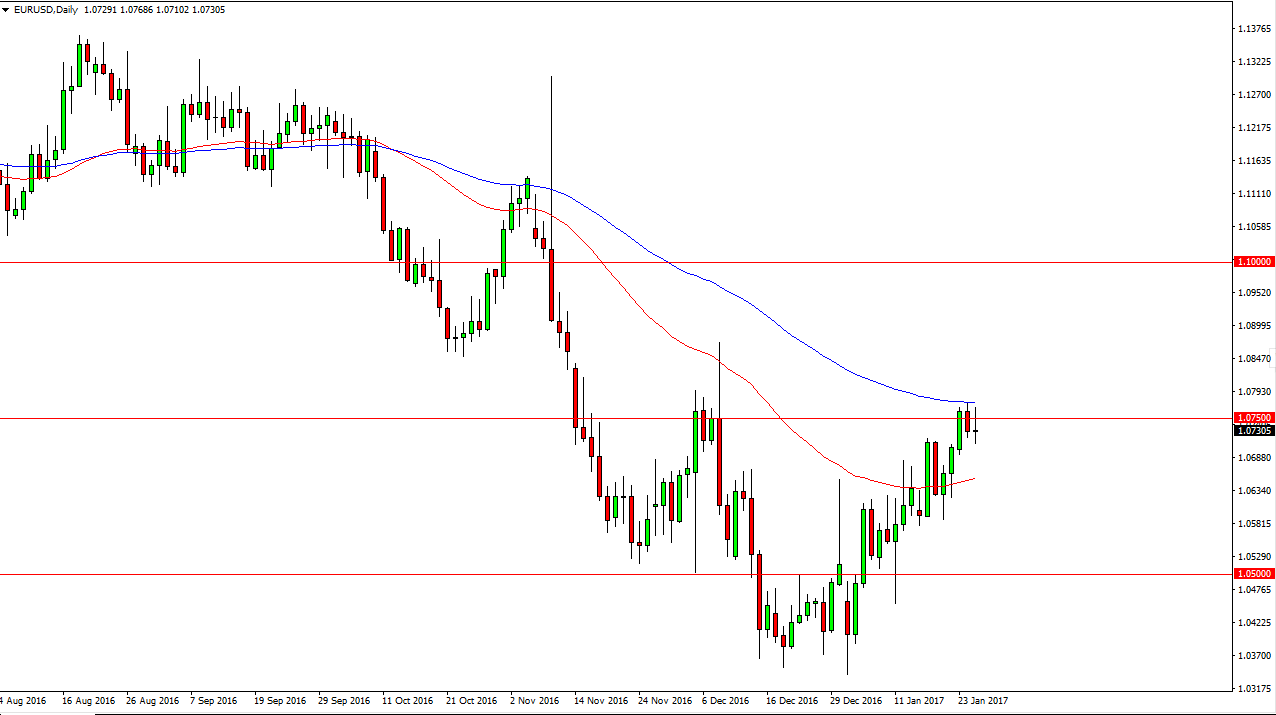

EUR/USD

The EUR/USD pair initially rallied on Wednesday, but found quite a bit of resistance above the 1.0750 level, and just as importantly, the 100-exponential moving average. The shooting star like candle suggests that we are getting ready to roll over and I think if we can break down below the bottom of the candle during the day on Wednesday should send this market much lower. The market should then reach down to the 1.06 handle, and then eventually the 1.05 handle. At this point, if we can break above the top of the shooting star and of course the 100-exponential moving average, I think that the market then could go to the 1.09 level and possibly even the 1.10 level after that.

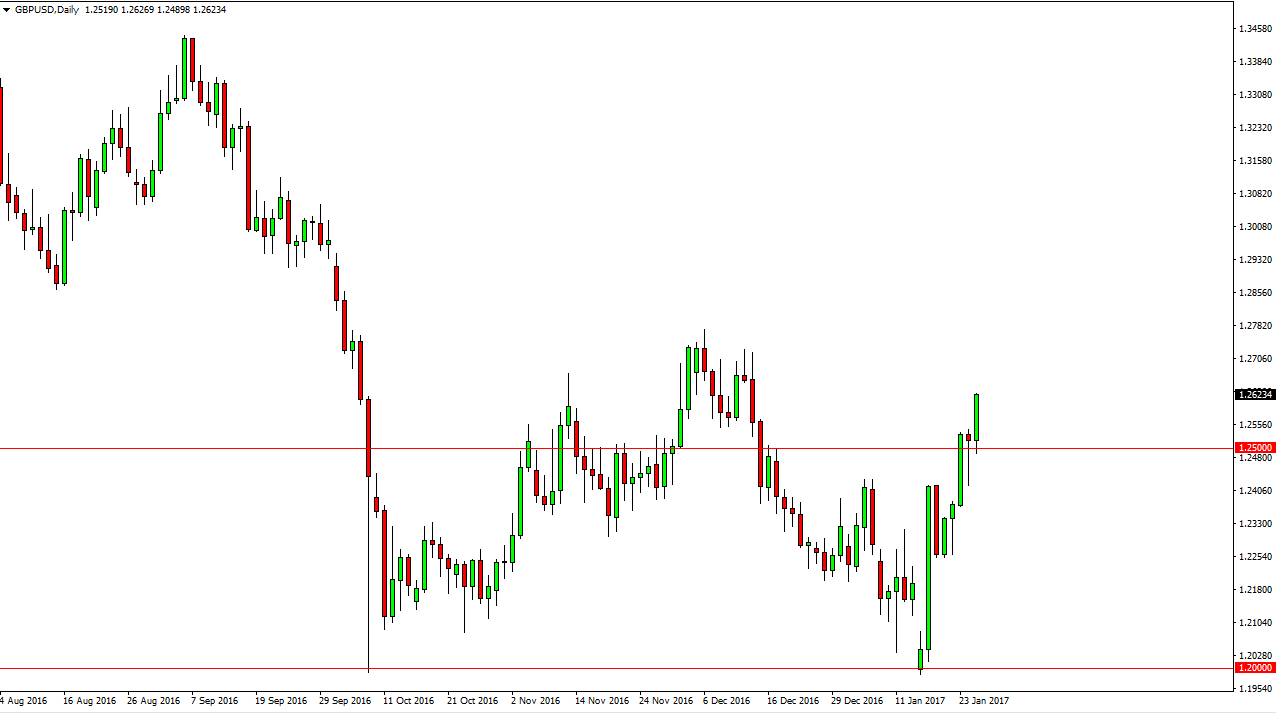

GBP/USD

The British pound broke above the top of a hammer from the session on Tuesday during the Wednesday session. This shows quite a bit of strength, and thus I think that the 1.25 level will start offering quite a bit of support in a potential “floor” in this market. The British pound is starting to show real signs of strength again, and I believe that given enough time we will reach towards the 1.22750 level which has been resistance in the past. I think the support extends all the way down to the 1.24 handle, so quite frankly I have no interest in shorting this market.

The candle strengthening during the day and of course closing towards the top of it shows it’s quite massive in its support, and of course it’s momentum. The GBP/USD pair has formed what looks like a bottoming pattern on the longer-term charts, especially the weekly period. The 1.20 level has been a massive floor in the past, so it’s not a surprise that it acted as such this time. Expect volatility, but it certainly looks as if the British pound is starting to flex its muscles.