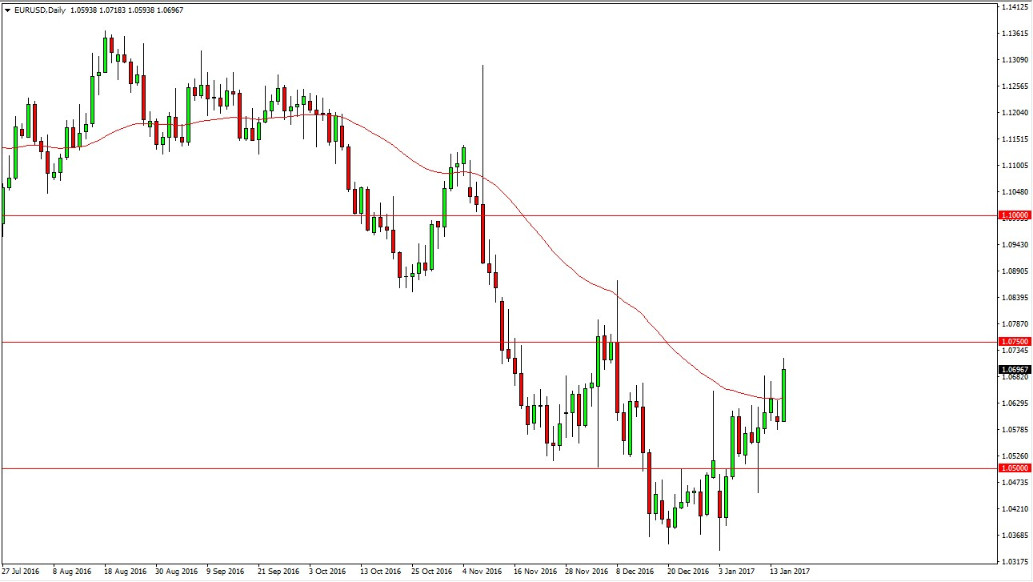

EUR/USD

The EUR rally during the session on Tuesday, breaking above the 50-day exponential moving average, and testing the 1.07 handle. I believe that there is resistance all the way to the 1.0750 level, so although we have seen quite a bit of bullish pressure and did break above the top of the previous sessions shooting star, there is a chance that sellers will still step into the marketplace. We are still in a downtrend but I’m the first person to admit that things are starting to look a little bit more bullish for the EUR at the moment. Ultimately, I’m waiting to see whether or not we get a candle the we can start selling just above, or if we get a daily close above the 1.0750 level. If we close above there, it’s time to start buying. Otherwise, this could offer quite a bit of “value” in the US dollar.

GBP/USD

The British pound rallied rather significantly during the day on Tuesday, as the speech from Teresa May suggested that the United Kingdom was going to work very closely with the European Union after the exit. Because of this, it seemed to calm quite a bit of nerves when it came to the British pound, but I still see a significant amount of resistance at the 1.25 level above. That’s an area where think sellers will step back into the marketplace, but if we the daily close above there I would recognize that the longer-term trend could be changing. This is a massively impulsive candle, so I think there will be a bit of follow-through, but quite frankly I’m a bit surprised by the reaction. After all, it’s hard to fathom the idea that the United Kingdom and the European Union would suddenly be hostile towards each other. Beyond that, the United States, Canada, New Zealand, Australia, and a host of other countries are more than willing to step in with trade agreements when it comes to the United Kingdom.