WTI Crude Oil

The WTI Crude Oil market went back and forth on Thursday, as we filled the gap from earlier in the week. By bouncing from here, it looks as if the market is going to try to grind its way to the upside, but I don’t expect anything in the way of a large move right now. Today is the last trading day before Christmas, and that of course will weigh upon any type of volume in the market. I think that short-term buyers may come in and pick up a few ticks here and there, but beyond that it’s probably asking a lot for the market to do much. I have no interest in selling, I think there is quite a bit of support just below. Longer term we may break down, but right now I don’t think we’re going to see that happen.

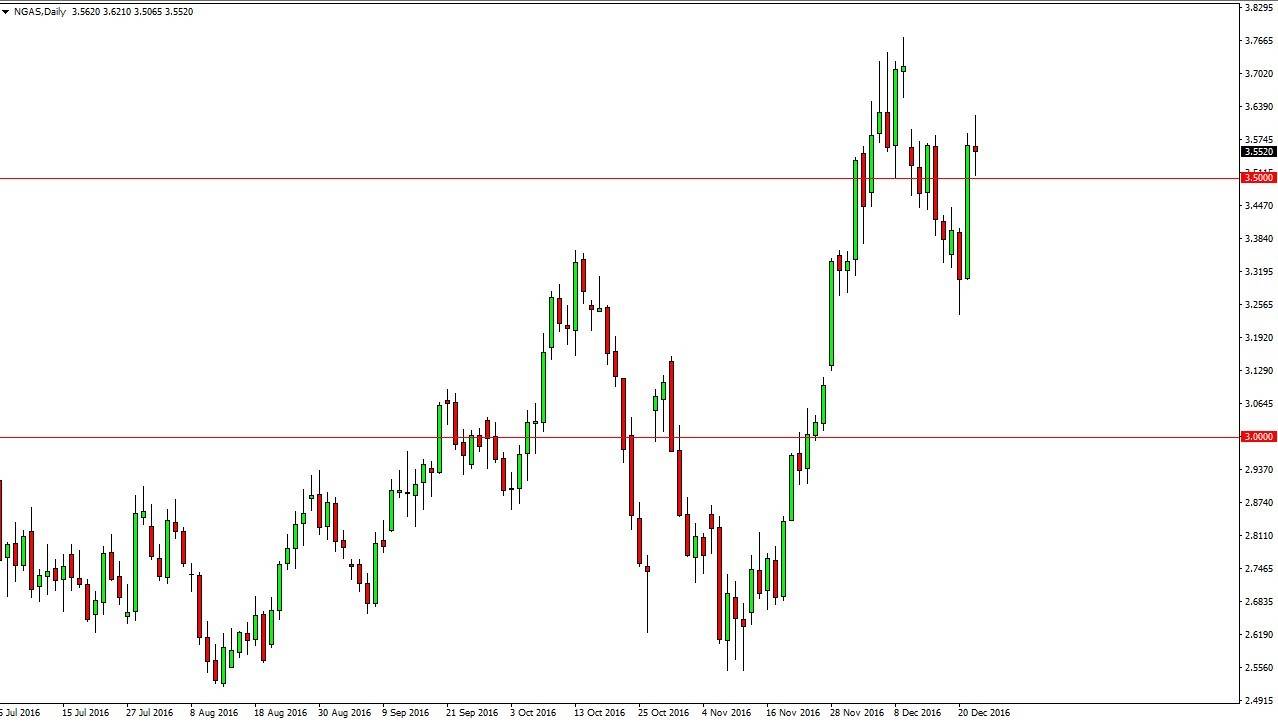

Natural Gas

The natural gas markets went back and forth on Thursday, as we saw a support level at the 3.50 level, and a resistance barrier and of the $3.60 level. Ultimately, I feel that we need to fill the gap from a couple of weeks ago, meaning that the market will probably try to reach towards the $3.75 handle. There is a lot of noise in this general vicinity, and thus I think it will be very choppy and difficult. If we breakdown below the 3.50 level however, I feel that the market will probably drop back to the $3.30 level. The gap has not been filled, and that typically happen so I think that’s going to happen sooner rather than later. Eventually, I think the sellers come back though because of the negative gap, which typically means that you’re going to see more selling pressure. Eventually, the oversupply of natural gas becomes the focus yet again.