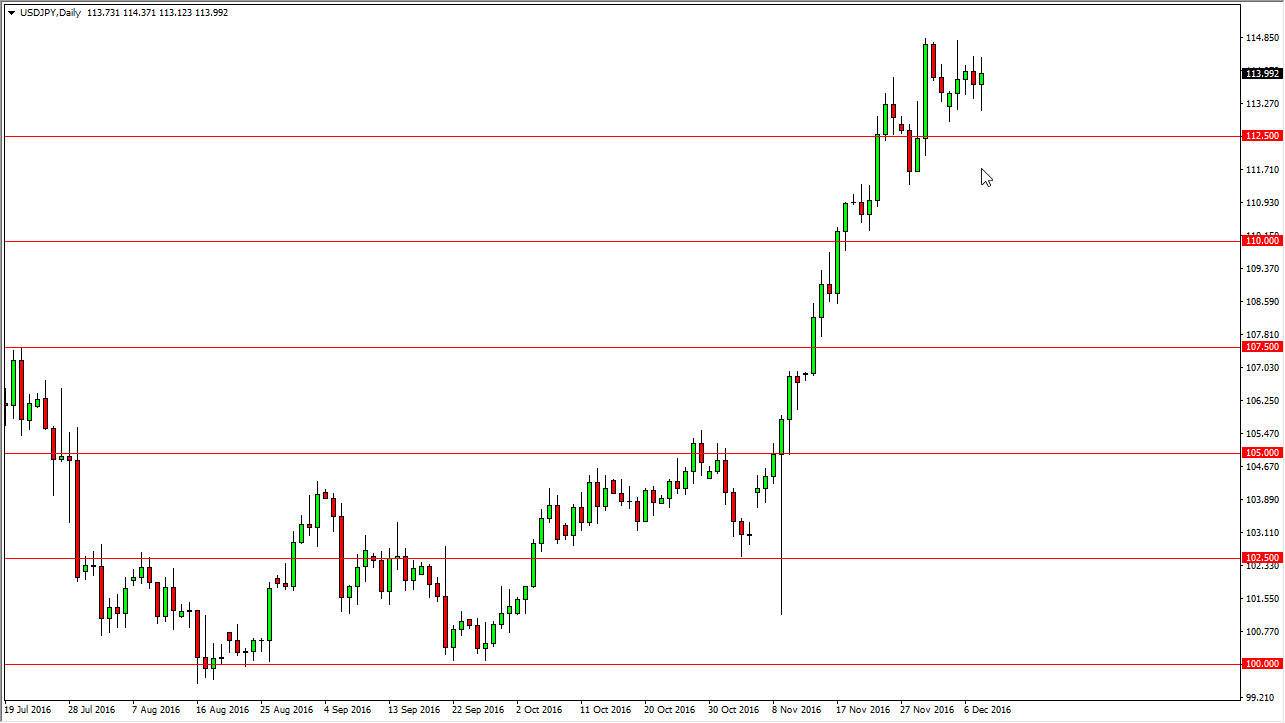

USD/JPY

The US dollar went back and forth against the Japanese yen during the session on Thursday, as we continue to see quite a bit of choppiness. The 114 handle is essentially “fair value” on the short-term charts, as we have been bouncing between the 130 level on the bottom and the 115 level on the top. I’m waiting to see whether or not we get some type of move lower in order to start looking for supportive candles underneath the give us an opportunity to take advantage of “value.” The longer-term market outlook is fairly strong, and I believe that we will continue to see the US dollar strengthen against the Japanese yen. I have no interest in selling. Buying on the dips will probably continue to be the best way to go going forward in a market that has been so explosive.

NZD/USD

The New Zealand dollar went back and forth on Thursday as we continue to see quite a bit of choppiness, but we are testing the bottom of the uptrend line that should now be resistive. At this point, I believe that if we can break above the top of the candle, the market will then reach towards the 0.74 level. A break down below the bottom of the candle should send this market down to the 0.70 level underneath. Keep in mind that the New Zealand dollar tends to be very sensitive to the overall wins of the commodity markets, so you’ll have to pay attention to those in order to get an idea as to how the Kiwi will behave.

I think that the next couple of sessions will be very telling as to where we go next, and I’m going to implement a simple “breakout strategy” when it comes to the neutral candle that has formed for Thursday.