USD/CHF Signal Update

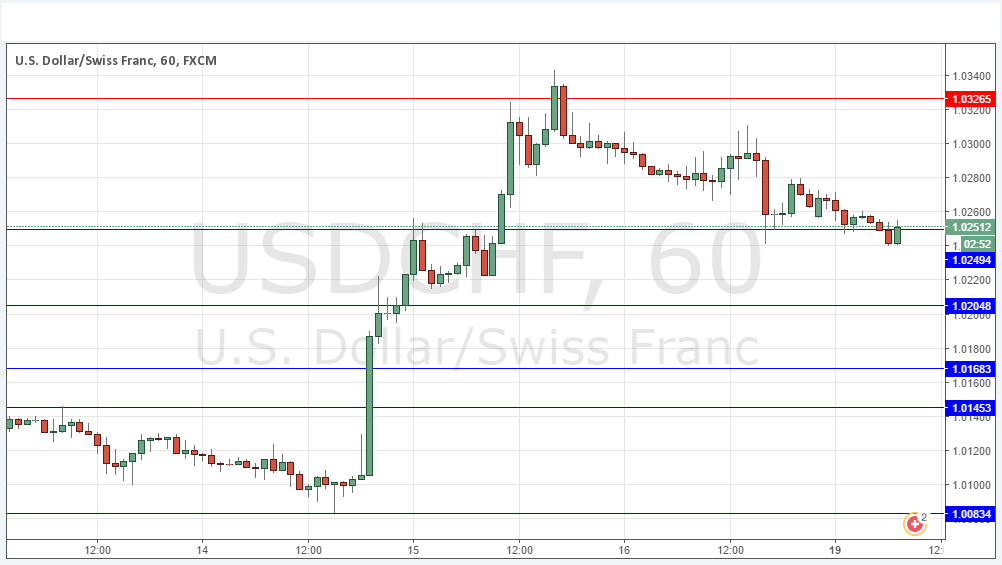

Last Thursday’s signals were not triggered as the bearish price action took place a little above the key resistance level identified at 1.0327. However, that was generally accurate as a good resistance level.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 1.0205 or 1.0168.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.0327.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair is now being overshadowed by its sister pair, EUR/USD, as it has made only a new 5-year high unlike the EUR/USD which made a new 13-year low! It is starting to look as if this pair is due a deeper pull back to at least 1.0205. At the time of writing, the price looks to be erasing the former support level at 1.0250, which is a passively bearish sign.

Overall, the long-term trend is still bullish.

There is nothing due tomorrow concerning either the CHF or the USD.