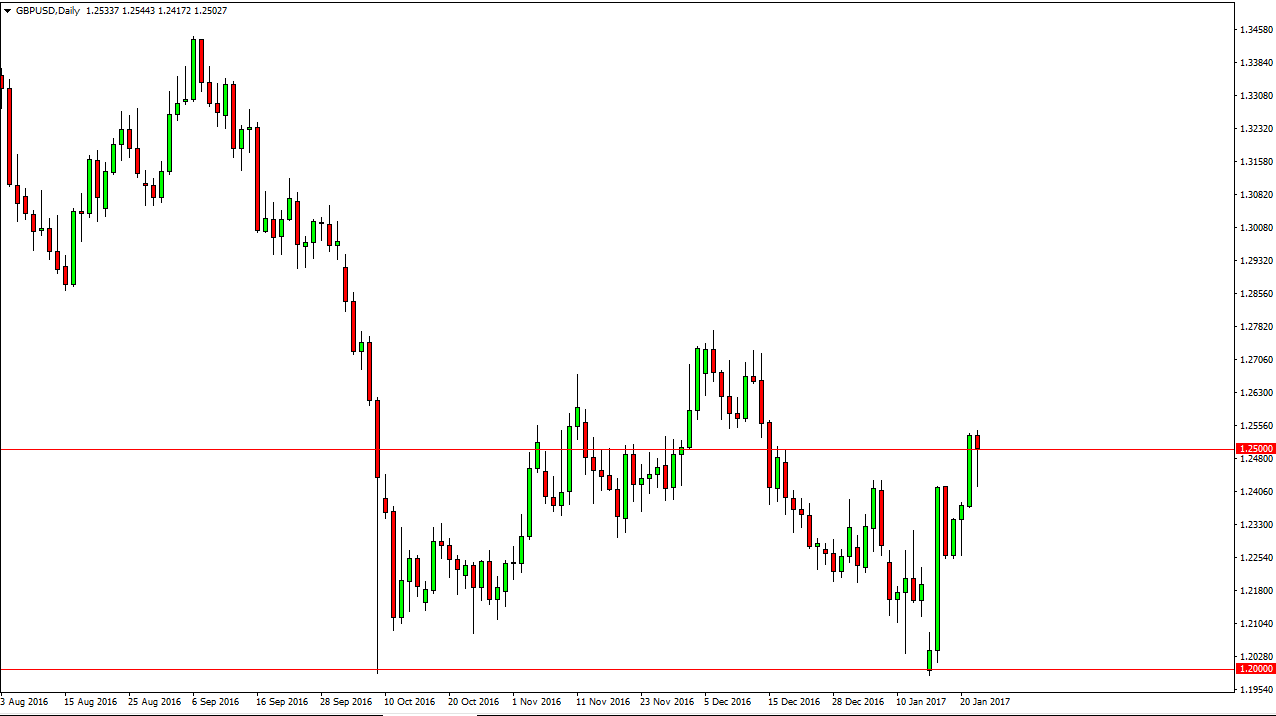

GBP/USD

The British pound initially fell on Tuesday, but found enough support above the 1.24 level to turn things around to form a hammer. This is a very bullish looking candle and if we can break above the top of that I think that the market will and reach towards the 1.2750 level above. Alternately, breakdown below that hammer is a very negative sign and could send this market much lower. However, it’s starting to look like the British pound is starting to form a bit of a bottom longer-term, and thus this is going to be one of the more interesting markets to pay attention to. Currently, I would have to say that if you are a longer-term trader, you might be willing to hang on to the trade, but one thing for sure is that is going to take a certain amount of wherewithal to deal with the volatility.

I’m the first to admit though that if we breakdown below the 1.24 level, it starts to throw a bit of doubt into the potential turn around.