EUR/USD

The EUR/USD pair rose towards the 1.0750 level during the session on Monday, testing significant resistance. The level has previously been resistance, so it should act as such again. On top of that, we have the 100-day exponential moving average pictured in blue, which of course will be resistive from a longer-term perspective. Ultimately, we have to see whether or not we can close above the 100-day exponential moving average on a daily chart, or if we pull back and breakdown below the bottom of the range for the Monday candle. If we breakdown below the bottom the Monday range, the market should then reach towards the 1.06 level below. Alternately, if we close above the 100-day exponential moving average, I believe that the market then goes towards the 1.10 level higher. Regardless what happens you can expect quite a bit of volatility.

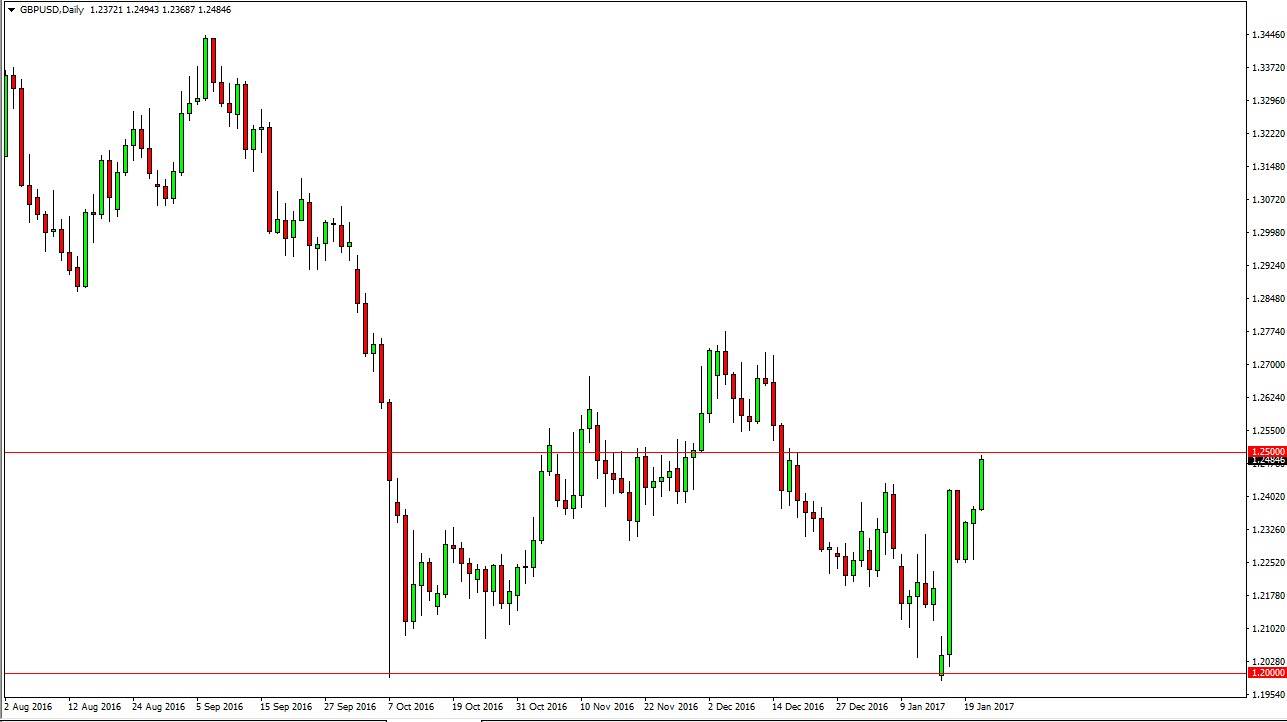

GBP/USD

The British pound broke higher on Monday, slamming into the 1.25 handle. This is an area of a serious psychological resistance and of course support and resistance overall. Because of this, I expect some type of reaction but at the time of writing, we are hanging just below that level. Because of this, I’m going to wait and see whether we can break above the 1.25 level and close on a daily chart to start buying. Once we do, the market should then reach towards the 1.2750 level above which was massively resistive.

Ultimately, if we see some type of exhaustive candle in this area it could be selling opportunity. Having said that, it certainly looks as if the British pound is trying to make a statement, and could perhaps be in the beginning of turning around the negative trend that we have seen for so long. When that happens, you can almost always count on a massive amount of volatility, offering plenty of trading opportunities.