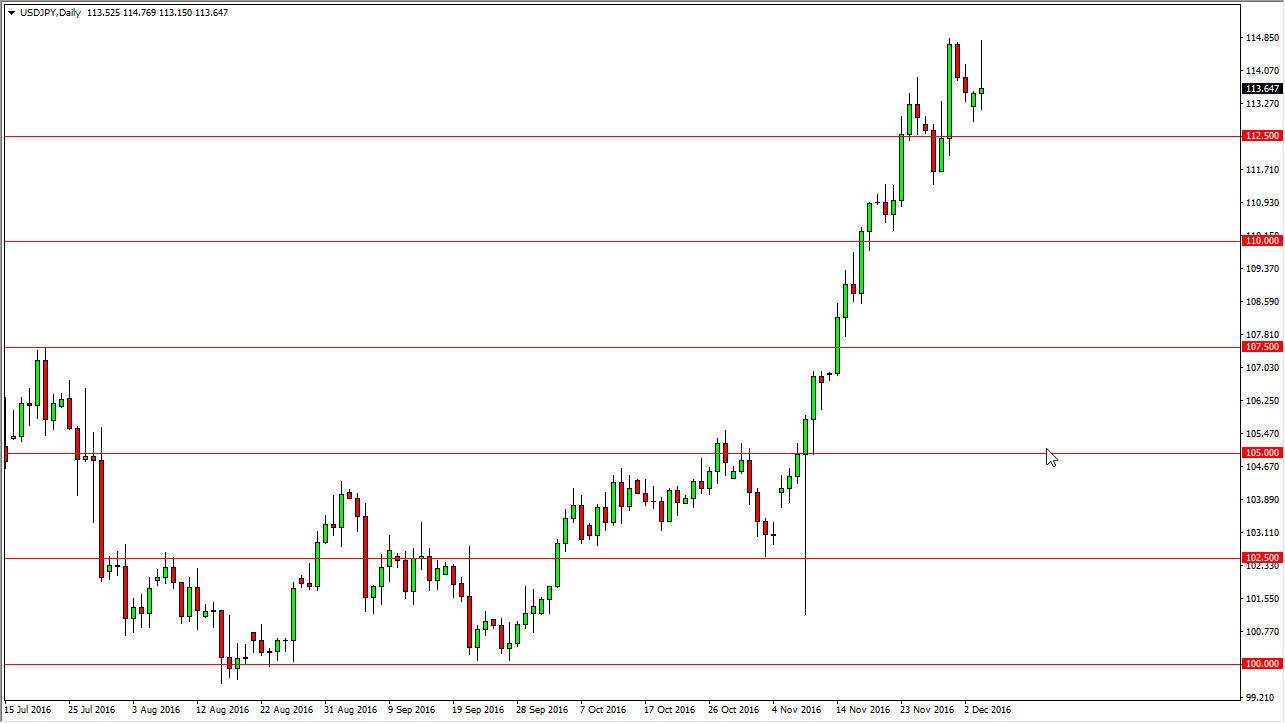

USD/JPY

The US dollar initially rallied against the Japanese yen, but gave back most of the gains late in the day. Ultimately, this is an exhaustive looking candle, and I believe that we need to drop from here. Given enough time, I think that the buyers will of course return, because there is so much in the way of bullish pressure over the last couple of weeks. I think the 110 level below will be supportive, and could be a bit of a “floor” in this market. I want to see some type of pullback in order to find value so that I can continue to go long. I have absolutely no interest in selling the us dollar as the Japanese yen is so soft at the moment.

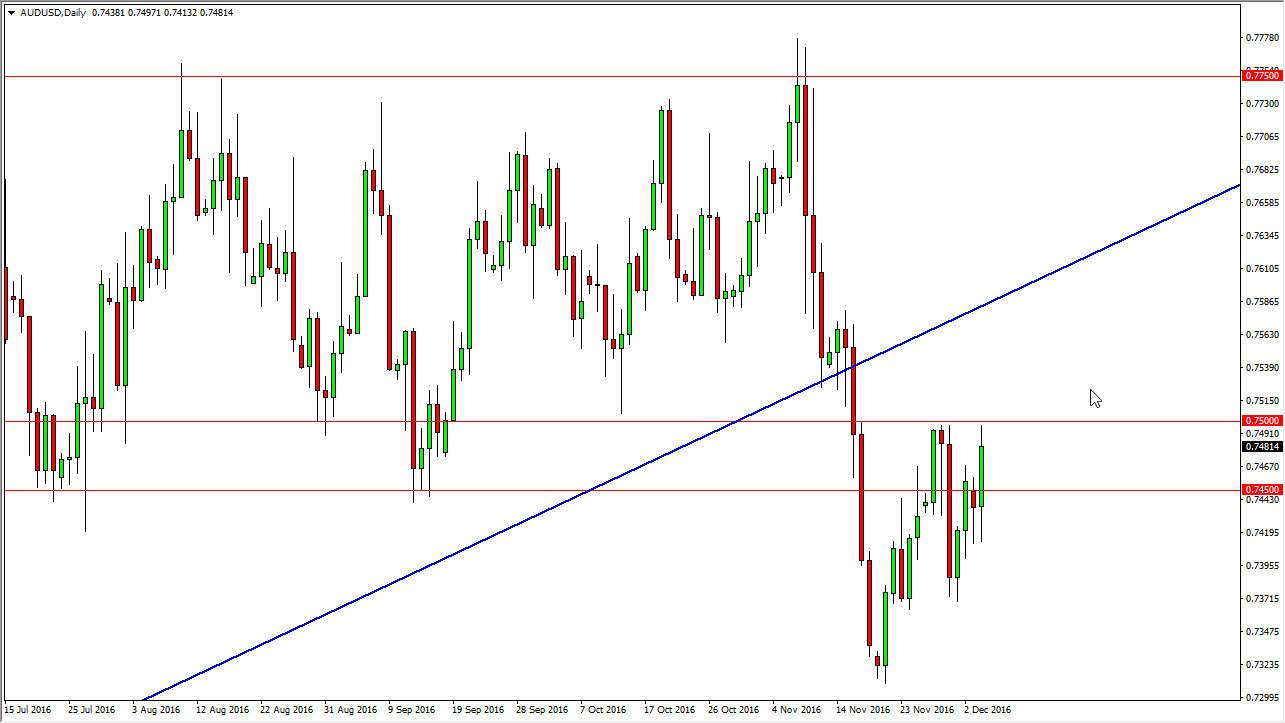

AUD/USD

The Australian dollar initially fell during the day on Monday but then shot higher, reaching towards the 0.75 level. That is a level that is massively resistive, and we did see the market pullback from their slightly. Pay attention to gold, because if we get a lot of negative pressure in that market, that might be reason enough for this pair to fall. I believe that an exhaustive candle is reason enough to start selling, perhaps reaching down to the 0.73 level below. On the other hand, if we can break above the 0.75 level, we will more than likely tried to test of the previous uptrend line which should be massively resistive. At this point, I don’t really have much in the way of interest like comes to buying the Aussie, and I think it’s only a matter time before we see a continuation of the breakdown that happened just a couple of weeks ago,

The US dollar continues to strengthen in general, as interest-rate hikes will do that for a currency. Because of this, I feel much more comfortable shorting than anything else.