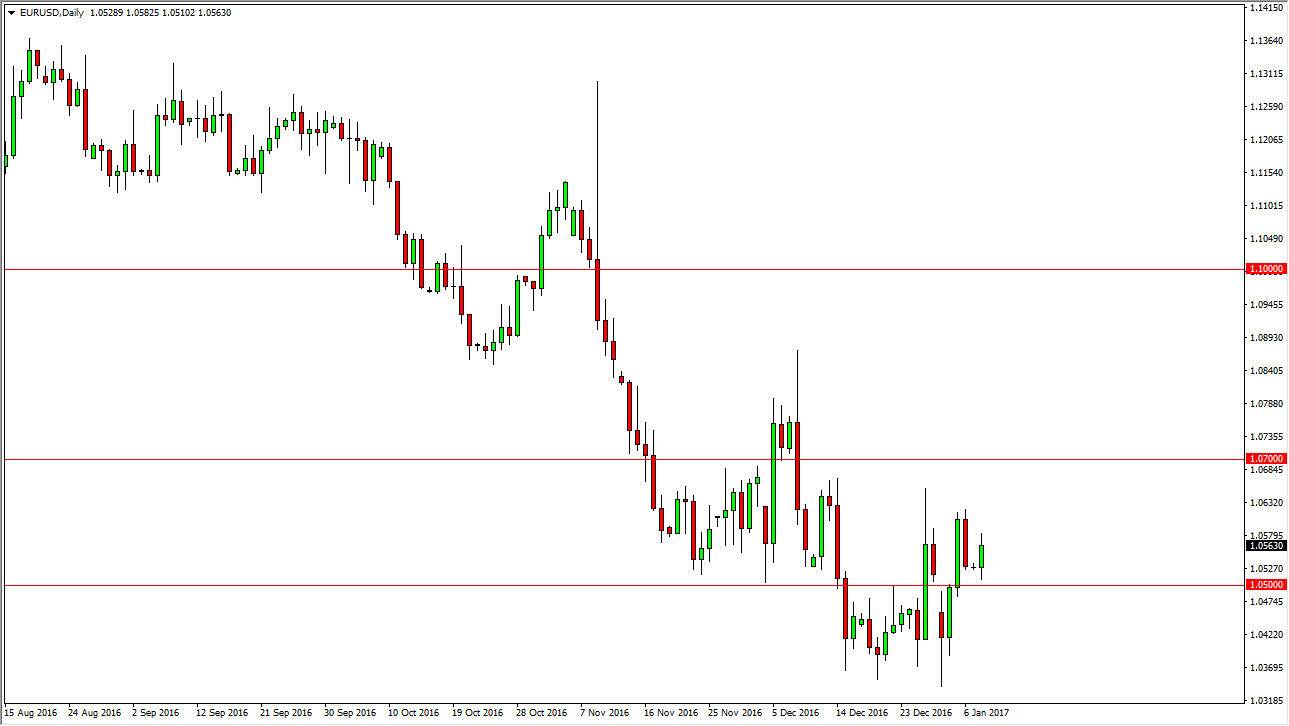

EUR/USD

The Euro rallied on Monday, after initially dropping down to the 1.05 level. This is an area that is massively supportive, and with that being the case I think that the market is going to continue to consolidate in general. The 1.07 level above should be a resistive level, and essentially a “ceiling.” Ultimately, I want to see some type of exhaustive candles I can start selling yet again. Underneath, I believe that sellers are waiting to get involved if we drop below the 1.05 level as well. Longer-term, I believe that the Euro drops as the US dollar continues to have support due to the fact that interest-rate hikes are coming. The ECB has recently extended quantitative easing on the other side of that equation.

GBP/USD

The British pound fell on Monday, making a fresh, new low. The market found a bit of support at the 1.21 level below, and bounced slightly. I believe that it’s only matter time before the sellers get involved though, and exhaustive candles will be used to get involved in what has been a relatively soft British pound in general. I think that we will reach to the 1.20 level underneath, and perhaps even longer than that. A break down below there should send this market to the 1.15 level which is a massive long-term support barrier that is seen on the monthly charts.

If we do rally, I believe it’s only a matter of time before the sellers get involved and start selling. I look for exhaustive candles on rallies to short the market on small moves. I think the 1.25 level been broken above could be a signal that were going to go in the opposite direction, but until we close above that level on a daily chart, I don’t think that there’s any way to buy the British pound.