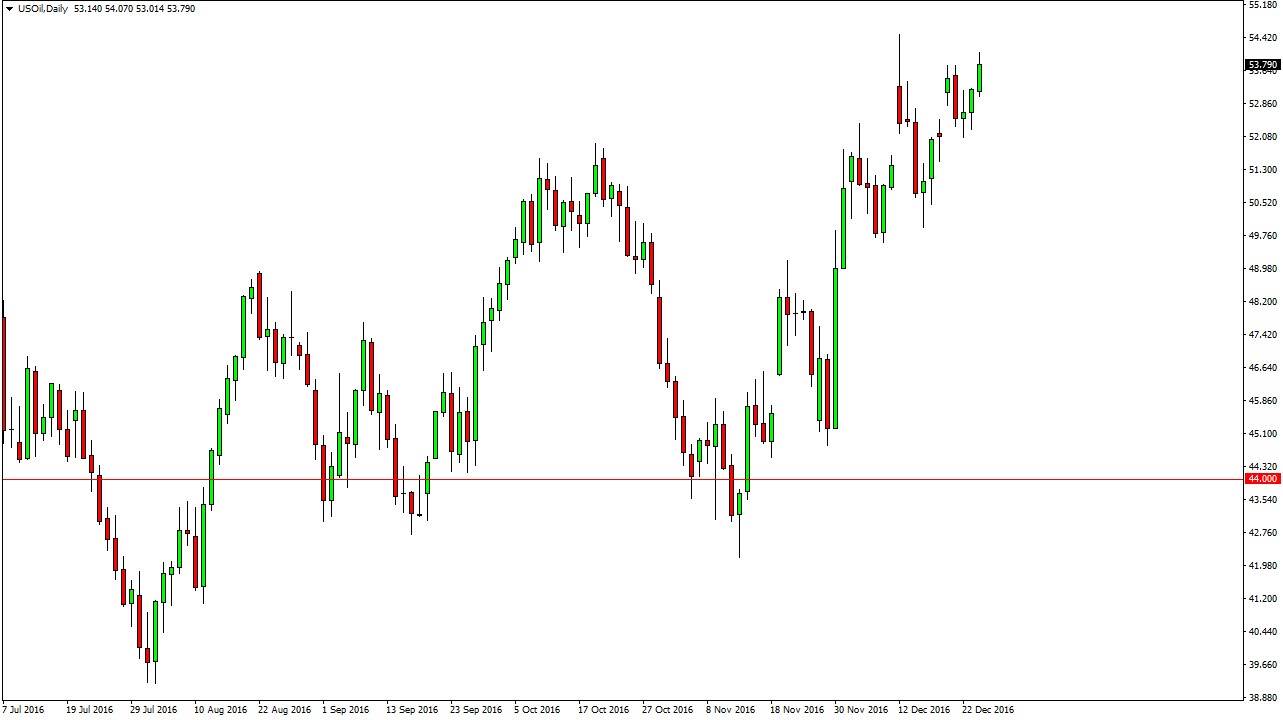

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Tuesday, as volume picked up a little bit after the holiday. However, we are still in a very thin trading environment, and because of this I think it’s only a matter of time before market standstill from time to time. However, there is obviously an upward bias at this point, so I believe that we will try to reach the $55 level. Pullbacks should be buying opportunities as the market is obviously bullish, but longer term I think they’re going to be a lot of concerns when it comes to oversupply even though the OPEC and non-OPEC countries recently settled on a production cut. Currently, I think that the buyers are in control so selling will be done until we see a longer-term signal.

Natural Gas

The natural gas markets gap tire at the open on Tuesday, then turned around to fill the gap, and then closed near the $3.75 level. If we can break above the top of a hammer, it’s likely that we will continue to go higher but there is a lot of noise between here and the $4 level that could cause quite a bit of volatility. Because of this, I expect that it could be very choppy going in the near term, but I have to think that it’s only a matter of time before the buyers return every time we pull back.

A breakdown below the bottom of the hammer for the Tuesday session could be a negative sign, but I still think there is more than enough of a floor below at the $3.50 level, and that should be an area where buyers would return. On a longer-term chart, though, I will keep an eye on whether or not we are bound to turn around. Given enough time, we will, but right now it looks as if it’s likely to be a positive market for at least the next few weeks.