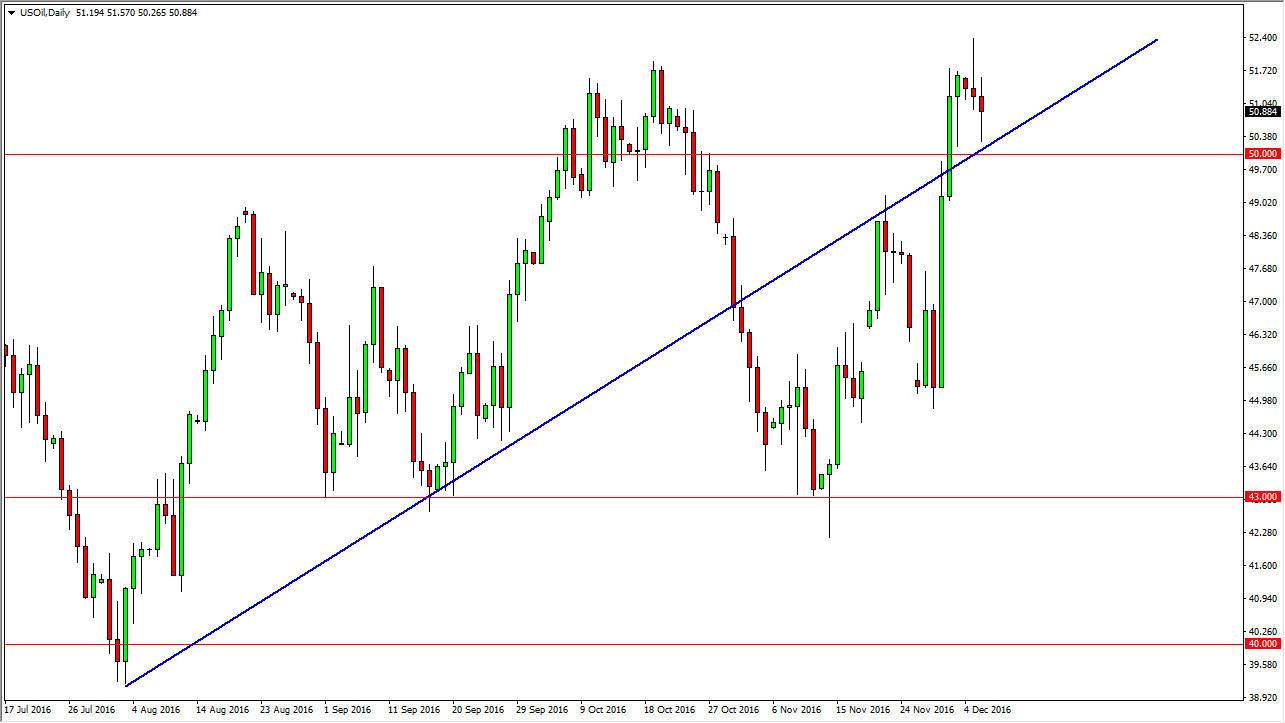

WTI Crude Oil

The WTI Crude Oil market fell during most of the session on Tuesday, but found enough support off of the previous uptrend line and more importantly the $50 level, we turned around to form a hammer. I think today will be crucial when it comes to the WTI Crude Oil market, as we get the Crude Oil Inventories number. Ultimately, we are expected to see a drop of 1.2 million barrels in inventory. If we see more, that shows a pickup in demand and that could be reason enough for us to continue going long. However, we see a number higher than that, the market will more than likely break down below the $50 level. On a daily close below there, I think it would be a nice opportunity to start selling yet again.

Natural Gas

Natural gas markets rally during the day on Tuesday but found the market to be a little bit overextended at this point. We ended up turning back around to form a shooting star, and with that I believe that it is only a matter time before we reach towards the $3.50 level. I believe that the market could very well break down below there, and as a result it’s probably only a matter of time before we find buyers but I recognize that this market has been so overbought that we need this pullback. Even if we broke above the top of the shooting star, it’s almost impossible to buy this market simply because we are so overextended.

No pullback from here is reason enough to sell as far as I’m concerned, because quite frankly we have seen such a violent move to the upside. Given enough time, I believe the buyers will return and will be interested in going long based upon the sudden change in attitude.