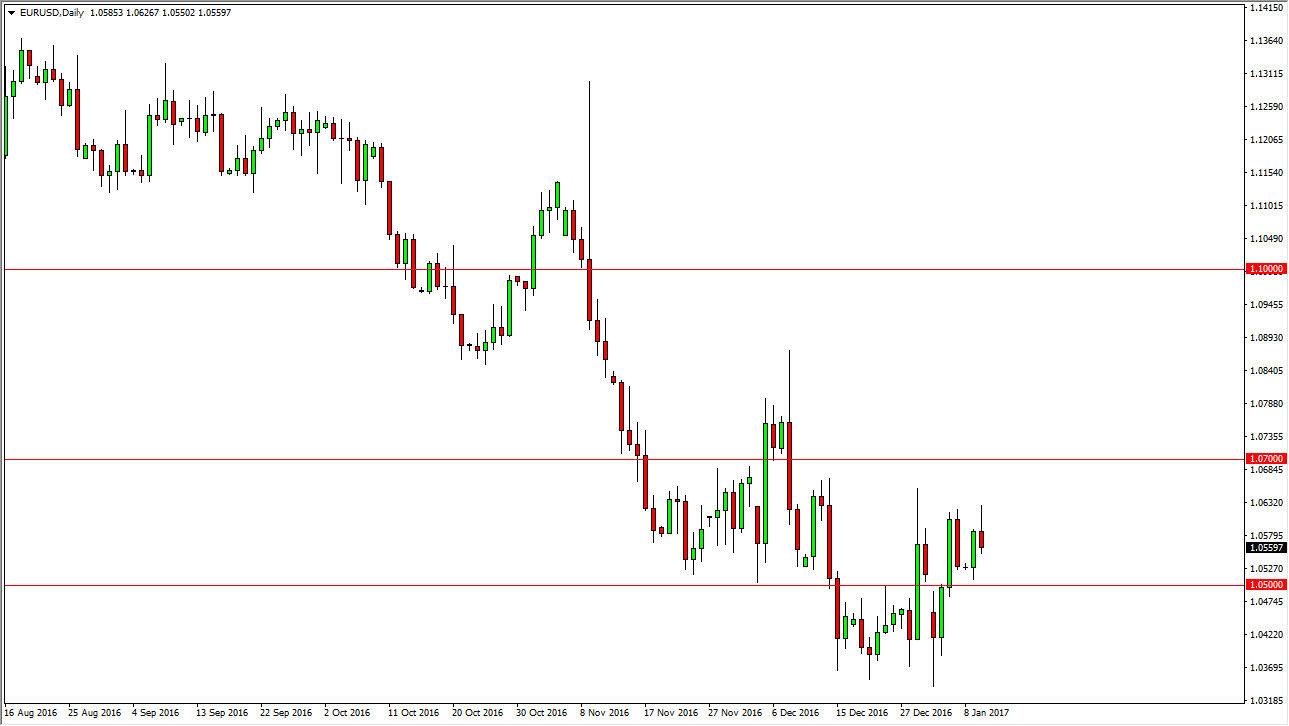

EUR/USD

The Euro initially rallied on Tuesday but found enough resistance just above the 1.06 level to turn things around and start selling off again. By forming a shooting star, looks as if the market is ready to continue going lower, perhaps reaching down to the 1.05 level underneath. If we can break down below there, the market should then go to the 1.0350 level under that. Even if we break above here, I still believe that there is a massive amount of resistance near the 1.07 level above, and with that being the case I have no interest in buying. The Euro continues to suffer at the hands of the ECB and its extension of quantitative easing, while the Federal Reserve looks to be ready to raise interest-rate hikes again.

GBP/USD

The GBP/USD pair initially fell on Tuesday, but found enough support underneath at the 1.21 level underneath to form a hammer. The hammer of course is a bullish sign, so we could get a little bit of a bounce but sooner or later I believe that the sellers will jump back into this market, and an exhaustive candle should be a nice selling opportunity as we have been in a downtrend over the last several weeks. Longer-term, I look at the 1.21 level as support, that extends all the way down to the 1.20 level underneath.

If we can break down below there, I believe that the market will then reach much lower, perhaps even down to the 1.15 handle which is massively supportive on the monthly charts. Any rally at this point in time is an opportunity to take advantage of value in the US dollar. I have no interest in buying, and will continue to sell time and time again. It is not until we break above the 1.25 level that I would even consider going long.