WTI Crude Oil

The WTI Crude Oil market had a volatile session during the session on Wednesday, as we await the Crude Oil Inventories announcement coming out today, which of course has quite a bit of influence on where this market goes next. I recognize that the $55 level above offers quite a bit of resistance, so it’s not until we break above their that I feel comfortable buying. On the other hand, I believe that any breakdown at this point will at best drop to the $52 level. Longer-term, it’s no secret that I think that the oversupply will become an issue again, but currently it seems as if the buyers are in control and it is almost impossible to short this market for any real length of time.

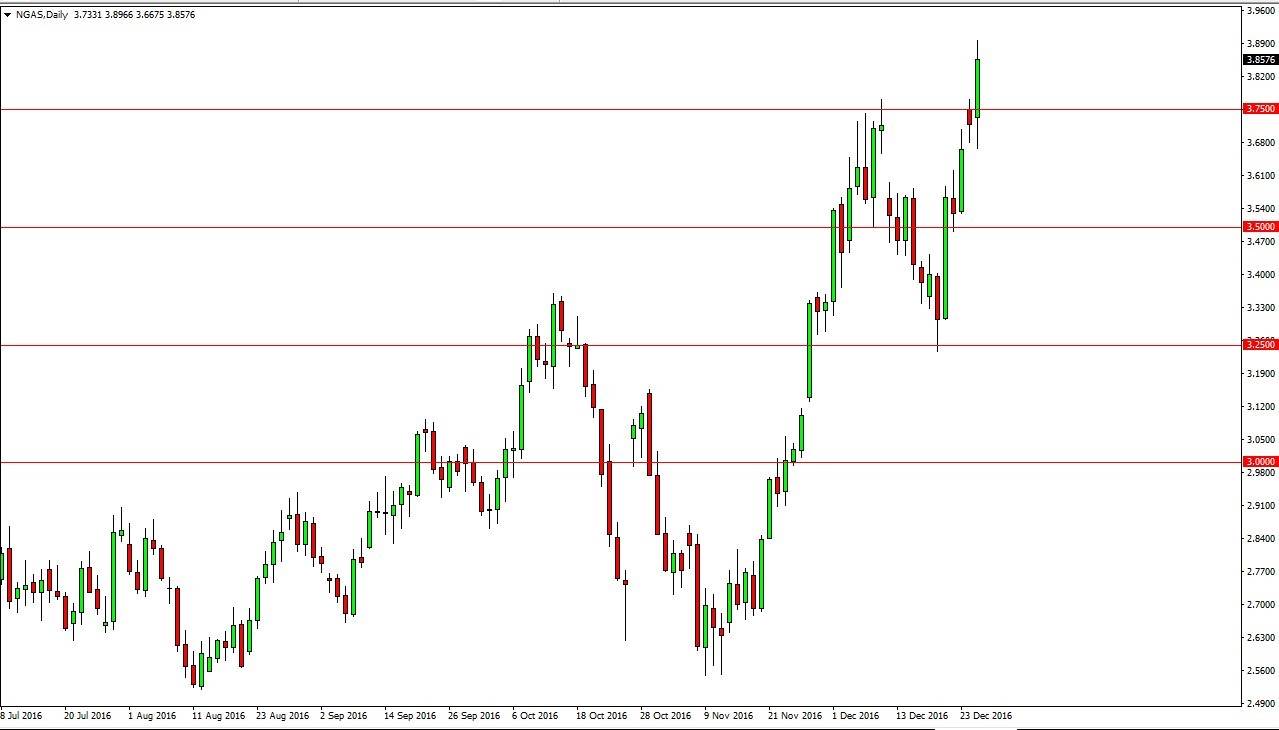

Natural Gas

Natural gas markets initially fell during the Wednesday session and then broke out to the upside, finally slamming through the $3.75 resistance barrier. It now appears that the market is going to try to reach towards the $4 handle, but now the first thing that I notice is that there is a massive amount of noise above, and it will keep this market very volatile and choppy. Unless you are willing to hang on to the volatility, you will probably be best served buying short-term pullbacks as they offer short burst of value. I don’t have any interest in selling this market now, although I think longer term we will have supply come in and flood the market. This of course will drive down the value of natural gas, but currently it seems that the market is focusing on the cold temperatures in the Northeastern part of the United States, one of the biggest consumers of natural gas in the world.

If we were to break down, I think there is a significant amount of support at the $3.50 level. I don’t see that happening, but there is always the alternate scenario that you must look at.