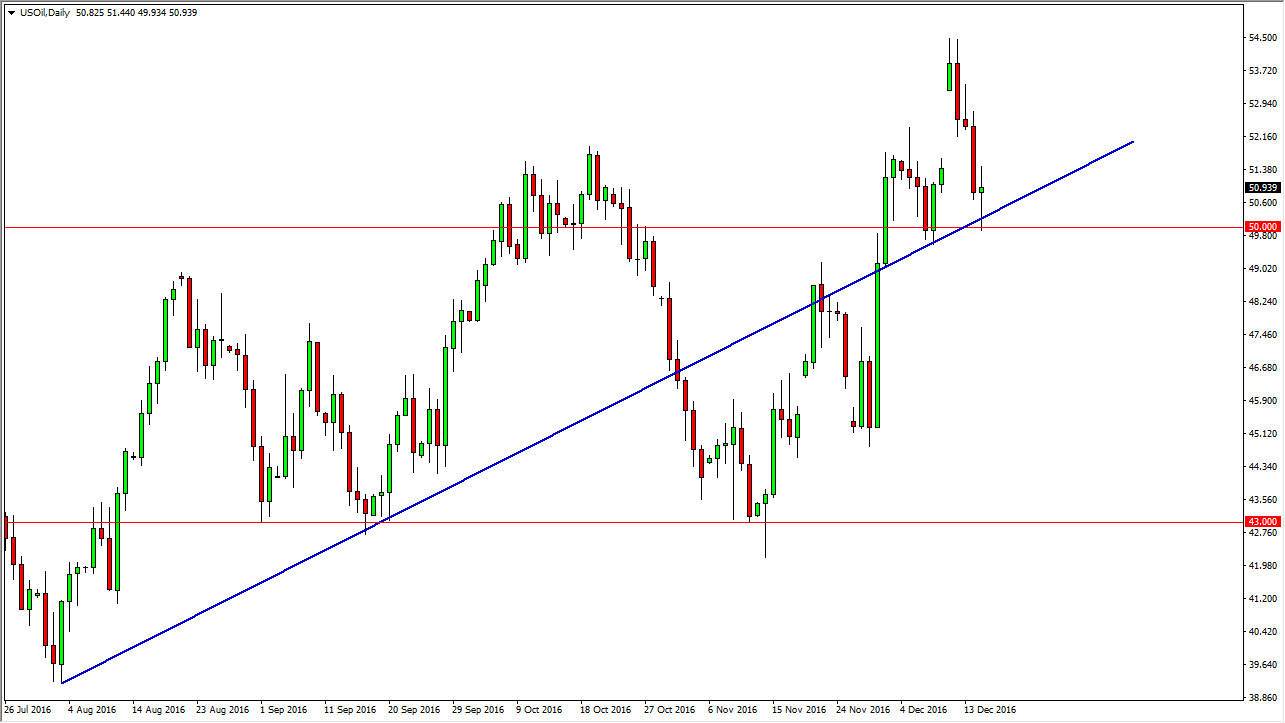

WTI Crude Oil

The WTI Crude Oil market fell initially on Thursday but found enough support at the $50 level to turn around and form a hammer. This is a hammer that I think signifies that we will probably try to reach the highs again, if we can break above the top of the range for the Thursday session. It doesn’t necessarily mean that the markets going to explode to the upside, but ultimately, I think the next couple of weeks could be quiet. That of course would make quite a bit of sense as we are starting to reach towards the holidays, and that tends to be quiet time it here anyway. It would not surprise me at all if we continue to consolidate until we make some type of significant decision.

Natural Gas

The natural gas markets fell during the day on Thursday, slicing below the previous consolidation. I think that the market looks likely to roll over, but at this point the market should find quite a bit of support just below. The $3.30 level below could be very supportive as it was previously resistive, and the $3.25 level below there would be even more supportive. A supportive candle below should be a buying opportunity as the market will continue to go to the upside.

We will more than likely have to fill the gap as markets tend to do, but it could be a bit volatile in the meantime. I think eventually the buyers will return, but if we did break down below the $3.25 level, at that point you would probably see a pretty significant sell off as it would represent a massive change in attitude and could start the ball rolling to the downside. Longer-term, we have a large structural oversupply issue, so given enough time I feel that the market will fall, but in the meantime the cold temperatures will continue to drive up pricing.