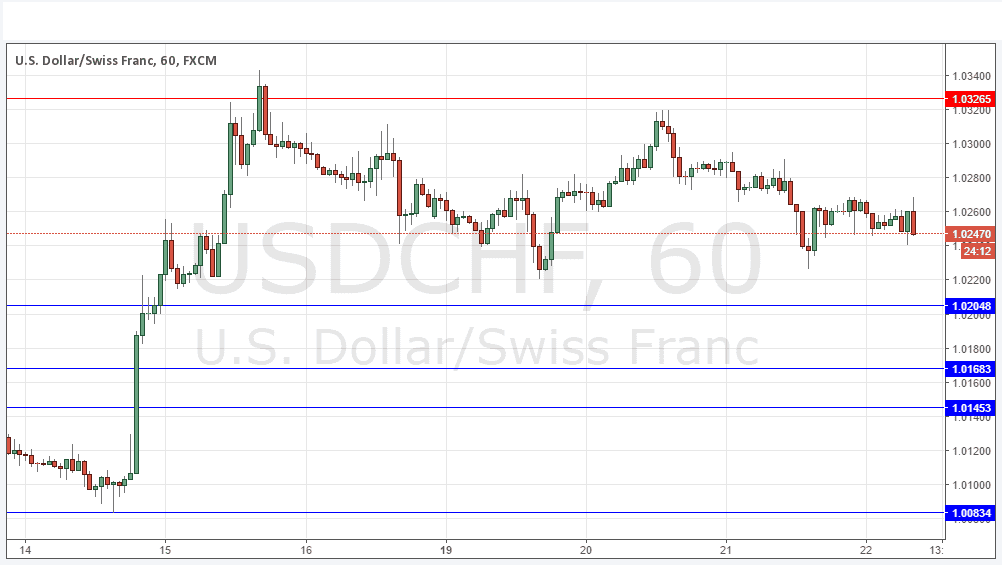

USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.50% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trades

* Long entry after bullish price action on the H1 time frame following the next touch of 1.0205 or 1.0168.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next touch of 1.0327.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

This pair was in quite a strong upwards trend, but has now been consolidating and failing to make a new high for a week.

It looks as if the price is more likely to fall than rise over the short term, and a bullish bounce becomes more likely as soon as 1.0225 is reached, ahead of the key resistance level at 1.0205.

There is nothing due today regarding the CHF. Concerning the USD, there will be releases of Core Durable Goods Orders, Final GDP and Unemployment Claims data at 1:30pm London time.