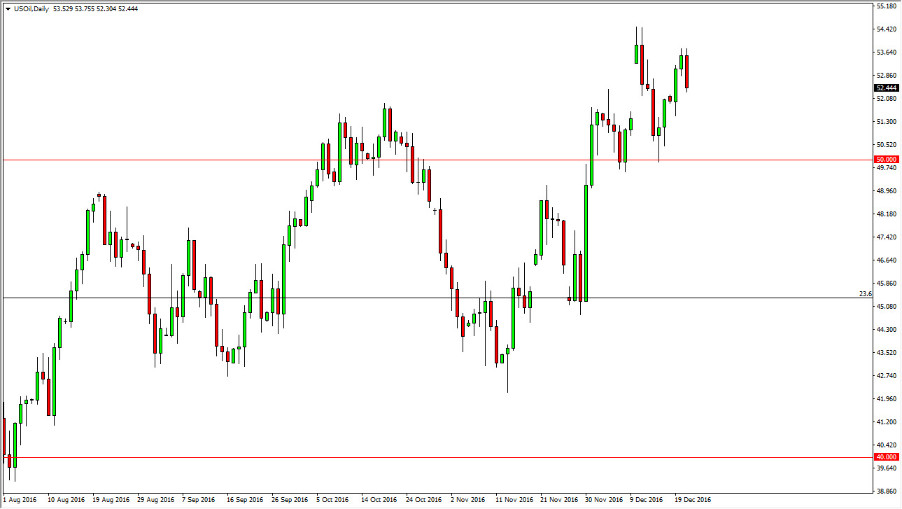

WTI Crude Oil

The WTI Crude Oil markets fell on Wednesday, as we continue to see quite a bit of volatility in the oil market. Quite frankly, this is a market that I think is going to consolidate between now and the end of the year, with the $50 level on the bottom being the floor of the market, while the $54.50 level above being resistance. You will more than likely have to do a lot of range trading between now and then, simply selling once we get a little too high, and buying once we get a little bit too low. If we did break out of this consolidation area, about the only thing you can do is follow the market once we do get one of those moves.

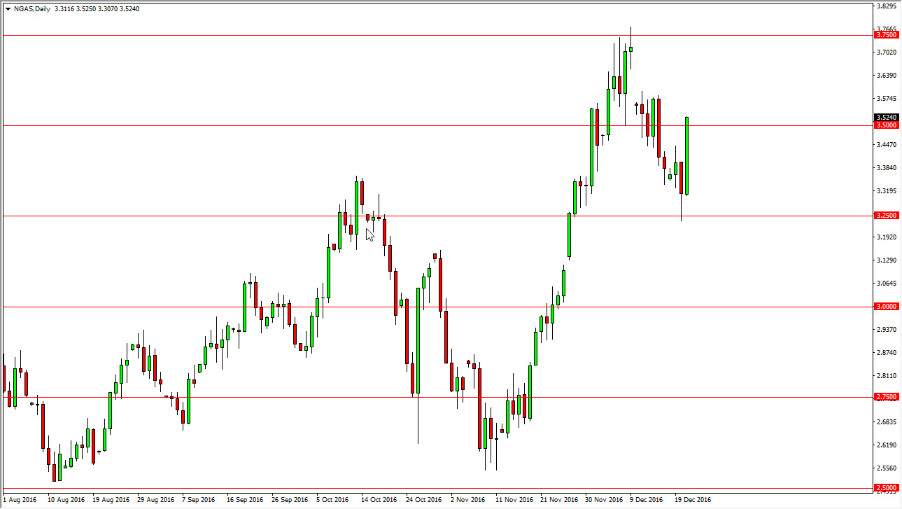

Natural Gas

On the other hand, natural gas markets exploded to the upside during the Wednesday session, breaking above the $3.50 level. This is an area that of course has certain psychological importance, but ultimately I think this market is just going to continue to grind higher and try to fill the gap from a couple of weeks ago. That sends the market looking towards the $3.70 level above, and that is my target. I have no interest whatsoever in hanging onto a trade beyond there, at least not until we get a daily close above the top of the shooting star that touched that the $3.75 level. Ultimately, what typically happens with a gap lower is that we go back and fill it’s, and then form some type of exhaustive candle to continue the move lower. While the weather is colder in the northeastern part United States, the reality is that the supply of natural gas will continue to outweigh the demand, and probably for decades going forward as the United States and Canada both have an overabundance of it.