USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were reached during the London session.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today.

Long Trades

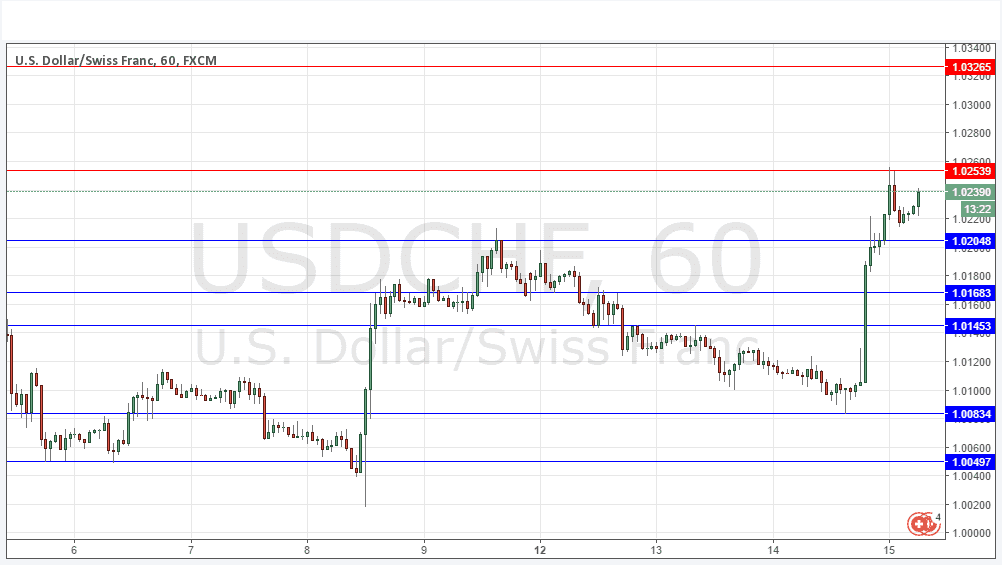

Long entry after bullish price action on the H1 time frame following the next touch of 1.0205 or 1.0168.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Short entry after bearish price action on the H1 time frame following the next touch of 1.0254 or 1.0327.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The price was fairly quiet until the FOMC release, which produced the anticipated rate hike, but more importantly, produced a forecast of higher rates than had been expected for 2017. This sent the USD rising everywhere, and as the CHF has been one of the weakest currencies, the move upwards in this pair was strong.

Two resistance levels were cleanly broken and look to have flipped to become likely support. Note however that the multi-week high at 1.0254 remains intact so far, although the price still looks bullish and appears to be readying for another attempt to break past that level. There is also a multi-year high at 1.0327 above that.

It looks as if the long-term bullish trend is continuing.

Regarding the CHF, there will be releases of the SNB’s Monetary Policy Assessment and LIBOR Rate at 8:30am London time, followed by the usual press conference. Concerning the USD, there will be releases of CPI, Unemployment Claims and Philly Fed Manufacturing Index data at 1:30pm.